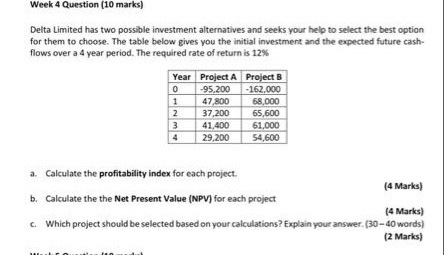

Question: Week 4 Question (10 marks) Delta Limited has two possible investment alternatives and seeks your help to select the best option for them to choose.

Week 4 Question (10 marks) Delta Limited has two possible investment alternatives and seeks your help to select the best option for them to choose. The table below gives you the initial investment and the expected future cash flows over a 4 year period. The required rate of return is 12% Year Project A 0 -95.200 1 47 800 2 37.200 3 41.400 29,200 Project B -162.000 68,000 65.600 61.000 54,600 a. Calculate the profitability index for each project. (4 Marks) b. Calculate the the Net Present Value (NPV) for each project (4 Marks) Which project should be selected based on your calculations? Explain your answer 30-40 words) (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts