Question: Week 9 - Weekly Class Discussion - Inventories (part 2): Estimation Techniques and Other Issues Select Start a New Conversation (in the row of tabs

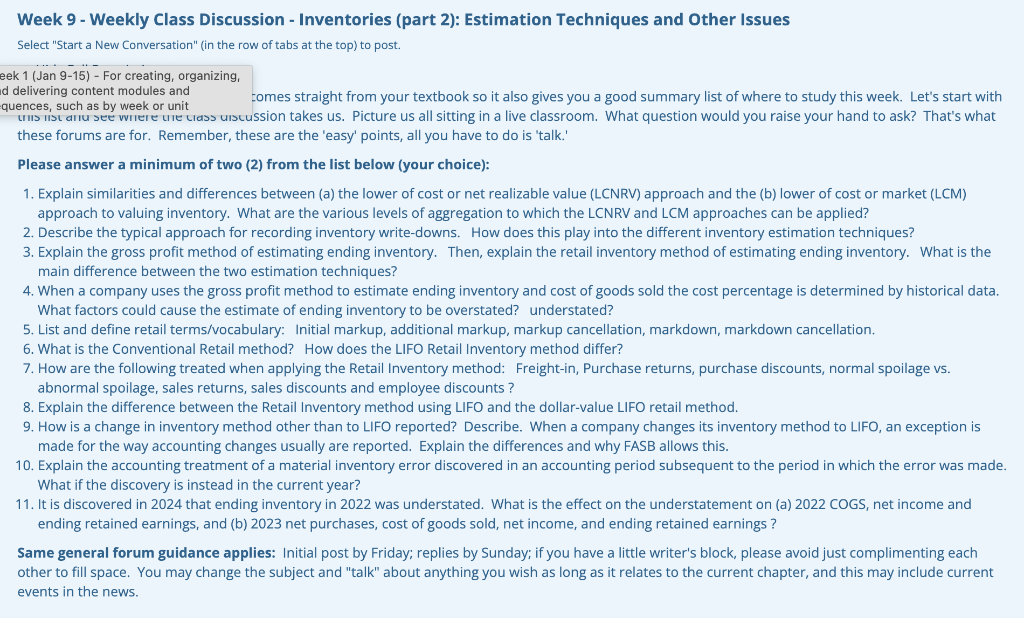

Week 9 - Weekly Class Discussion - Inventories (part 2): Estimation Techniques and Other Issues Select "Start a New Conversation" (in the row of tabs at the top) to post. 1 (Jan 9-15) - For creating, organizing, delivering content modules and these forums are for. Remember, these are the 'easy' points, all you have to do is 'talk.' Please answer a minimum of two (2) from the list below (your choice): 1. Explain similarities and differences between (a) the lower of cost or net realizable value (LCNRV) approach and the (b) lower of cost or market (LCM) approach to valuing inventory. What are the various levels of aggregation to which the LCNRV and LCM approaches can be applied? 2. Describe the typical approach for recording inventory write-downs. How does this play into the different inventory estimation techniques? 3. Explain the gross profit method of estimating ending inventory. Then, explain the retail inventory method of estimating ending inventory. What is the main difference between the two estimation techniques? 4. When a company uses the gross profit method to estimate ending inventory and cost of goods sold the cost percentage is determined by historical data. What factors could cause the estimate of ending inventory to be overstated? understated? 5. List and define retail terms/vocabulary: Initial markup, additional markup, markup cancellation, markdown, markdown cancellation. 6. What is the Conventional Retail method? How does the LIFO Retail Inventory method differ? 7. How are the following treated when applying the Retail Inventory method: Freight-in, Purchase returns, purchase discounts, normal spoilage vs. abnormal spoilage, sales returns, sales discounts and employee discounts ? 8. Explain the difference between the Retail Inventory method using LIFO and the dollar-value LIFO retail method. 9. How is a change in inventory method other than to LIFO reported? Describe. When a company changes its inventory method to LIFO, an exception is made for the way accounting changes usually are reported. Explain the differences and why FASB allows this. 10. Explain the accounting treatment of a material inventory error discovered in an accounting period subsequent to the period in which the error was made. What if the discovery is instead in the current year? 11. It is discovered in 2024 that ending inventory in 2022 was understated. What is the effect on the understatement on (a) 2022 COGS, net income and ending retained earnings, and (b) 2023 net purchases, cost of goods sold, net income, and ending retained earnings ? Same general forum guidance applies: Initial post by Friday; replies by Sunday; if you have a little writer's block, please avoid just complimenting each other to fill space. You may change the subject and "talk" about anything you wish as long as it relates to the current chapter, and this may include current events in the news

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts