Question: Week 6 Chapter 20 5-8 Please help with this Accounting problems. 5 Required information [The following information applies to the questions displayed below.] Connie recently

Week 6 Chapter 20 5-8

Please help with this Accounting problems.

5

![[The following information applies to the questions displayed below.] Connie recently provided](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667ff084d2a0b_676667ff084bf475.jpg)

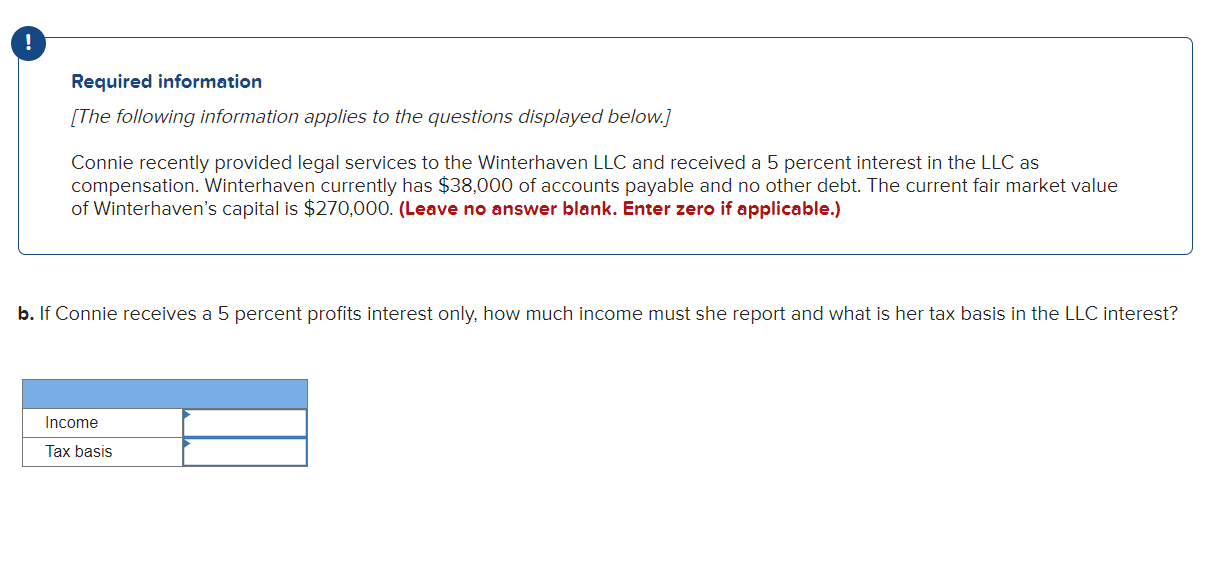

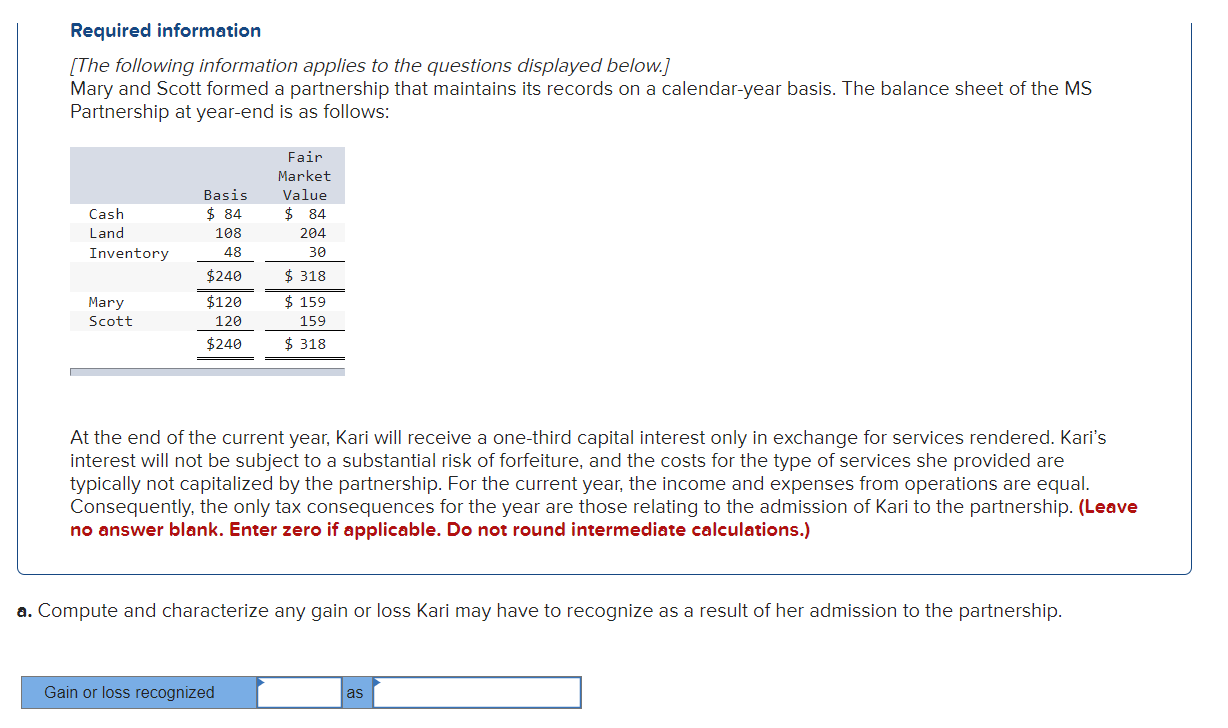

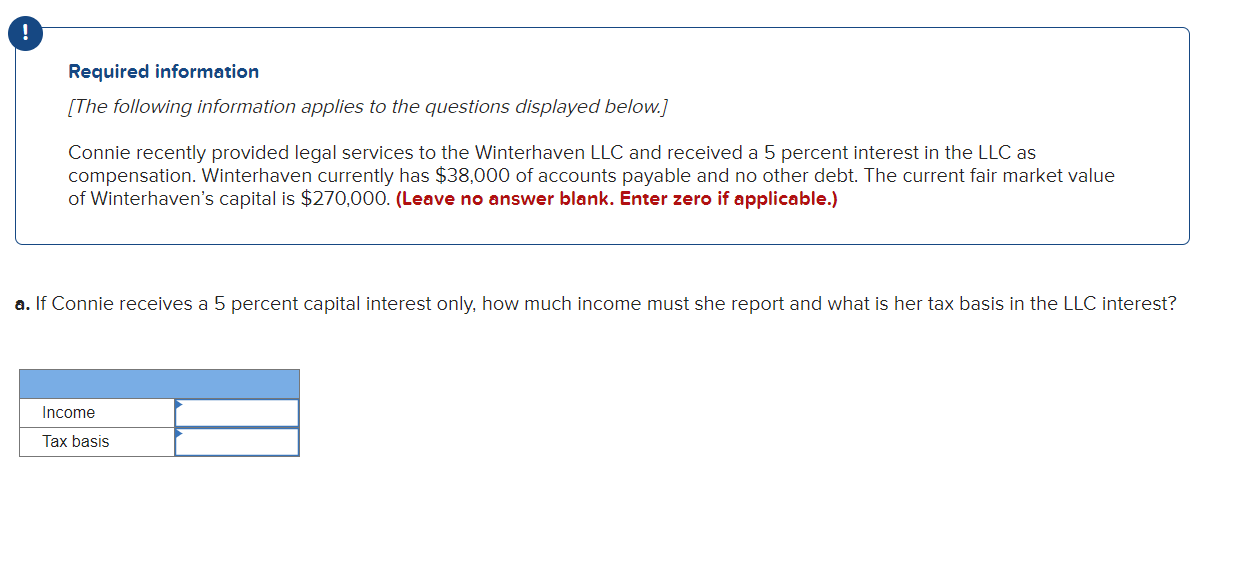

Required information [The following information applies to the questions displayed below.] Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $38,000 of accounts payable and no other debt. The current fair market value of Winterhaven's capital is $270,000. (Leave no answer blank. Enter zero if applicable.) b. If Connie receives a 5 percent profits interest only, how much income must she report and what is her tax basis in the LLC interest? Tax basis Required information [The following information applies to the questions displayed below.] Connie recently provided legal services to the Winterhaven LLC and received a & percent interest in the LLC as compensation. Winterhaven currently has $38,000 of accounts payable and no other debt. The current fair market value of Winterhaven's capital is $270,000. (Leave no answer blank. Enter zero if applicable.) . [f Connie receives a 5 percent capital and profits interest, how much income must she report and what is her tax basis in the LLC interest? Tax basis Required information [The following information applies to the questions displayed below.] Mary and Scott formed a partnership that maintains its records on a calendar-year basis. The balance sheet of the MS Partnership at year-end Is as follows: Fair Market Basis Value Cash $ 84 $ 84 Land 188 294 Inventory 48 38 $240 % 318 Mary %120 % 159 Scott 126 159 4240 % 318 At the end of the current year, Kari will receive a one-third capital interest only in exchange for services rendered. Kari's interest will not be subject to a substantial risk of forfeiture, and the costs for the type of services she provided are typically not capitalized by the partnership. For the current year, the income and expenses from operations are equal. Consequently, the only tax consequences for the year are those relating to the admission of Kari to the partnership. (Leave no answer blank. Enter zero if applicable. Do not round intermedliate calculations.) a. Compute and characterize any gain or loss Kari may have {o recognize as a result of her admission to the partnership. TN B 0000 | Required information [The following information applies to the questions displayed below.] Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $38,000 of accounts payable and no other debt. The current fair market value of Winterhaven's capital is $270,000. (Leave no answer blank. Enter zero if applicable.) a. If Connie receives a 5 percent capital interest only, how much income must she report and what is her tax basis in the LLC interest? Income Tax basis

Step by Step Solution

There are 3 Steps involved in it

Lets break down the answers for each of the questions based on the provided information Question 5 p... View full answer

Get step-by-step solutions from verified subject matter experts