Question: Week 4 Connect Homework (10 points) i Saved Help Save & Exit Submit Check my work 6 Suppose the following bond quote for IOU Corporation

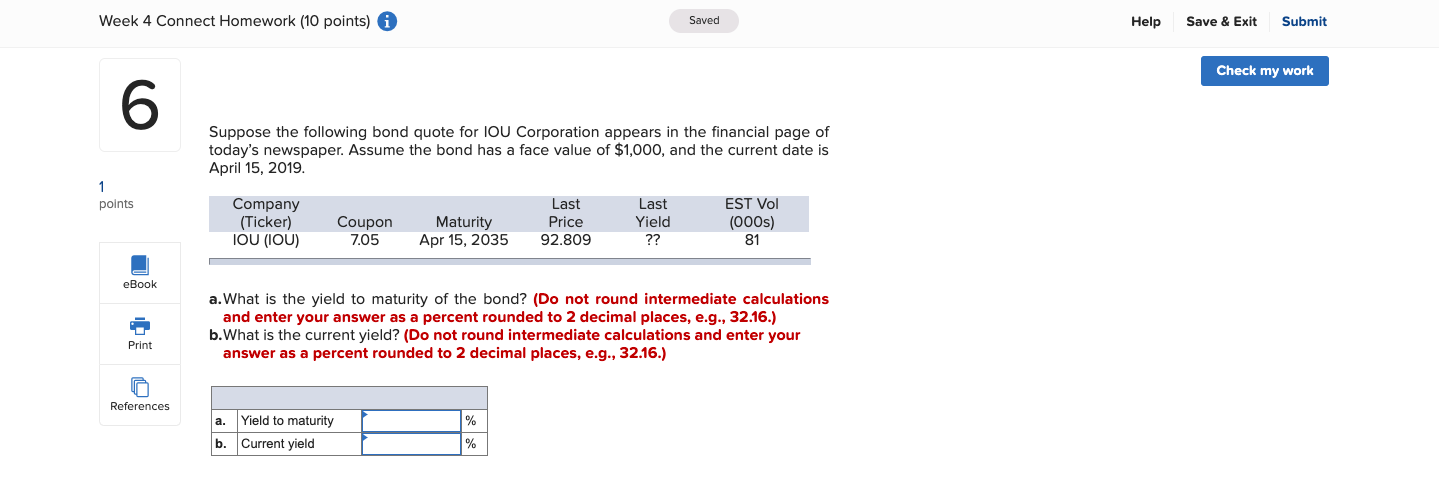

Week 4 Connect Homework (10 points) i Saved Help Save & Exit Submit Check my work 6 Suppose the following bond quote for IOU Corporation appears in the financial page of today's newspaper. Assume the bond has a face value of $1,000, and the current date is April 15, 2019 1 points Company (Ticker) IOU (OU) Coupon 7.05 Maturity Apr 15, 2035 Last Price 92.809 Last Yield ?? EST Vol (000s) 81 eBook a. What is the yield to maturity of the bond? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b.What is the current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Print References a. % Yield to maturity b. Current yield %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts