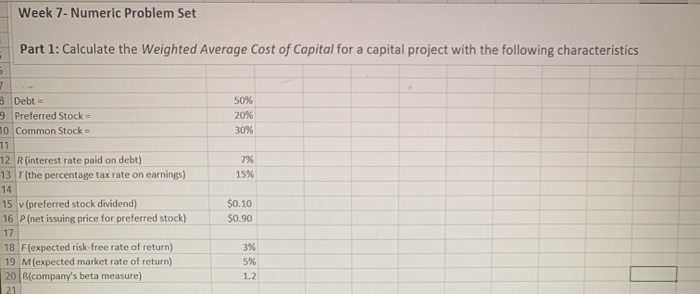

Question: Week 7- Numeric Problem Set Part 1: Calculate the weighted Average Cost of Capital for a capital project with the following characteristics B Debt -

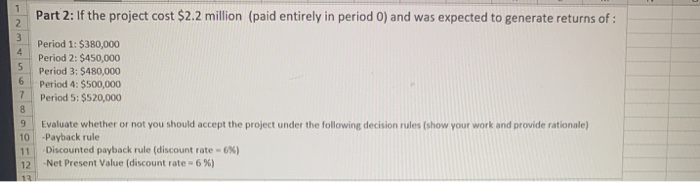

Week 7- Numeric Problem Set Part 1: Calculate the weighted Average Cost of Capital for a capital project with the following characteristics B Debt - 9 Preferred Stock 10 Common Stock 50% 20% 30% 15% 12 R(interest rate paid on debt) 13 T (the percentage tax rate on earnings) 14 15 v(preferred stock dividend) 16 P (net issuing price for preferred stock) $0.10 $0.90 17 18 Flexpected risk-free rate of return) 19 M (expected market rate of return) 20 B[company's beta measure) 21 Part 2: If the project cost $2.2 million (paid entirely in period 0) and was expected to generate returns of : Period 1: $380,000 Period 2: $450,000 Period 3: $480,000 Period 4: $500,000 Period 5: $520,000 7 9 10 Evaluate whether or not you should accept the project under the following decision rules (show your work and provide rationale) Payback rule Discounted payback rule (discount rate - 6%) Net Present Value (discount rate 6%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts