Question: Week 6 Homework Assignment: Decentralization and Performance Evaluation Question 2 of 4 - 16 5 : Current Attempt in Progress For fiscal year 2020, Marx

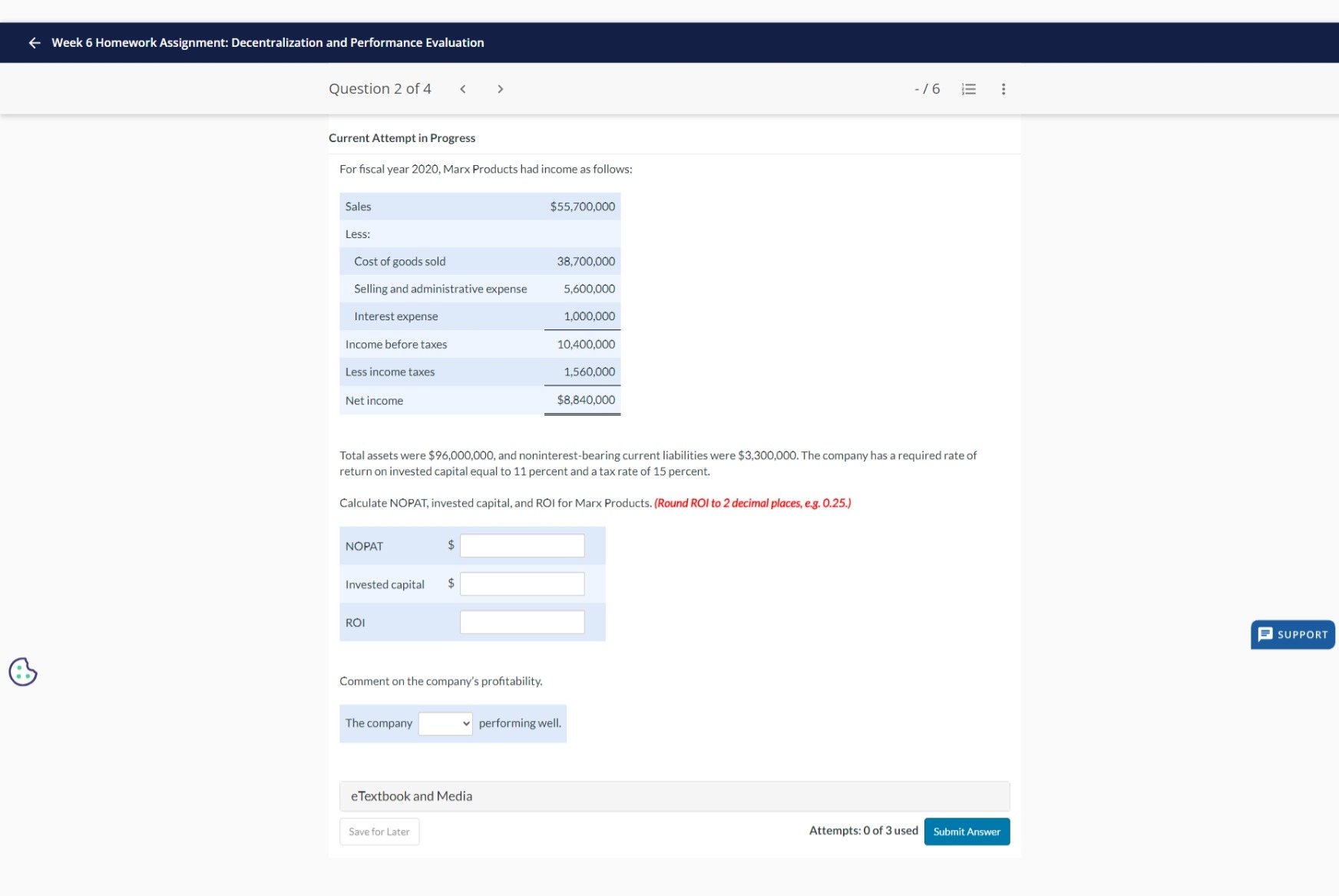

Week 6 Homework Assignment: Decentralization and Performance Evaluation Question 2 of 4 - 16 5 : Current Attempt in Progress For fiscal year 2020, Marx Products had income as follows: Sales $55,700,000 Less: Cost of goods sold 38,700,000 Selling and administrative expense 5,600,000 Interest expense 1,000,000 Income before taxes 10,400,000 Less income taxes 1,560,000 Net income $8,840,000 Total assets were $96,000,000, and noninterest-bearing current liabilities were $3,300,000. The company has a required rate of return on invested capital equal to 11 percent and a tax rate of 15 percent. Calculate NOPAT, invested capital, and ROI for Marx Products. (Round ROI to 2 decimal places, e.g. 0.25.) NOPAT $ Invested capital $ ROI SUPPORT Comment on the company's profitability. The company performing well. e Textbook and Media Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts