Question: Week #12HW: Variable Costing Savod Help Save & Exit Submit Check my work 3 0 1 points 8 00:42:16 Required information [The following information applies

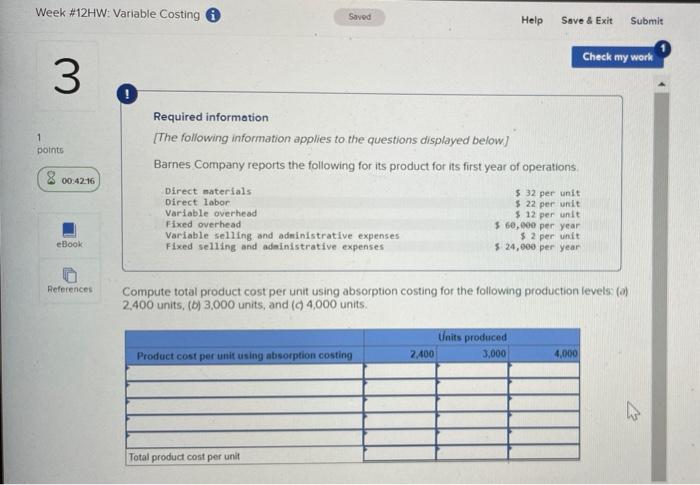

Week #12HW: Variable Costing Savod Help Save & Exit Submit Check my work 3 0 1 points 8 00:42:16 Required information [The following information applies to the questions displayed below) Barnes Company reports the following for its product for its first year of operations Direct materials $ 32 per unit Direct labor $ 22 per unit Variable overhead $ 12 per unit Fixed overhead $ 60,000 per year Variable selling and administrative expenses $ 2 per unit Fixed selling and administrative expenses $ 24,000 per year eBook References Compute total product cost per unit using absorption costing for the following production levels (6) 2.400 units. () 3.000 units, and (94,000 units. Units produced 2.400 3,000 Product cost per unit using absorption costing 4,000 is Total product cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts