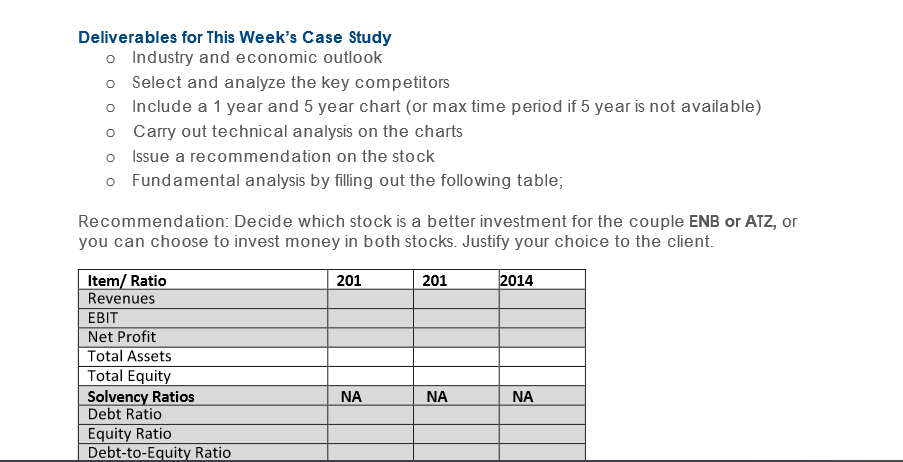

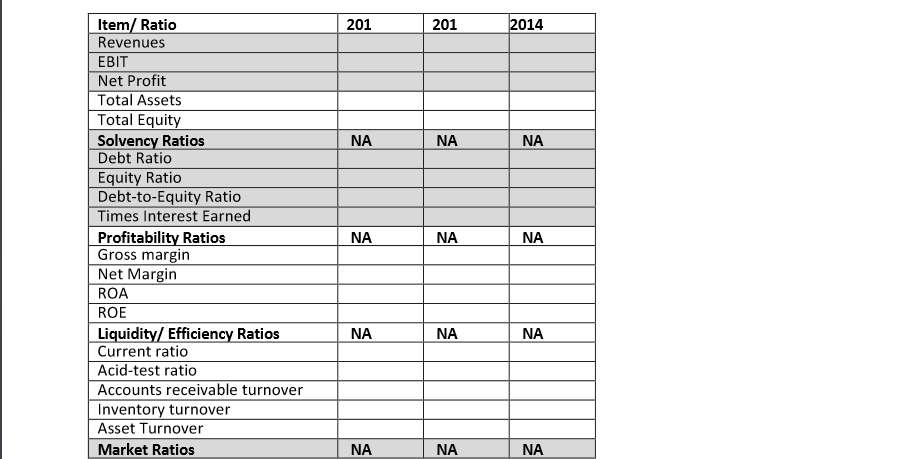

Question: Week 8 Applicable VLOs or EESs for This Week's Case Study 6 Evaluate the financial performance of a business through the analysis of financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts