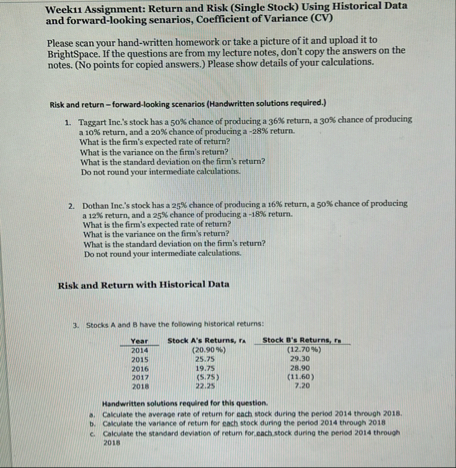

Question: Week 1 1 Assignment: Return and Risk ( Single Stock ) Using Historical Data and forward - looking senarios , Coefficient of Variance ( CV

Week Assignment: Return and Risk Single Stock Using Historical Data and forwardlooking senarios Coefficient of Variance CV

Please scan your handwritten homework or take a picture of it and upload it to BrightSpace. If the questions are from my lecture notes, don't copy the answers on the notes. No points for copied answers. Please show details of your calculations.

Risk and return forwardlooking scenarios Handwritten solutions required.

Tagzart Inc.s stock has a chance of producing a return, a chance of producing a return, and a chance of producing a return.

What is the firm's expected rate of return?

What is the variance on the firm's retum?

What is the standard deviation on the firm's return?

Do not round your intermediate calculations.

Dothan Inc.s stock has a chance of producing a return, a chance of producing a return, and a chance of producing a return.

What is the firm's expected rate of return?

What is the variance on the firm's return?

What is the standard deviation on the firm's return?

Do not round your intermediate calculations.

Risk and Return with Historical Data

Stocks A and have the following historical returns:

tableYearStock. As Returns, raStock Bs Returns, rs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock