Question: Week 8 Quiz Practice Problems 3) (20 pts) You are considering three stocks for your portfolio. The expected return on the market portfolio is 12%

Week 8 Quiz Practice Problems

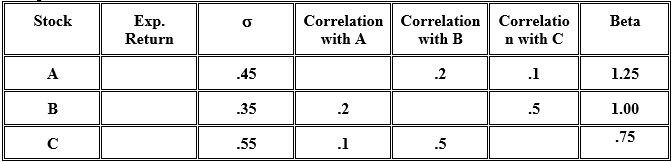

3) (20 pts) You are considering three stocks for your portfolio. The expected return on the market portfolio is 12% and the risk free rate is 4%.

a) (5 pts) What is a reasonable estimate of the expected returns for stocks A, B and C?

It is reasonable to use the CAPM to estimate the required rate of return for stocks A, B and C.

Ra = 4% + 1.25 (.12 - .04) = .14

Rb = 4% + 1.00 (.12 - .04) = .12

Rc = 4% + .75 (.12 - .04) = .10

b) (5 pts) What is a reasonable estimate of the expected return for a portfolio that includes $100 of A, $100 of B, and $200 of C.

You can estimate the beta of this portfolio and plug it into the CAPM.

bp = wa ba + wb bb + wc bc = .25 (1.25) + .25 (1.00) + .50 ( .75) = .9375

rp = .04 + .9375 (.12 - .04) = .115

OR you can estimate the expected return from the weighted average of returns from part a

rp =.25 (.14) + .25 (.12) + .50 (.10) = .115

c) (5 pts) What is the standard deviation of a portfolio that includes $300 of stock B and $700 of stock C?

The weight of b is .3 and the weight of c is .7. The ?correlation between the two stocks is .5.

sp = [(.3)2 (.35)2 + (.7)2 (.55)2 + 2 (.3) (.7) (.35) (.55) (.5)](1/2) = .447

d) (5 pts) Explain why it can be true that one stock can have a higher standard deviation and a lower expected return?

The standard deviation includes two kinds of risk systematic and unsystematic. Investors are rewarded only for the undiversifiable (systematic) risk. If one stock has a very high standard deviation but a great deal of unsystematic risk then it can have a lower expected return than a stock with a standard deviation that is predominantly systematic risk.

4) (10 pts) The beta of Nikes common stock is 1.20. Its capital structure is 40% debt. Nikes cost of debt is 10%. What is Nikes required return on equity? What is its WACC? Explain any differences in the cost of equity, cost of debt and WACC. (tax rate is zero)

Recall that you can assume that rf = .04 and rm = .12 for this exam.

E[re]=rf + beta eq (rm-rf) = .04+1.20(.12-.04)=13.60%

WACC = return on assets = 60% x 13.60 + 40% * 10% = 12.16%

The WACC, or required return on assets represents the underlying required return for Nikes business. The required return on debt is lower because the debt is less risky than Nikes overall business because it has a priority claim on the cash flows. The required return on equity is higher than the required return on debt because it is riskier (it is second in line to get paid). For the same reason, it is higher than the required return on assets because the equity is more risky than the underlying business because of its secondary claim on the cash flows created by that business.

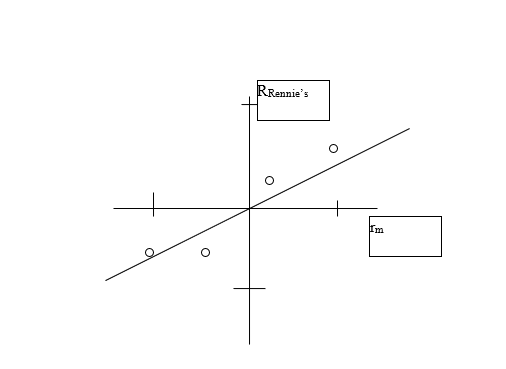

5) (10 pts) The following returns reflect annual returns to Rennies stock and the S&P 500.

|

| Rennies | S&P 500 |

| 1999 | .12 | .20 |

| 2000 | -.09 | -.20 |

| 2001 | .06 | .05 |

| 2002 | -.10 | -.10 |

- (5 pts) Plot the characteristic line versus the market return.

- (5 pts) Provide good guess at Rennies beta.

A reasonable guess is .50. You might guess anywhere between .25 to .75 and get full credit.

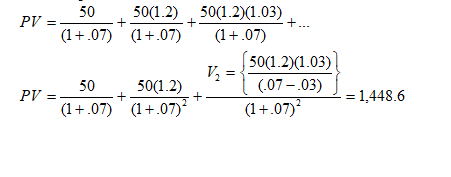

6) (25 pts) Rennies is considering an expansion project. Rennies has debt of $200,000 and equity of $600,000. Rennies analyst projects that the expansion will add $50,000 in incremental after-tax free cash flows next year. That figure will grow for the next year by 20% in year 2. After year 2 your analyst believes that the growth rate will be 3% in perpetuity. The expected market return is 12% and the risk free rate is 4%. Assume that the beta of the debt is 0.

- (10 pts) Using your beta estimate from question 5b and 6, what is the correct required rate of return to use in valuing the expansion project?

WACC will work here because this is a scale expansion of Rennies. Assuming the beta of the debt is 0 the required rates of return on the debt is the risk free rate and using the CAPM and our estimated beta of the equity of the required rate of return on equity is 8%.

Requity = .04 + .5 (.12 - .04) = .08

WACC = (.25) (.04) + (.75) (.08) = .07

- (15 pts) How much would Rennie be willing to pay in construction costs to expand the business?

The PV of the expected cash flows at the required rate of return on Rennies business is 1,448.6. If construction costs are less than this number the project will have a positive NPV and they should expand the business.

8) (5 pts) Why dont you get compensated for all risks of holding a stock?

--because you can inexpensively diversify away much of the risk of holding stocks. You dont get rewarded with additional returns for risks that can be eliminated.

Stock 0 Beta Exp. Return Correlation Correlation Correlatio with A with B n with C A .45 .2 .1 1.25 B .35 .2 .5 1.00 .75 .55 .1 .5 RRennie's Im PV = + + 50 50(1.2) 50(1-2)(1.03) +... (1+.07) (1+.07) (1+.07) 50(1.2)(1.03) VE 50 50(1.2) (.07-03) (1+.07) (1+.07) (1 +.07)? = PV + + = 1,448.6 Stock 0 Beta Exp. Return Correlation Correlation Correlatio with A with B n with C A .45 .2 .1 1.25 B .35 .2 .5 1.00 .75 .55 .1 .5 RRennie's Im PV = + + 50 50(1.2) 50(1-2)(1.03) +... (1+.07) (1+.07) (1+.07) 50(1.2)(1.03) VE 50 50(1.2) (.07-03) (1+.07) (1+.07) (1 +.07)? = PV + + = 1,448.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts