Question: Welcome Message Assessment 1 Question 1 Select the correct answer. The process used to determine the goodwill amount where the parent holds a 90% shareholding

Welcome Message

Assessment 1

Question 1

Select the correct answer. The process used to determine the goodwill amount where the parent holds a 90% shareholding in a subsidiary, consists of the following:

a.

Investment in subsidiary minus 90% of the (Share capital + Retained earnings + Other components of equity) equity of the subsidiary.

b.

Investment in subsidiary minus 100% of the (Share capital + Retained earnings + Other components of equity) equity of the subsidiary.

c.

Investment in subsidiary minus 90% of the (Share capital + Retained earnings + Other components of equity) equity of the subsidiary plus 10% of the (Share capital + Retained earnings + Other components of equity) equity of the subsidiary.

d.

Investment in subsidiary minus 90% of the (Share capital + Retained earnings + Other components of equity) equity of the subsidiary minus 10% of the (Share capital + Retained earnings + Other components of equity) equity of the subsidiary

Question 2 The closing balance of the revaluation surplus for the year in the consolidated statement of changes in equity amounts to:

a. R359 200

b. R313 700

c. R320 700

d. R395 200

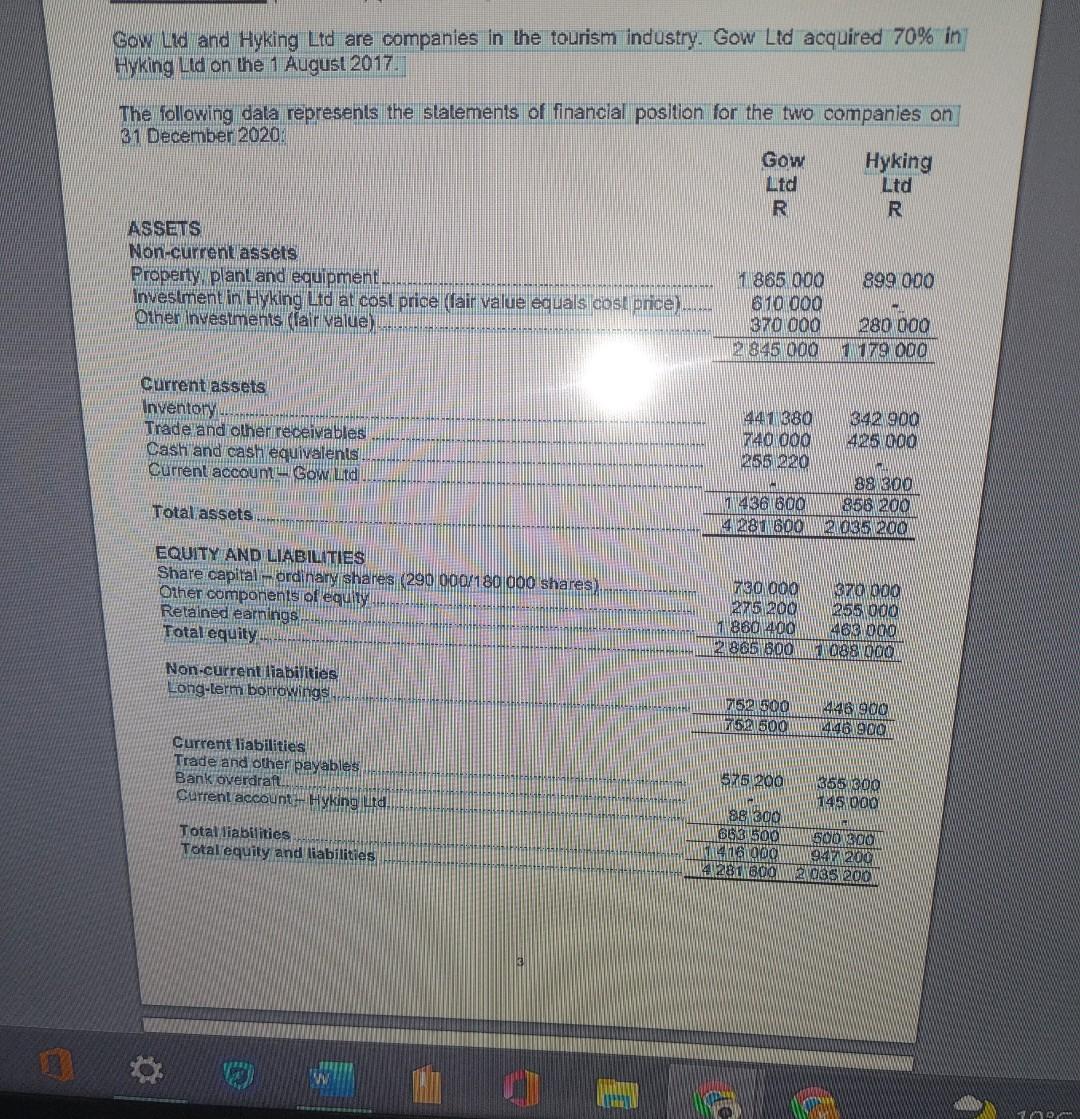

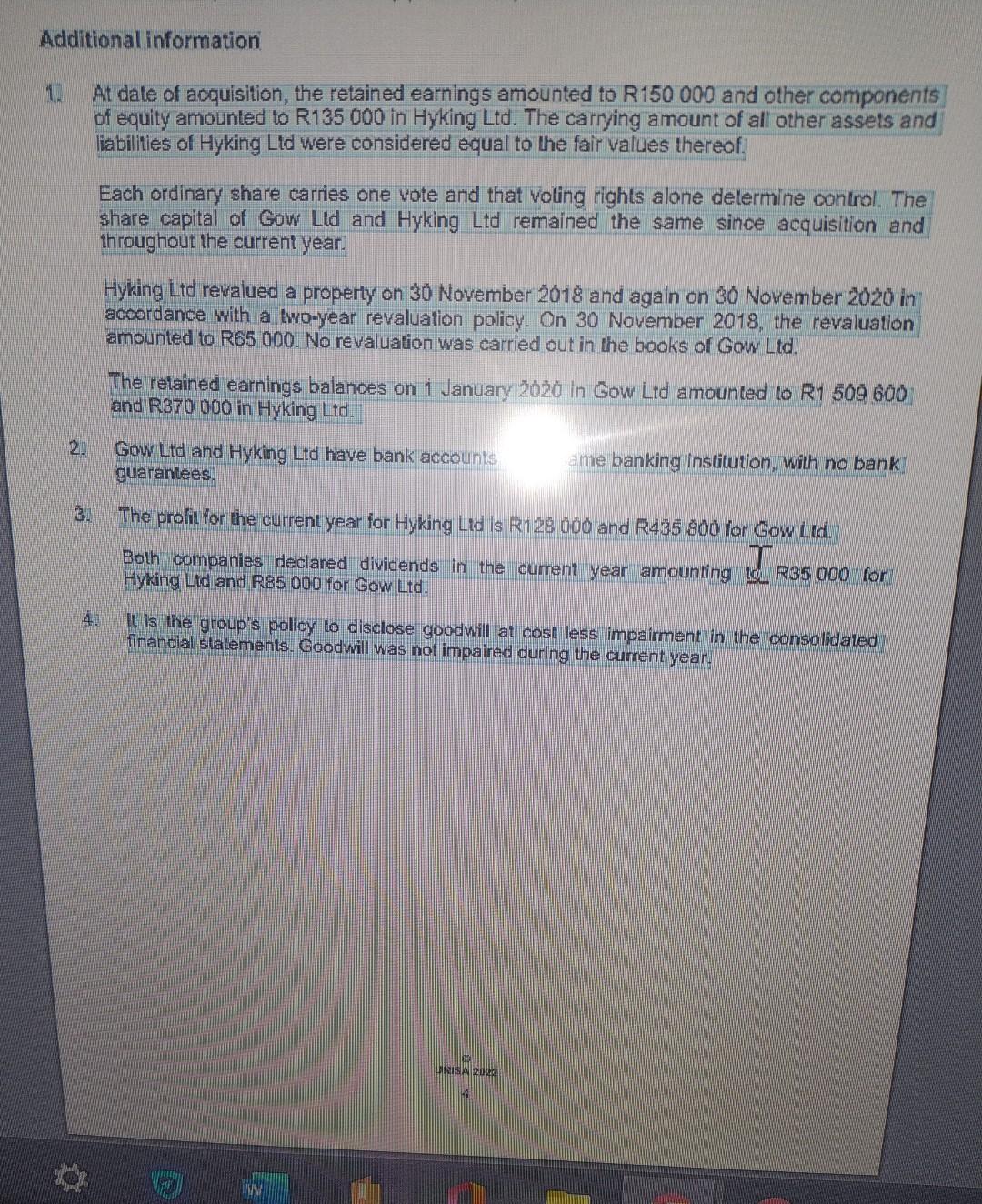

Gow Ltd and Hyking Ltd are companies in the tourism industry. Gow Lid acquired 70% in Hyking Lld on the 1 August 2017. The following dala represents the slatements of financlal position for the two companies on 31 December 2020 : ASSEIS Non-current assets currentassets Inventory Non-currentiliabilities Long-lermbonovings, Current liabilities Trade and other payabless Bankoveraraft. 5761200355coo Total liabilities Total equity and liabilities 3 dditional information At date of acquisition, the retained earnings amounted to R150000 and other components of equity amounted to R135 000 in Hyking Ltd. The carrying amount of all other assets and liabilities of Hyking Lid were considered equal to the fair values thereof. Each ordinary share carries one vote and that voling rights alone delermine control. The share capital of Gow Lld and Hyking Ltd remained the same since acquisition and throughout the current year. Hyking Ltd revalued a property on 30 November 20.18 and again on 30 November 20200 in accordance with a two-year revaluation policy. On 30 November 2018 , the revaluation amounted to R65 000. No revaluation was carried out in the books of Gow Ltd. The retained earnings balances on 1 January 20200 in Gow Ltd amounted to R1 5009600 and R370 000 in Hyking Ltd. 2. Gow Ltd and Hyking Ltd have bank accounts ame banking institution, with no bank guarantees. 3. The profit for the current year for Hyking Lid is R128000 and R435 800 for Gow Ltd. Both companies declared dividends in the current year amounting id R35 000 for Hyking Lid and R85 000 for Gow Ltd. 4. It is the group's policy to disclose goodwill at cost less impairment in the consolidated financial statements. Goodwill was not impaired during the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts