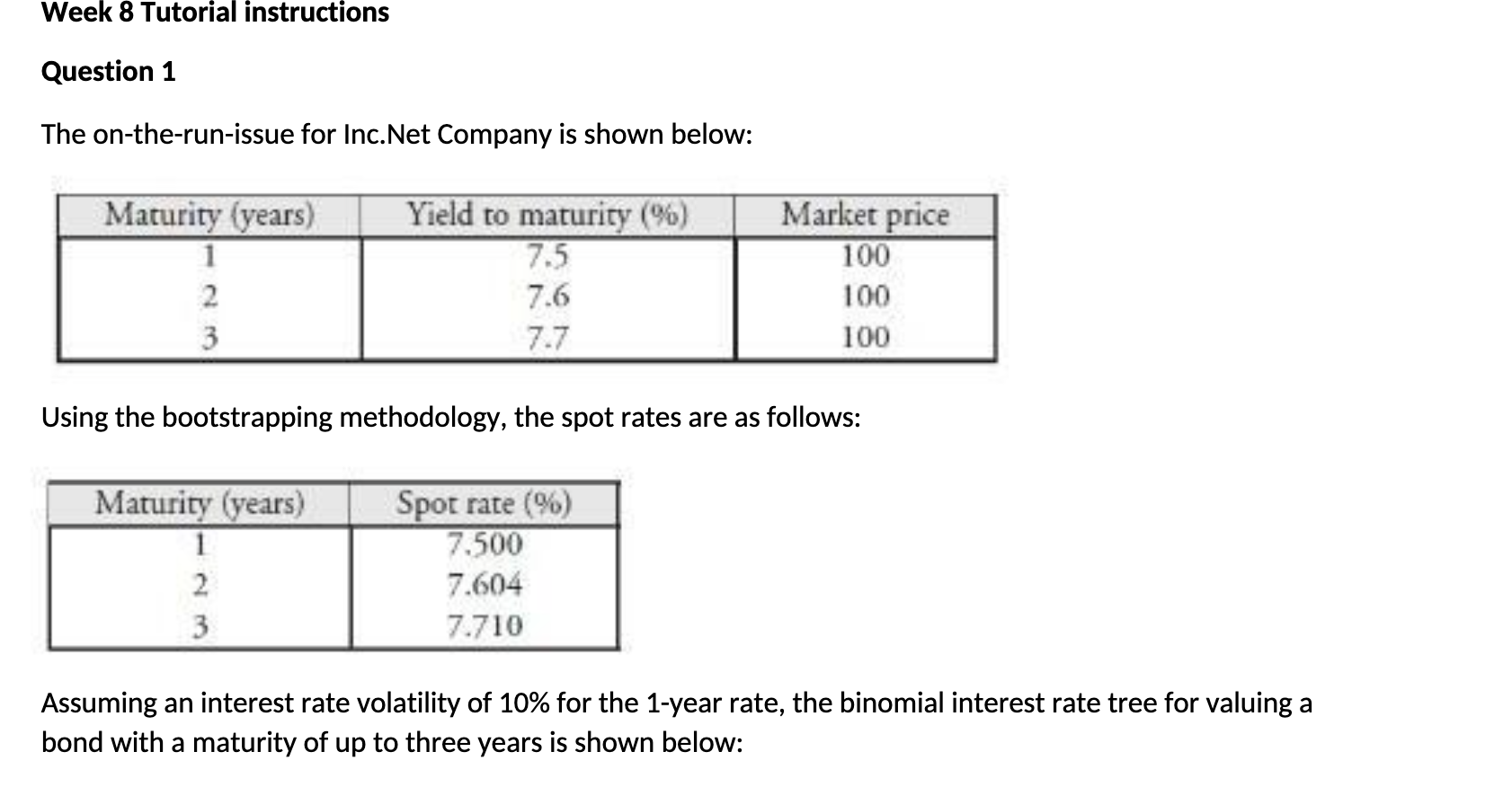

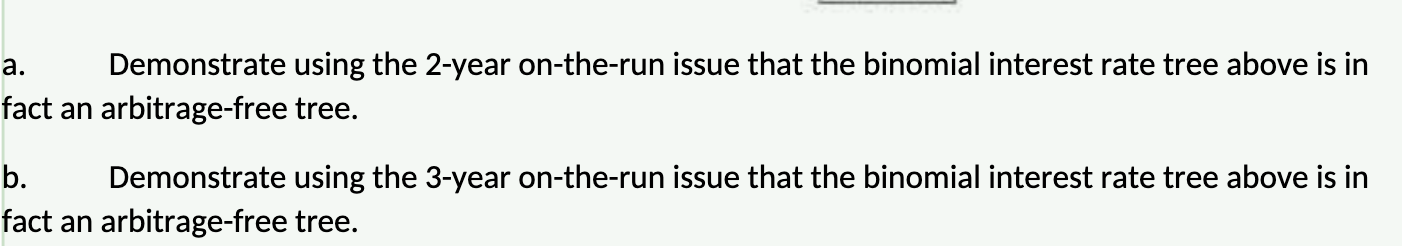

Question: Week 8 Tutorial instructions Question 1 The on-the-run-issue for Inc.Net Company is shown below: Maturity (years) Yield to maturity (%) Market price 7.5 100 7.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts