Question: week 8, #2 Problem: If Wild Widgets, Inc. were an all equity company, it would have a beta of 1.15. The company has a target

week 8, #2

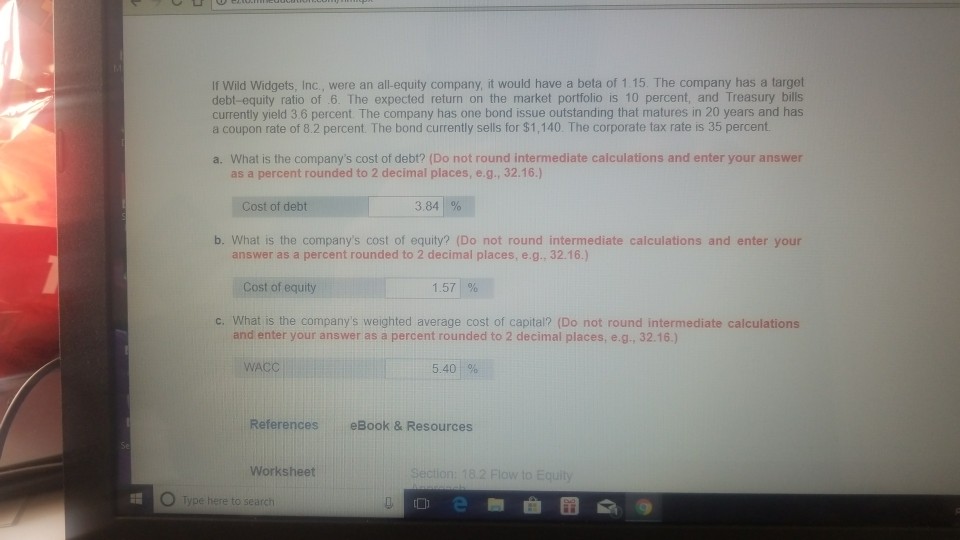

Problem: If Wild Widgets, Inc. were an all equity company, it would have a beta of 1.15. The company has a target debt-equit ratio of 6. The expected return on the market portfolio is 10 percent, and treasury bills currently yield 3.6 percent. The company has one bond issue outstanding that matures in 20 years and has a coupon rate of 8.2 percent. The bond currently sells for $1,140. The corporate tax rate is 35 percent.

A) What is the company's cost of debt? B) What is the company's cost of equity? C) What is the company's weighted average cost of capital?

(Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16)

Side note: The answers you see displayed are the wrong answers. For whatever reason the online homework system believes these are wrong. I've submitted this answer multiple times to cheggs. Each time I've been given the wrong answer by the tutors. I've done my own calculations and haven't come up with the correct answers. Will someone please help me?

Thank you in advance

If Wild Widgets, Inc, were an all-equity company, it would have a beta of 1.15. The company has a target debt-equity ratio of .6. The expected return on the market portfolio is 10 percent, and Treasury bills currently yield 3 6 percent The company has one bond issue outstanding that matures in 20 years and has a coupon rate of 8.2 percent. The bond currently sells for $1,140 The corporate tax rate is 35 percent a. What is the company's cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) t of debt 3.84) % b. What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity 1.571 % c. What is the company's weighted average cost of capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 5.401 % References eBook & Resources Worksheet Section: 18.2 Flow to Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts