Question: Weighted average method, inspection at 80% completion. (A. Atkinson) The Kim Company is a furniture manufacturer with two departments: molding and finishing. The company uses

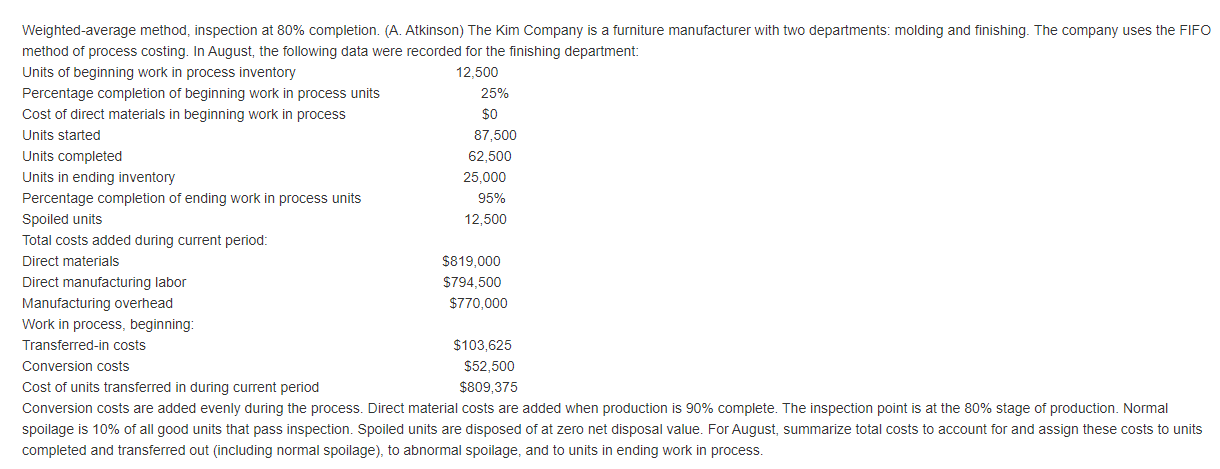

Weighted average method, inspection at 80% completion. (A. Atkinson) The Kim Company is a furniture manufacturer with two departments: molding and finishing. The company uses the FIFO method of process costing. In August, the following data were recorded for the finishing department: Units of beginning work in process inventory 12,500 Percentage completion of beginning work in process units 25% Cost of direct materials in beginning work in process $0 Units started 87,500 Units completed 62,500 Units in ending inventory 25,000 Percentage completion of ending work in process units 95% Spoiled units 12,500 Total costs added during current period: Direct materials $819,000 Direct manufacturing labor $794,500 Manufacturing overhead $770,000 Work in process, beginning: Transferred-in costs $103,625 Conversion costs $52,500 Cost of units transferred in during current period $809,375 Conversion costs are added evenly during the process. Direct material costs are added when production is 90% complete. The inspection point is at the 80% stage of production. Normal spoilage is 10% of all good units that pass inspection. Spoiled units are disposed of at zero net disposal value. For August, summarize total costs to account for and assign these costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. Weighted average method, inspection at 80% completion. (A. Atkinson) The Kim Company is a furniture manufacturer with two departments: molding and finishing. The company uses the FIFO method of process costing. In August, the following data were recorded for the finishing department: Units of beginning work in process inventory 12,500 Percentage completion of beginning work in process units 25% Cost of direct materials in beginning work in process $0 Units started 87,500 Units completed 62,500 Units in ending inventory 25,000 Percentage completion of ending work in process units 95% Spoiled units 12,500 Total costs added during current period: Direct materials $819,000 Direct manufacturing labor $794,500 Manufacturing overhead $770,000 Work in process, beginning: Transferred-in costs $103,625 Conversion costs $52,500 Cost of units transferred in during current period $809,375 Conversion costs are added evenly during the process. Direct material costs are added when production is 90% complete. The inspection point is at the 80% stage of production. Normal spoilage is 10% of all good units that pass inspection. Spoiled units are disposed of at zero net disposal value. For August, summarize total costs to account for and assign these costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts