Question: Week 6 Assignment 1) A $1,000 par value bond with 5 years of maturity pays 5% coupon rate, paid annually. What is the value of

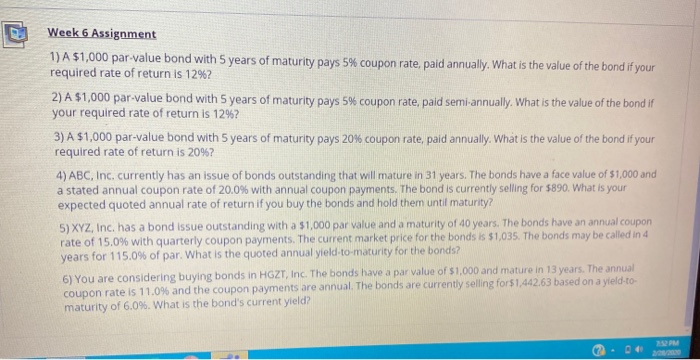

Week 6 Assignment 1) A $1,000 par value bond with 5 years of maturity pays 5% coupon rate, paid annually. What is the value of the bond if your required rate of return is 12%? 2) A $1,000 par-value bond with 5 years of maturity pays 5% coupon rate, pald semi-annually. What is the value of the bond if your required rate of return is 12%? 3) A $1,000 par-value bond with 5 years of maturity pays 20% coupon rate, paid annually. What is the value of the bond if your required rate of return is 20%? 4) ABC, Inc. currently has an issue of bonds outstanding that will mature in 31 years. The bonds have a face value of $1,000 and a stated annual coupon rate of 20.0% with annual coupon payments. The bond is currently selling for $890. What is your expected quoted annual rate of return if you buy the bonds and hold them until maturity? 5) XYZ, Inc. has a bond issue outstanding with a $1,000 par value and a maturity of 40 years. The bonds have an annual coupon rate of 15.0% with quarterly coupon payments. The current market price for the bonds is $1,035. The bonds may be called in 4 years for 115.0% of par. What is the quoted annual yield-to-maturity for the bonds? 6) You are considering buying bonds in HGZT, Inc. The bonds have a par value of $1,000 and mature in 13 years. The annual coupon rate is 11.0% and the coupon payments are annual. The bonds are currently selling for $1,442.63 based on a yield-to- maturity of 6.0%. What is the bond's current yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts