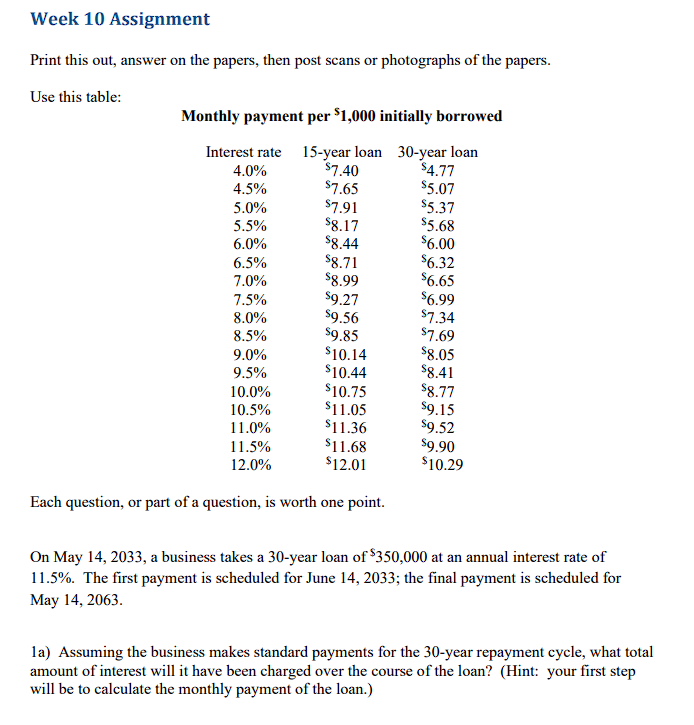

Question: Week 10 Assignment Print this out, answer on the papers, then post scans or photographs of the papers. Use this table: Monthly payment per s1,000

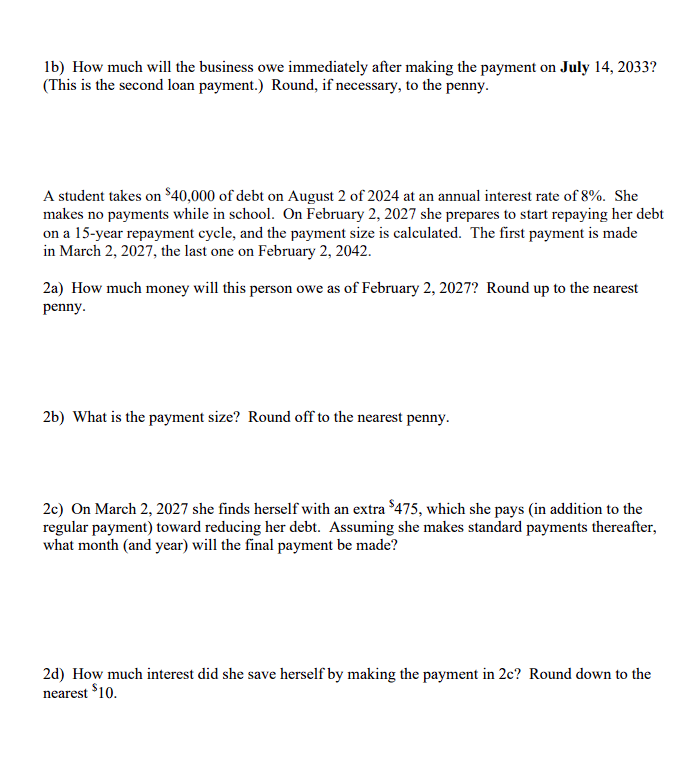

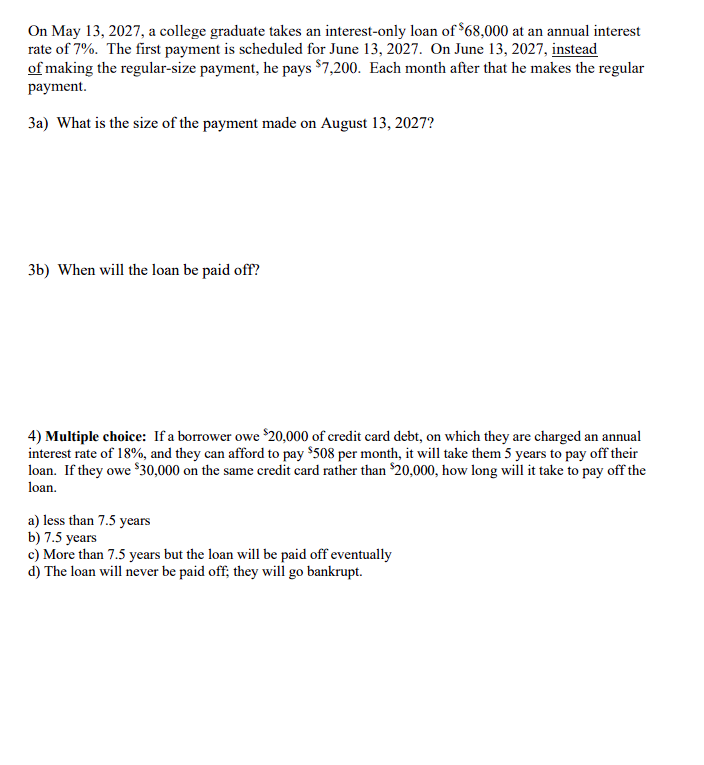

Week 10 Assignment Print this out, answer on the papers, then post scans or photographs of the papers. Use this table: Monthly payment per s1,000 initially borrowed Each question, or part of a question, is worth one point. On May 14, 2033, a business takes a 30 -year loan of $350,000 at an annual interest rate of 11.5%. The first payment is scheduled for June 14, 2033; the final payment is scheduled for May 14, 2063. 1a) Assuming the business makes standard payments for the 30-year repayment cycle, what tota amount of interest will it have been charged over the course of the loan? (Hint: your first step will be to calculate the monthly payment of the loan.) 1b) How much will the business owe immediately after making the payment on July 14, 2033 ? (This is the second loan payment.) Round, if necessary, to the penny. A student takes on s40,000 of debt on August 2 of 2024 at an annual interest rate of 8%. She makes no payments while in school. On February 2, 2027 she prepares to start repaying her debt on a 15 -year repayment cycle, and the payment size is calculated. The first payment is made in March 2, 2027, the last one on February 2, 2042. 2a) How much money will this person owe as of February 2, 2027? Round up to the nearest penny. 2b) What is the payment size? Round off to the nearest penny. 2c) On March 2, 2027 she finds herself with an extra 5475, which she pays (in addition to the regular payment) toward reducing her debt. Assuming she makes standard payments thereafter, what month (and year) will the final payment be made? 2d) How much interest did she save herself by making the payment in 2c ? Round down to the nearest $10. On May 13, 2027, a college graduate takes an interest-only loan of $68,000 at an annual interest rate of 7%. The first payment is scheduled for June 13, 2027. On June 13, 2027, instead of making the regular-size payment, he pays $7,200. Each month after that he makes the regular payment. 3a) What is the size of the payment made on August 13, 2027 ? 3b) When will the loan be paid off? 4) Multiple choice: If a borrower owe 220,000 of credit card debt, on which they are charged an annual interest rate of 18%, and they can afford to pay $508 per month, it will take them 5 years to pay off their loan. If they owe s30,000 on the same credit card rather than s20,000, how long will it take to pay off the loan. a) less than 7.5 years b) 7.5 years c) More than 7.5 years but the loan will be paid off eventually d) The loan will never be paid off; they will go bankrupt. Week 10 Assignment Print this out, answer on the papers, then post scans or photographs of the papers. Use this table: Monthly payment per s1,000 initially borrowed Each question, or part of a question, is worth one point. On May 14, 2033, a business takes a 30 -year loan of $350,000 at an annual interest rate of 11.5%. The first payment is scheduled for June 14, 2033; the final payment is scheduled for May 14, 2063. 1a) Assuming the business makes standard payments for the 30-year repayment cycle, what tota amount of interest will it have been charged over the course of the loan? (Hint: your first step will be to calculate the monthly payment of the loan.) 1b) How much will the business owe immediately after making the payment on July 14, 2033 ? (This is the second loan payment.) Round, if necessary, to the penny. A student takes on s40,000 of debt on August 2 of 2024 at an annual interest rate of 8%. She makes no payments while in school. On February 2, 2027 she prepares to start repaying her debt on a 15 -year repayment cycle, and the payment size is calculated. The first payment is made in March 2, 2027, the last one on February 2, 2042. 2a) How much money will this person owe as of February 2, 2027? Round up to the nearest penny. 2b) What is the payment size? Round off to the nearest penny. 2c) On March 2, 2027 she finds herself with an extra 5475, which she pays (in addition to the regular payment) toward reducing her debt. Assuming she makes standard payments thereafter, what month (and year) will the final payment be made? 2d) How much interest did she save herself by making the payment in 2c ? Round down to the nearest $10. On May 13, 2027, a college graduate takes an interest-only loan of $68,000 at an annual interest rate of 7%. The first payment is scheduled for June 13, 2027. On June 13, 2027, instead of making the regular-size payment, he pays $7,200. Each month after that he makes the regular payment. 3a) What is the size of the payment made on August 13, 2027 ? 3b) When will the loan be paid off? 4) Multiple choice: If a borrower owe 220,000 of credit card debt, on which they are charged an annual interest rate of 18%, and they can afford to pay $508 per month, it will take them 5 years to pay off their loan. If they owe s30,000 on the same credit card rather than s20,000, how long will it take to pay off the loan. a) less than 7.5 years b) 7.5 years c) More than 7.5 years but the loan will be paid off eventually d) The loan will never be paid off; they will go bankrupt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts