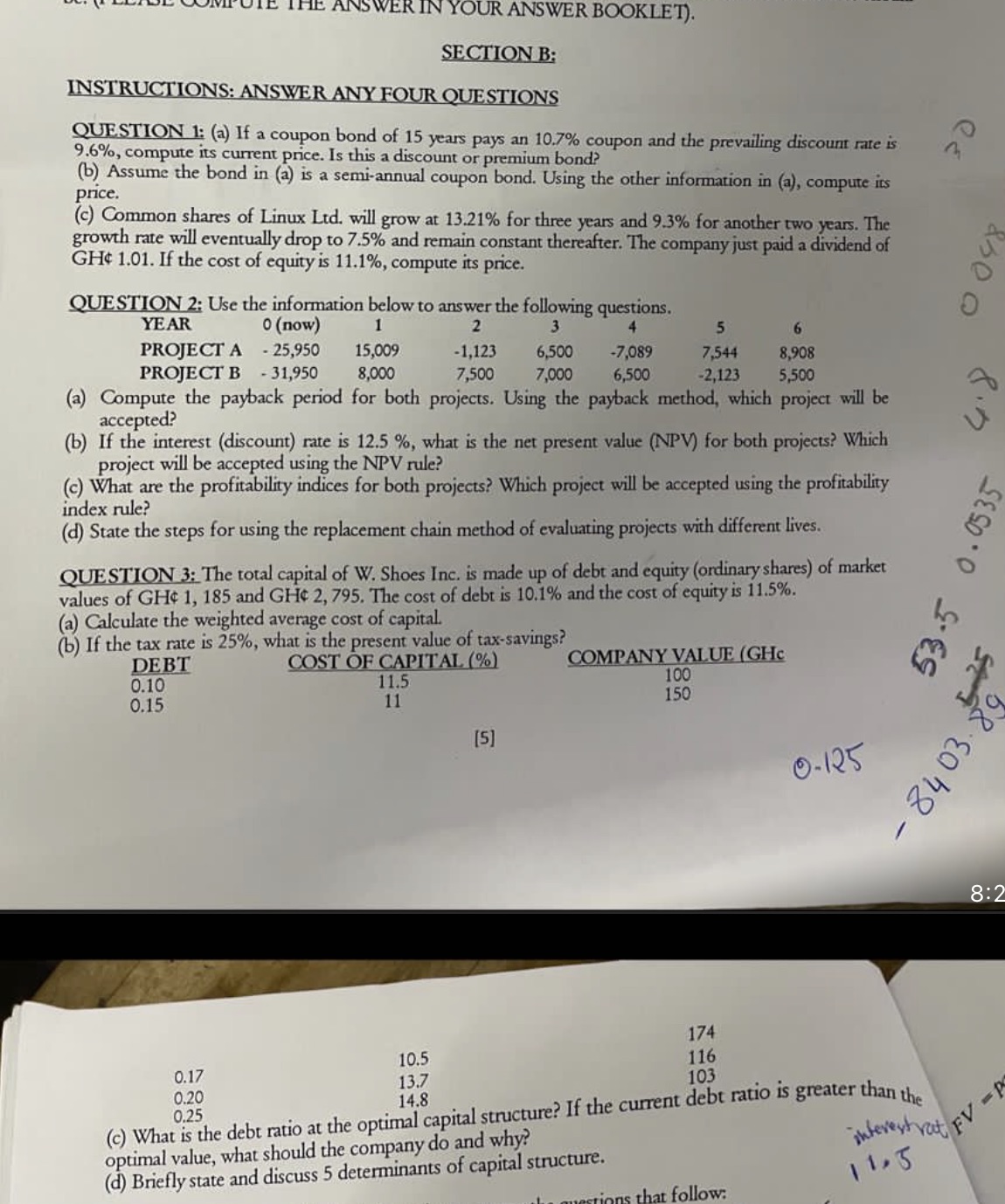

Question: WER IN YOUR ANSWER BOOKLET). SECTION B; INSTRUCTIONS: ANSWER ANY FOUR QUESTIONS QUESTION 1: (a) If a coupon bond of 15 years pays an 10.7%

WER IN YOUR ANSWER BOOKLET). SECTION B; INSTRUCTIONS: ANSWER ANY FOUR QUESTIONS QUESTION 1: (a) If a coupon bond of 15 years pays an 10.7% coupon and the prevailing discount rate is 9.6%, compute its current price. Is this a discount or premium bond? price. (b) Assume the bond in (a) is a semi-annual coupon bond. Using the other information in (a), compute its (c) Common shares of Linux Ltd. will grow at 13.21% for three years and 9.3% for another two years. The growth rate will eventually drop to 7.5% and remain constant thereafter. The company just paid a dividend of GH$ 1.01. If the cost of equity is 11.1%, compute its price. QUESTION 2; Use the information below to answer the following questions. YEAR 0 (now) PROJECT A - 25,950 15,009 -1,123 6,500 -7,089 7,544 8,908 PROJECT B - 31,950 8,000 7,500 7,000 6,500 -2,123 5,500 (a) Compute the payback period for both projects. Using the payback method, which project will be accepted? (b) If the interest (discount) rate is 12.5 %, what is the net present value (NPV) for both projects? Which project will be accepted using the NPV rule? (c) What are the profitability indices for both projects? Which project will be accepted using the profitability index rule? (d) State the steps for using the replacement chain method of evaluating projects with different lives. QUESTION 3: The total capital of W. Shoes Inc. is made up of debt and equity (ordinary shares) of market 53. 5 0. 0535 values of GH 1, 185 and GHC 2, 795. The cost of debt is 10.1% and the cost of equity is 11.5%. (a) Calculate the weighted average cost of capital. (b) If the tax rate is 25%, what is the present value of tax-savings? DEBT COST OF CAPITAL (%) COMPANY VALUE (GHC 0.10 11.5 100 150 5 - 25 0.15 11 [5] 0-125 - 84 03. 8: 174 10.5 116 0.17 13.7 103 0.20 14.8 0.25 (c) What is the debt ratio at the optimal capital structure? If the current debt ratio is greater than the optimal value, what should the company do and why? interest rat FV (d) Briefly state and discuss 5 determinants of capital structure. 11, 5 hat follow