Question: Week 1 Date Transaction description 1 Paid the full amount owing to Shadow records, Check No. 903. Payment fell within discount period. 1 Obtained a

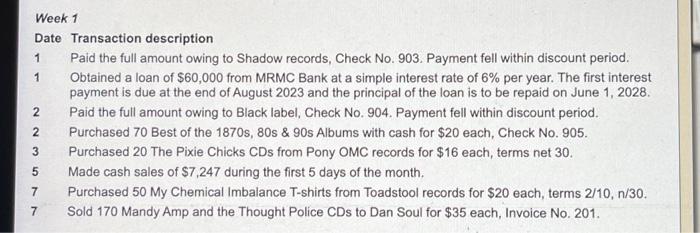

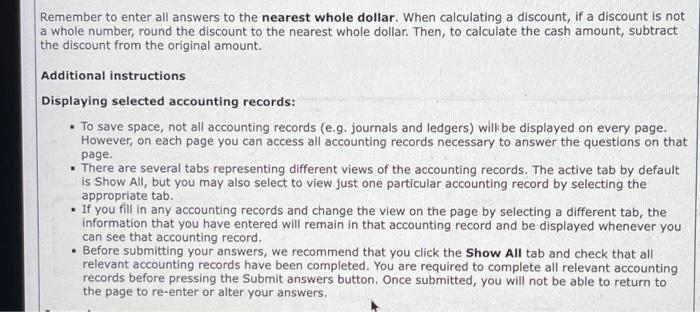

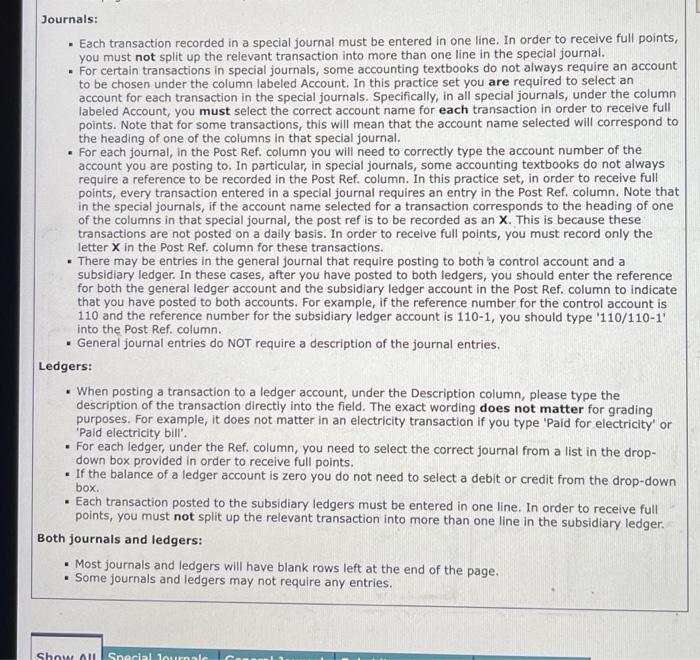

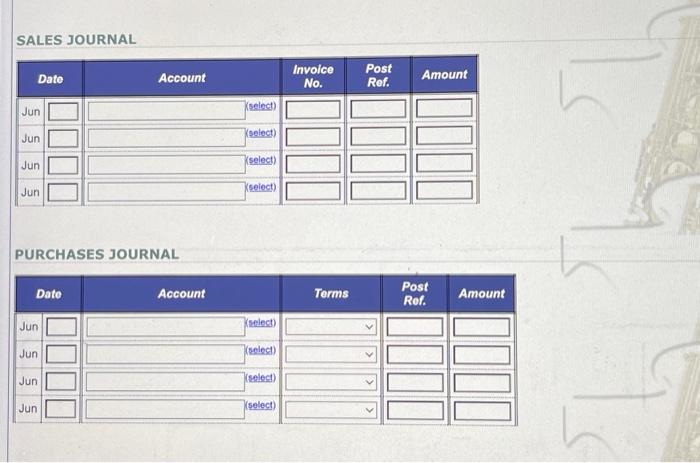

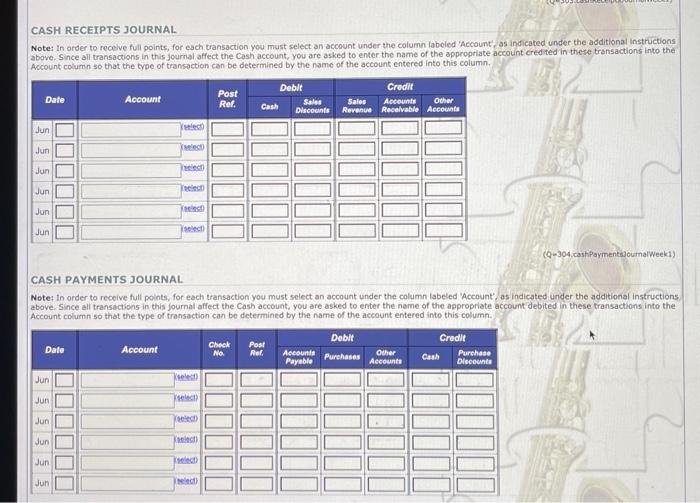

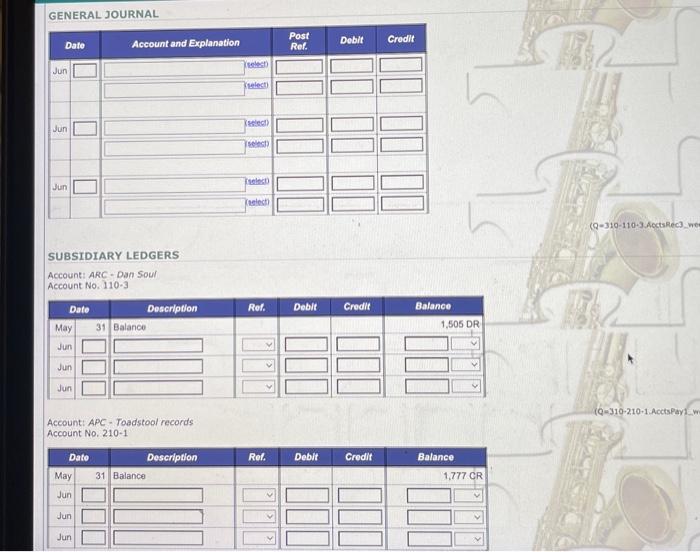

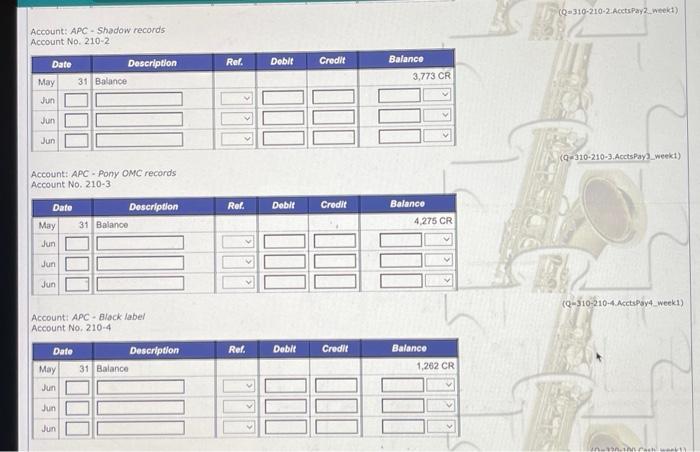

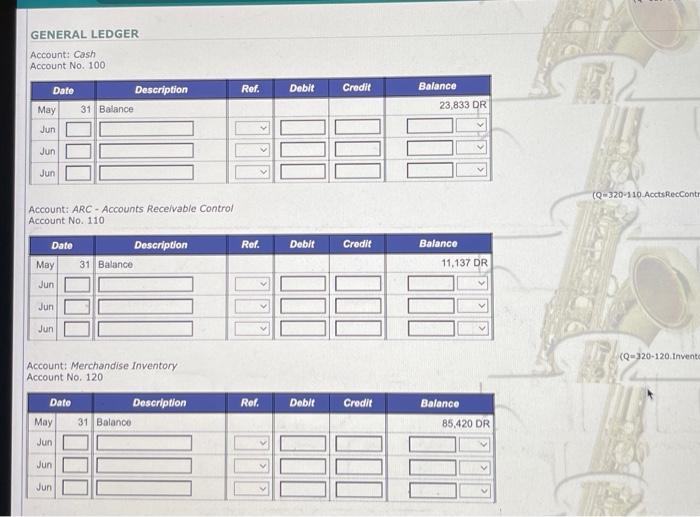

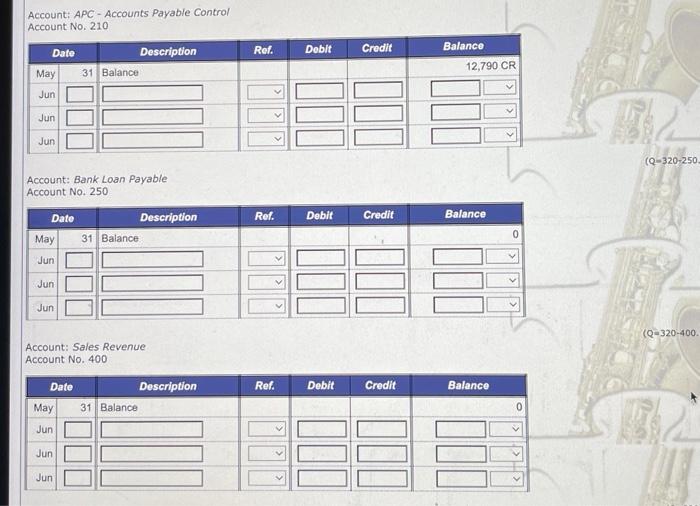

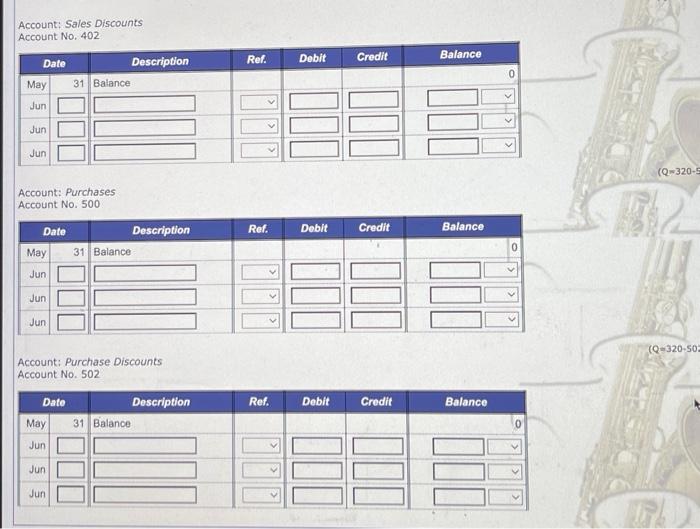

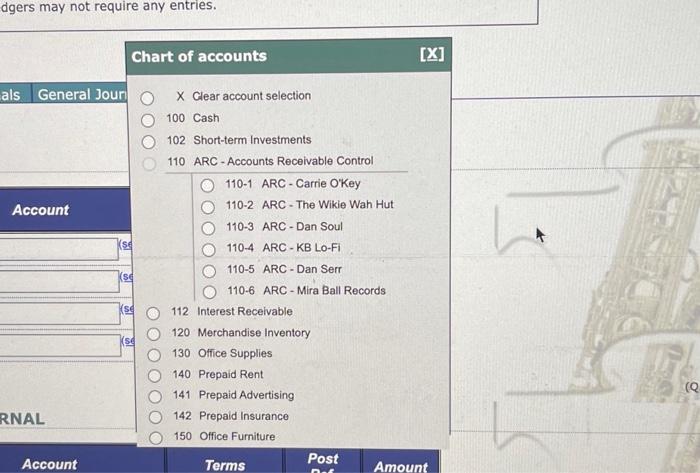

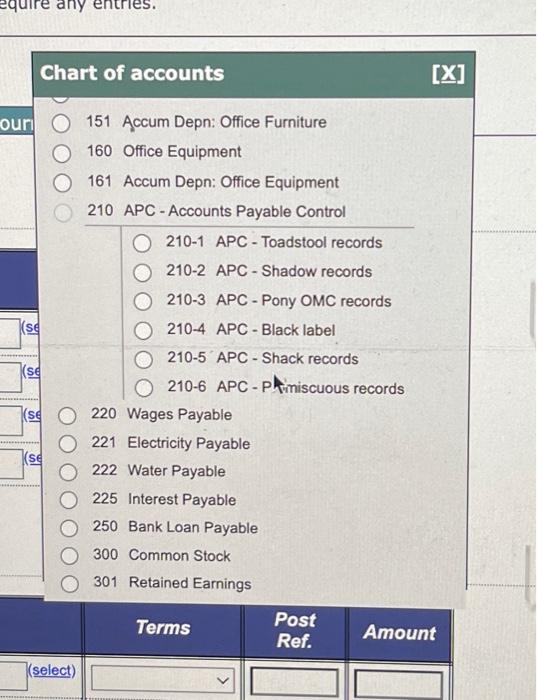

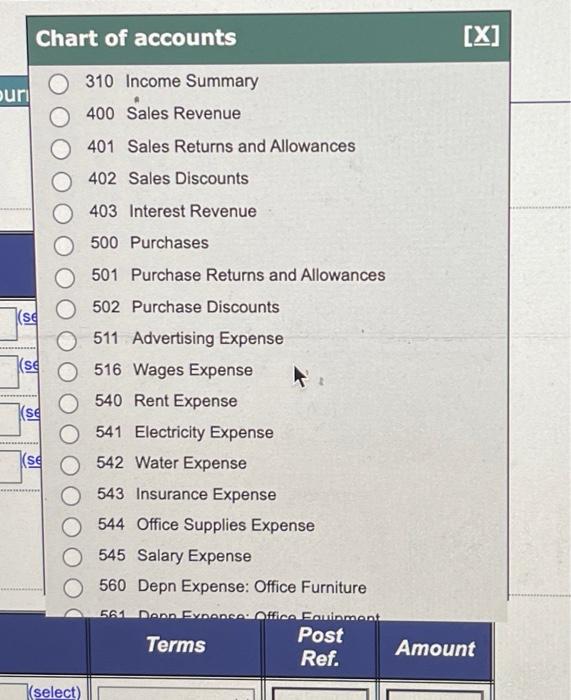

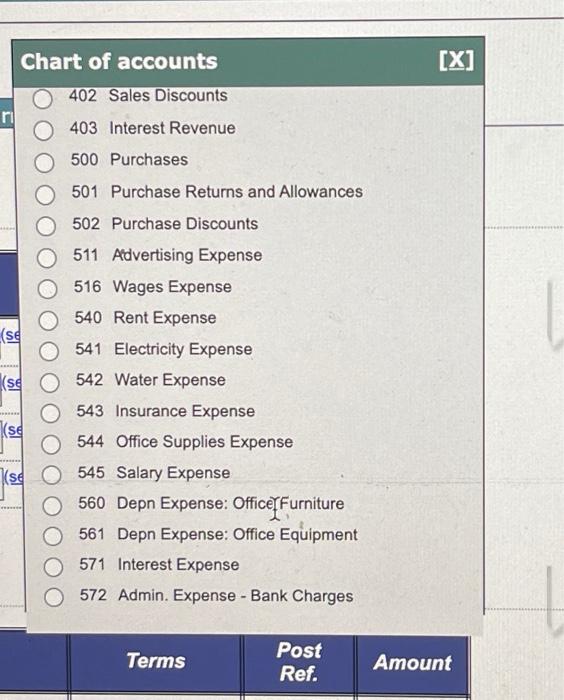

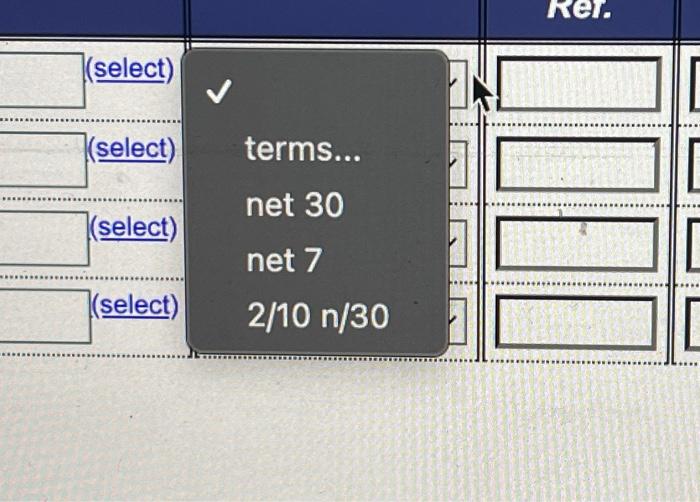

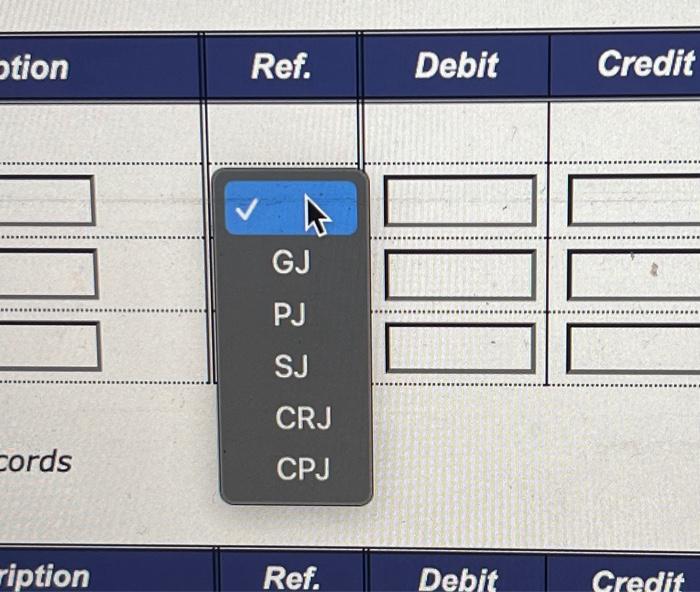

Week 1 Date Transaction description 1 Paid the full amount owing to Shadow records, Check No. 903. Payment fell within discount period. 1 Obtained a loan of $60,000 from MRMC Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2023 and the principal of the loan is to be repaid on June 1, 2028. 2 Paid the full amount owing to Black label, Check No. 904. Payment fell within discount period. 2 Purchased 70 Best of the 1870 s, 80 s \& 90 s Albums with cash for $20 each, Check No. 905. 3 Purchased 20 The Pixie Chicks CDs from Pony OMC records for $16 each, terms net 30. 5 Made cash sales of $7,247 during the first 5 days of the month. 7 Purchased 50 My Chemical Imbalance T-shirts from Toadstool records for $20 each, terms 2/10,n/30. 7 Sold 170 Mandy Amp and the Thought Police CDs to Dan Soul for \$35 each, Invoice No. 201. Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash amount, subtract the discount from the original amount. Additional instructions Displaying selected accounting records: - To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. - There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. - If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you have entered will remain in that accounting record and be displayed whenever you can see that accounting record. - Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. You are required to complete all relevant accounting records before pressing the Submit answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers. Journals: - Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. - For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. - For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. - There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 1101, you should type ' 110/1101 ' into the Post Ref. column. - General journal entries do NOT require a description of the journal entries. Ledgers: - When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. - For each ledger, under the Ref. column, you need to select the correct journal from a list in the dropdown box provided in order to receive full points. - If the balance of a ledger account is zero you do not need to select a debit or credit from the drop-down box. - Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger. Both journals and ledgers: - Most journals and ledgers will have blank rows left at the end of the page. - Some journals and ledgers may not require any entries. SALES JOURNAL PURCHASES JOURNAL CASH RECEIPTS JOURINAL. Note: in order to recelve full points, for each transaction you must select an account under the column labeled 'Account, as indicated under the additional instructions above. Since all transactions in this joumal affect the Cash account, you are asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of transection can be determined by the name of the account entered into this column. CASH PAYMENTS JOURNAL. (Q-304,cashPayments)oumalWeek1) Note: in order to receive full points, for each transaction you must select an account under the column labeled 'Account', as indicated under the additional instructions above. Since all transoctions in this journal affect the Cash account, you are asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. GENERAL JOURNAL SUBSIDIARY LEDGERS Account: ARC - Dan Soul Account No, 110-3 Account: APC - Toadstool records Account No. 210-1 Account: APC - Shadow records Account No, 210-2 Account: APC - Pony OMC records Account No. 210-3 (Q3102103.AcctsPay _weekt) Account: APC - Block label Aecount No. 210-4 Account: Cash AcCount No. 100 Account: ARC - Accounts Receivable Control Account No. 110 Account: Merchandise Inventory Account No, 120 Account: APC - Accounts Payable Control Account No. 210 Account: Bank Loan Payable Account No. 250 Account: Sales Revenue Account No. 400 Account: Sales Discounts Account No. 402 Account: Purchases Account No. 500 Account: Purchase Discounts Account No. 502 dgers may not require any entries. Post 151 Accum Depn: Office Furniture 160 Office Equipment 161 Accum Depn: Office Equipment 210 APC - Accounts Payable Control 210-1 APC - Toadstool records 210-2 APC - Shadow records 210-3 APC - Pony OMC records 210-4 APC - Black label 210-5 APC - Shack records 210-6 APC - PAimiscuous records 220 Wages Payable 221 Electricity Payable 222 Water Payable 225 Interest Payable 250 Bank Loan Payable 300 Common Stock 301 Retained Earnings Chart of accounts [x] 310 Income Summary 400 Sales Revenue 401 Sales Returns and Allowances 402 Sales Discounts 403 Interest Revenue 500 Purchases 501 Purchase Returns and Allowances 502 Purchase Discounts 511 Advertising Expense 516 Wages Expense 540 Rent Expense 541 Electricity Expense 542 Water Expense 543 Insurance Expense 544 Office Supplies Expense 545 Salary Expense 560 Depn Expense: Office Furniture Chart of accounts 402 Sales Discounts 403 Interest Revenue 500 Purchases 501 Purchase Returns and Allowances 502 Purchase Discounts 511 Addvertising Expense 516 Wages Expense 540 Rent Expense 541 Electricity Expense 542 Water Expense 543 Insurance Expense 544 Office Supplies Expense 545 Salary Expense 560 Depn Expense: Offic] Furniture 561 Depn Expense: Office Equipment 571 Interest Expense 572 Admin. Expense-Bank Charges

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts