Question: Week 9, Day 4 Comprehensive Problem You are considering investing in a real estate project. It is an eight-flex in a sleepy part of Scipio,

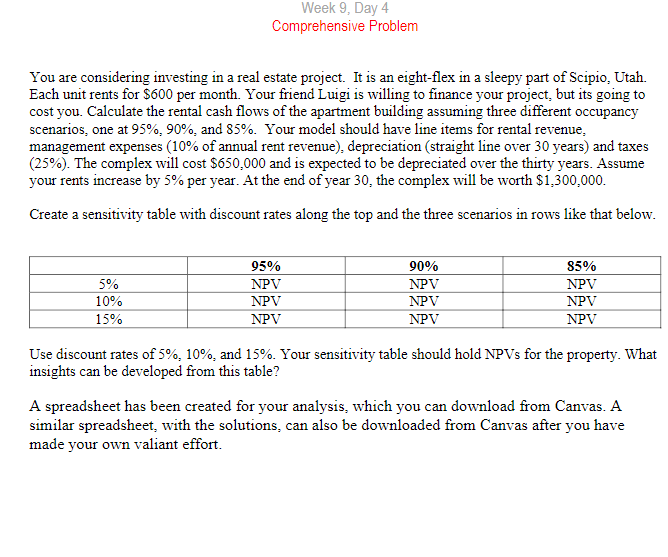

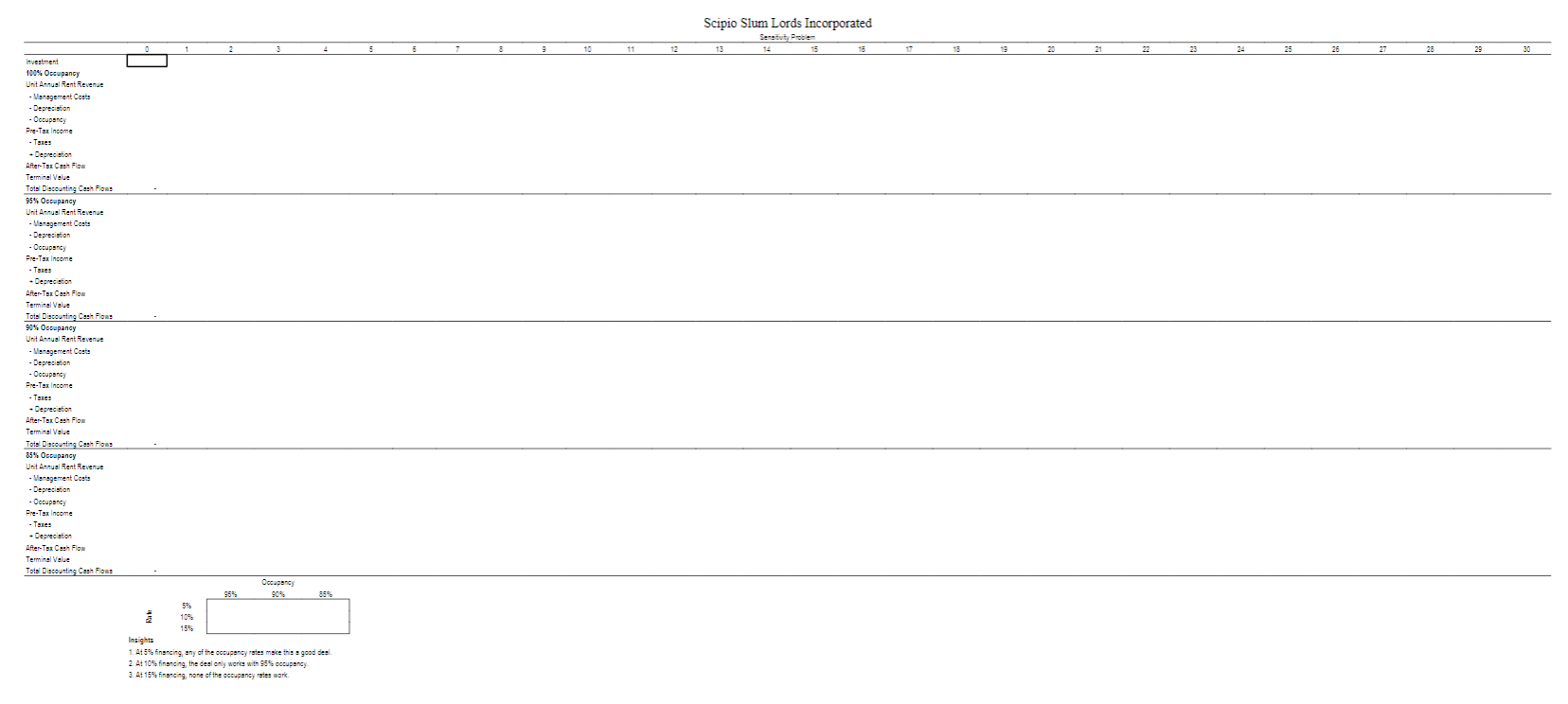

Week 9, Day 4 Comprehensive Problem You are considering investing in a real estate project. It is an eight-flex in a sleepy part of Scipio, Utah. Each unit rents for $600 per month. Your friend Luigi is willing to finance your project, but its going to cost you. Calculate the rental cash flows of the apartment building assuming three different occupancy scenarios, one at 95%, 90% and 85%. Your model should have line items for rental revenue, management expenses (10% of annual rent revenue), depreciation (straight line over 30 years) and taxes (25%). The complex will cost $650.000 and is expected to be depreciated over the thirty years. Assume your rents increase by 5% per year. At the end of year 30, the complex will be worth $1,300,000. Create a sensitivity table with discount rates along the top and the three scenarios in rows like that below. 5% 10% 15% 95% NPV NPV NPV 90% NPV NPV NPV 85% NPV NPV NPV Use discount rates of 5%, 10% and 15%. Your sensitivity table should hold NPVs for the property. What insights can be developed from this table? A spreadsheet has been created for your analysis, which you can download from Canvas. A similar spreadsheet, with the solutions, can also be downloaded from Canvas after you have made your own valiant effort. Scipio Slum Lords Incorporated 1 3 4 6 8 9 12 25 24 30 Investment 100% Occupancy Unit Annual Rent Revenue - Management Costs Depreciation - Occupancy Pre-Tox income Depreciation After-Tex Cash Flow Terminal Value Tots Discounting Cash Flow : 95% Occupancy Unit Annual Rent Revenue -Vanagement Costs - Depreciation - Occupancy Pre-Tex Income - Tous Depreciation After-Tex Cash Flow Terminal Value Tots Discounting Cash Flow 90% Occupancy Unit Annual Rent Revenus -Vanagement Costs - Depreciation - Occupancy Pre-Tox income - Tones - Depreciation After-Tox Cash Flow Terminal Value Tots Discounting Cashion 85% Occupancy Unit Annual Rent Revenue - Vanagement Costs - Depreciation - Occupancy Pre-Tex Income - Taxes Depreciation After-Tex Cash Flow Terminal Value Total Discounting Cash Flow Occupancy 9553 Mate 10% 159 Insights 1. At 5 financing any of the occupancy rates make this a good deal 2. Ar 10% financing the deal only worica with 95 cccupancy 3.A: 15% financing, none of the occupancy stemor Week 9, Day 4 Comprehensive Problem You are considering investing in a real estate project. It is an eight-flex in a sleepy part of Scipio, Utah. Each unit rents for $600 per month. Your friend Luigi is willing to finance your project, but its going to cost you. Calculate the rental cash flows of the apartment building assuming three different occupancy scenarios, one at 95%, 90% and 85%. Your model should have line items for rental revenue, management expenses (10% of annual rent revenue), depreciation (straight line over 30 years) and taxes (25%). The complex will cost $650.000 and is expected to be depreciated over the thirty years. Assume your rents increase by 5% per year. At the end of year 30, the complex will be worth $1,300,000. Create a sensitivity table with discount rates along the top and the three scenarios in rows like that below. 5% 10% 15% 95% NPV NPV NPV 90% NPV NPV NPV 85% NPV NPV NPV Use discount rates of 5%, 10% and 15%. Your sensitivity table should hold NPVs for the property. What insights can be developed from this table? A spreadsheet has been created for your analysis, which you can download from Canvas. A similar spreadsheet, with the solutions, can also be downloaded from Canvas after you have made your own valiant effort. Scipio Slum Lords Incorporated 1 3 4 6 8 9 12 25 24 30 Investment 100% Occupancy Unit Annual Rent Revenue - Management Costs Depreciation - Occupancy Pre-Tox income Depreciation After-Tex Cash Flow Terminal Value Tots Discounting Cash Flow : 95% Occupancy Unit Annual Rent Revenue -Vanagement Costs - Depreciation - Occupancy Pre-Tex Income - Tous Depreciation After-Tex Cash Flow Terminal Value Tots Discounting Cash Flow 90% Occupancy Unit Annual Rent Revenus -Vanagement Costs - Depreciation - Occupancy Pre-Tox income - Tones - Depreciation After-Tox Cash Flow Terminal Value Tots Discounting Cashion 85% Occupancy Unit Annual Rent Revenue - Vanagement Costs - Depreciation - Occupancy Pre-Tex Income - Taxes Depreciation After-Tex Cash Flow Terminal Value Total Discounting Cash Flow Occupancy 9553 Mate 10% 159 Insights 1. At 5 financing any of the occupancy rates make this a good deal 2. Ar 10% financing the deal only worica with 95 cccupancy 3.A: 15% financing, none of the occupancy stemor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts