Question: Weekly practice This section of the practical is designed to allow you to compare how a basic General Journal and Ledger System operates with a

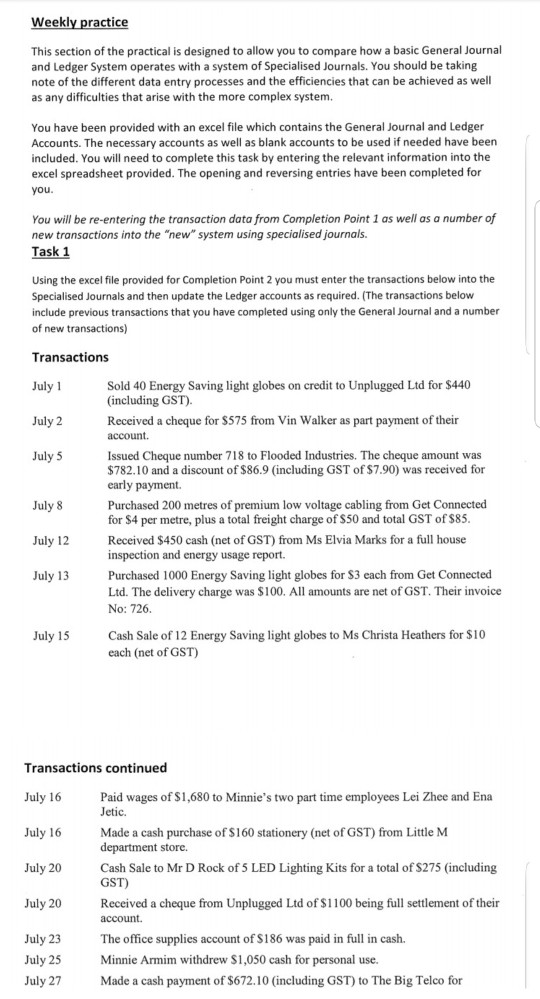

Weekly practice This section of the practical is designed to allow you to compare how a basic General Journal and Ledger System operates with a system of Specialised Journals. You should be taking note of the different data entry processes and the efficiencies that can be achieved as well as any difficulties that arise with the more complex system. You have been provided with an excel file which contains the General Journal and Ledger Accounts. The necessary accounts as well as blank accounts to be used if needed have been included. You will need to complete this task by entering the relevant information into the excel spreadsheet provided. The opening and reversing entries have been completed for you You will be re-entering the transaction data from Completion Point 1 as well as a number of new transactions into the "new" system using specialised journals as Using the excel file provided for Completion Point 2 you must enter the transactions below into the Specialised Journals and then update the Ledger accounts as required. (The transactions below include previous transactions that you have completed using only the General Journal and a number of new transactions) Transactions July 1 July 2 July Sold 40 Energy Saving light globes on credit to Unplugged Ltd for $440 (including GST) Received a cheque for S575 from Vin Walker as part payment of their account. July 8 July 12 July 13 Issued Cheque number 718 to Flooded Industries. The cheque amount was $782.10 and a discount of $86.9 (including GST of $7.90) was received for early payment. Purchased 200 metres of premium low voltage cabling from Get Connected for $4 per metre, plus a total freight charge of S50 and total GST of $85 Received $450 cash (net of GST) from Ms Elvia Marks for a full house inspection and energy usage report Purchased 1000 Energy Saving light globes for $3 each from Get Connected Ltd. The delivery charge was $100. All amounts are net of GST. Their invoice No: 726. Cash Sale of 12 Energy Saving light globes to Ms Christa Heathers for $10 each (net of GST) July 15 Transactions continued July 16 Paid wages of $1,680 to Minnie's two part time employees Lei Zhee and Ena July 16 July 20 July 20 Jetic Made a cash purchase of S160 stationery (net of GST) from Little M department store. Cash Sale to Mr D Rock of 5 LED Lighting Kits for a total of S275 (including GST) Received a cheque from Unplugged Ltd of S1100 being full settlement of their account July 23 The office supplies account of S186 was paid in full in cash. July 25 July 27 Minnie Armim withdrew $1,050 cash for personal use. Made a cash payment of S672.10 (including GST) to The Big Telco for Weekly practice This section of the practical is designed to allow you to compare how a basic General Journal and Ledger System operates with a system of Specialised Journals. You should be taking note of the different data entry processes and the efficiencies that can be achieved as well as any difficulties that arise with the more complex system. You have been provided with an excel file which contains the General Journal and Ledger Accounts. The necessary accounts as well as blank accounts to be used if needed have been included. You will need to complete this task by entering the relevant information into the excel spreadsheet provided. The opening and reversing entries have been completed for you You will be re-entering the transaction data from Completion Point 1 as well as a number of new transactions into the "new" system using specialised journals as Using the excel file provided for Completion Point 2 you must enter the transactions below into the Specialised Journals and then update the Ledger accounts as required. (The transactions below include previous transactions that you have completed using only the General Journal and a number of new transactions) Transactions July 1 July 2 July Sold 40 Energy Saving light globes on credit to Unplugged Ltd for $440 (including GST) Received a cheque for S575 from Vin Walker as part payment of their account. July 8 July 12 July 13 Issued Cheque number 718 to Flooded Industries. The cheque amount was $782.10 and a discount of $86.9 (including GST of $7.90) was received for early payment. Purchased 200 metres of premium low voltage cabling from Get Connected for $4 per metre, plus a total freight charge of S50 and total GST of $85 Received $450 cash (net of GST) from Ms Elvia Marks for a full house inspection and energy usage report Purchased 1000 Energy Saving light globes for $3 each from Get Connected Ltd. The delivery charge was $100. All amounts are net of GST. Their invoice No: 726. Cash Sale of 12 Energy Saving light globes to Ms Christa Heathers for $10 each (net of GST) July 15 Transactions continued July 16 Paid wages of $1,680 to Minnie's two part time employees Lei Zhee and Ena July 16 July 20 July 20 Jetic Made a cash purchase of S160 stationery (net of GST) from Little M department store. Cash Sale to Mr D Rock of 5 LED Lighting Kits for a total of S275 (including GST) Received a cheque from Unplugged Ltd of S1100 being full settlement of their account July 23 The office supplies account of S186 was paid in full in cash. July 25 July 27 Minnie Armim withdrew $1,050 cash for personal use. Made a cash payment of S672.10 (including GST) to The Big Telco for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts