Question: Week 4 Quiz Saved 7 Han is a self-employed carpenter and his wife, Christine, works full time as a grade school teacher. Han paid $525

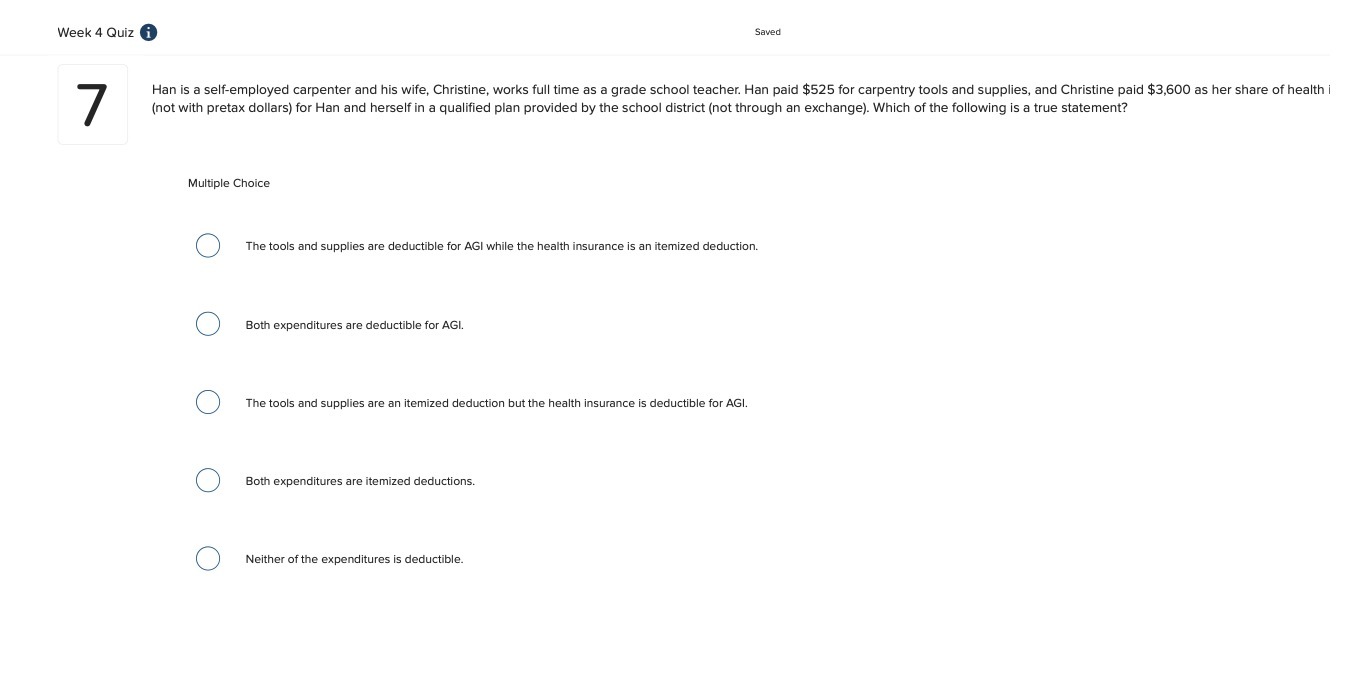

Week 4 Quiz Saved 7 Han is a self-employed carpenter and his wife, Christine, works full time as a grade school teacher. Han paid $525 for carpentry tools and supplies, and Christine paid $3,600 as her share of health i (not with pretax dollars) for Han and herself in a qualified plan provided by the school district (not through an exchange). Which of the following is a true statement? Multiple Choice O The tools and supplies are deductible for AGI while the health insurance is an itemized deduction. O Both expenditures are deductible for AGI. O The tools and supplies are an itemized deduction but the health insurance is deductible for AGI. O Both expenditures are itemized deductions. O Neither of the expenditures is deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts