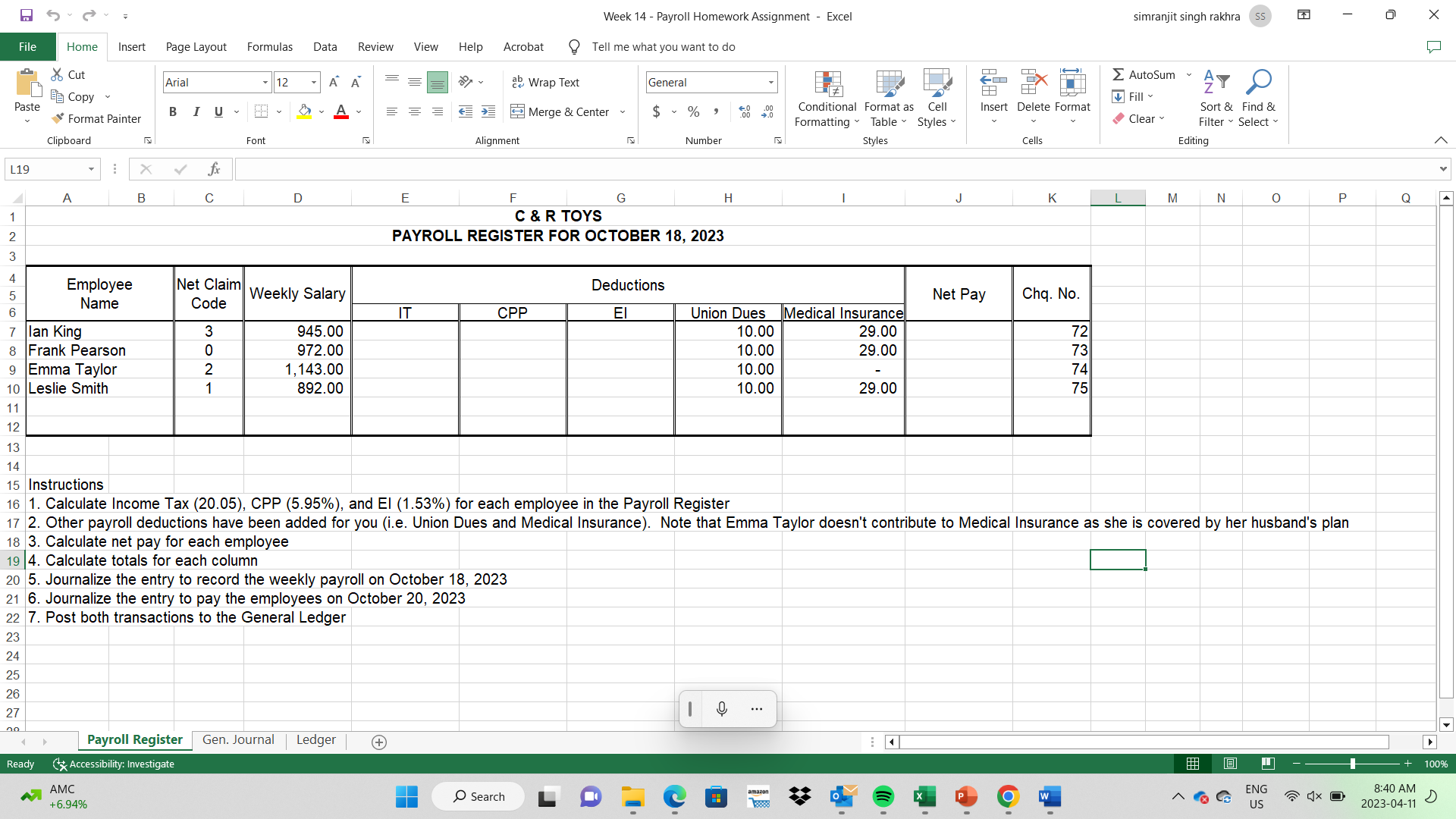

Question: Week 14 - Payroll Homework Assignment - Excel simranjit singh rakhra ($5 X File Home Insert Page Layout Formulas Data Review View Help Acrobat Tell

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock