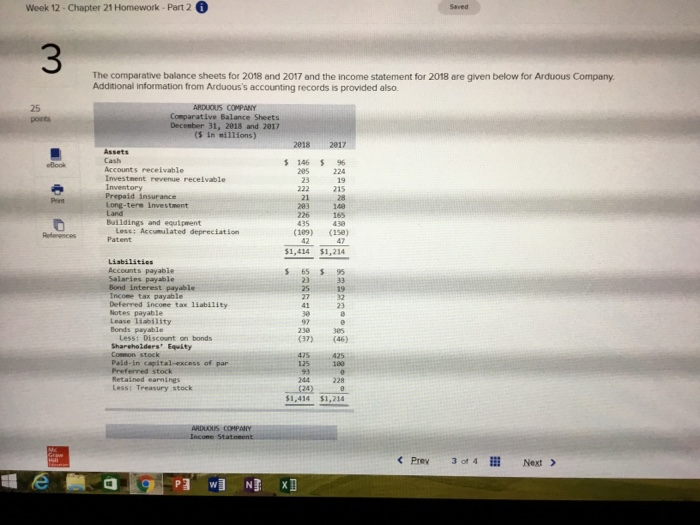

Question: Week 12 - Chapter 21 Homework - Part 2 The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given

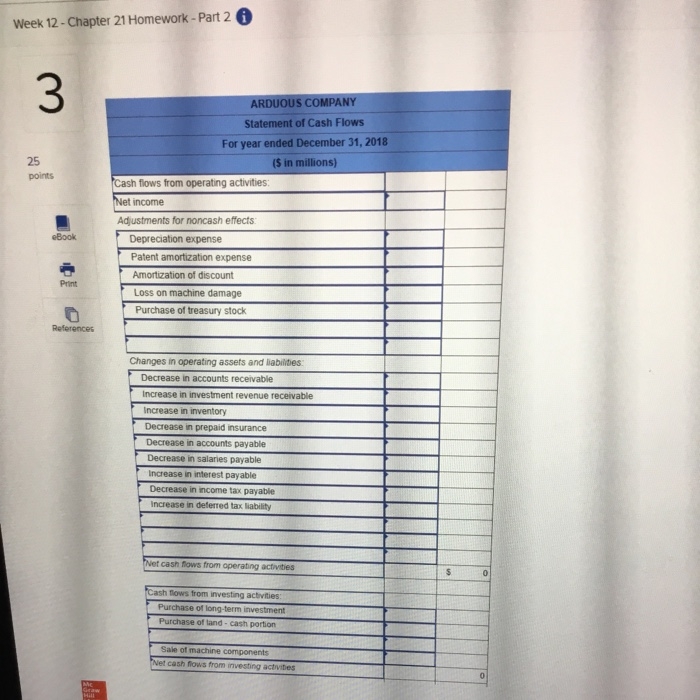

Week 12 - Chapter 21 Homework - Part 2 The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company Additional information from Arduous's accounting records is provided also ARDUOUS COMPANY Comparative Balance Sheets December 31, 2018 and 2017 15 In willions) 2018 2017 $ 166 6 Accounts receivable Investment revenue receivable Inventory Prepaid insurance Long-tere investment Land Buildings and out Less Accumulated depreciation Patent (109) (15) 51.414 $1,214 Liabilities Accounts payable Salaries payable Bond Interest payable Tnce tax payable Deferred Inc tal ity Notes payable Lease l ility Bonds payable Lesst Discount on bonds Shareholders' Equity Common stock Pald-in capital-excess of par Preferred stock Retained earnings Less Treasury stack (24) $1,414 $1,216 ARDUOUS COMPNIY Income Statement og pwNSX] Week 12 - Chapter 21 Homework - Part 2 points ARDUOUS COMPANY Statement of Cash Flows For year ended December 31, 2018 (5 in millions) Cash flows from operating activities: Net income Adjustments for noncash effects: Depreciation expense Patent amortization expense Amortization of discount Loss on machine damage Purchase of treasury stock References Changes in operating assets and liabilities Decrease in accounts receivable Increase in investment revenue receivable Increase in inventory Decrease in prepaid insurance Decrease in accounts payable Decrease in salaries payable Increase in interest payable Decrease in income tax payable Increase in deferred tax liability Net cash flows from operating activities Cash flows from investing activities: Purchase of long-term investment Purchase of land - cash portion Sale of machine components Net cash flows from investing activities Week 12 - Chapter 21 Homework - Part 2 The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company Additional information from Arduous's accounting records is provided also ARDUOUS COMPANY Comparative Balance Sheets December 31, 2018 and 2017 15 In willions) 2018 2017 $ 166 6 Accounts receivable Investment revenue receivable Inventory Prepaid insurance Long-tere investment Land Buildings and out Less Accumulated depreciation Patent (109) (15) 51.414 $1,214 Liabilities Accounts payable Salaries payable Bond Interest payable Tnce tax payable Deferred Inc tal ity Notes payable Lease l ility Bonds payable Lesst Discount on bonds Shareholders' Equity Common stock Pald-in capital-excess of par Preferred stock Retained earnings Less Treasury stack (24) $1,414 $1,216 ARDUOUS COMPNIY Income Statement og pwNSX] Week 12 - Chapter 21 Homework - Part 2 points ARDUOUS COMPANY Statement of Cash Flows For year ended December 31, 2018 (5 in millions) Cash flows from operating activities: Net income Adjustments for noncash effects: Depreciation expense Patent amortization expense Amortization of discount Loss on machine damage Purchase of treasury stock References Changes in operating assets and liabilities Decrease in accounts receivable Increase in investment revenue receivable Increase in inventory Decrease in prepaid insurance Decrease in accounts payable Decrease in salaries payable Increase in interest payable Decrease in income tax payable Increase in deferred tax liability Net cash flows from operating activities Cash flows from investing activities: Purchase of long-term investment Purchase of land - cash portion Sale of machine components Net cash flows from investing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts