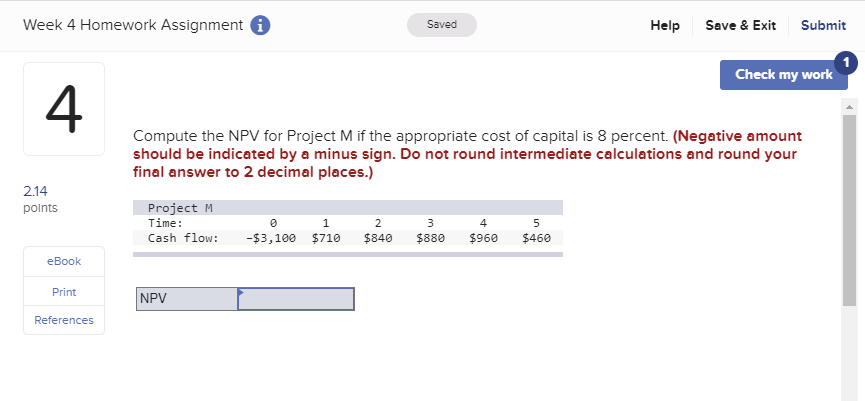

Question: Week 4 Homework Assignment i Saved Help Save & Exit Submit Check my work Compute the NPV for Project M if the appropriate cost of

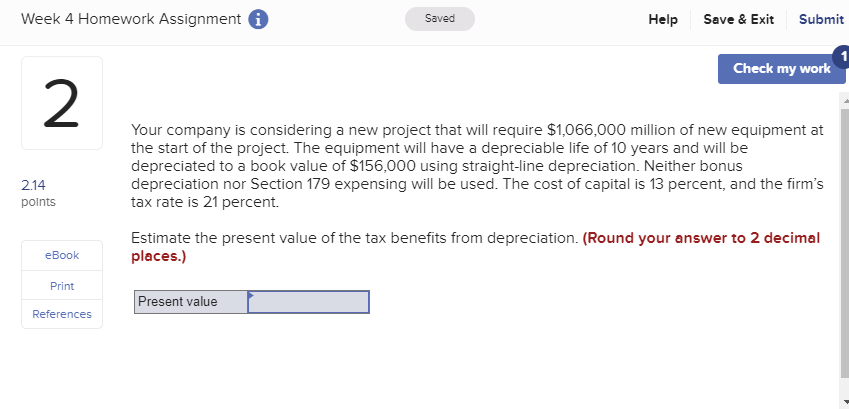

Week 4 Homework Assignment i Saved Help Save & Exit Submit Check my work Compute the NPV for Project M if the appropriate cost of capital is 8 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) 2.14 points Project M Time: Cash flow: 0 $3,100 1 $710 2 $840 3 $880 4 $960 5 $460 eBook Print NPV I References Week 4 Homework Assignment i Saved Help Save & Exit Submit Check my work Your company is considering a new project that will require $1,066,000 million of new equipment at the start of the project. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of $156,000 using straight-line depreciation. Neither bonus depreciation nor Section 179 expensing will be used. The cost of capital is 13 percent, and the firm's tax rate is 21 percent. 2.14 points Estimate the present value of the tax benefits from depreciation. (Round your answer to 2 decimal places.) eBook Print Present value References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts