Question: were supposed to do each question then compare them (why theyre alike and similar) tysm! Starkiller Base Inc. expects to have a changing dividend policy

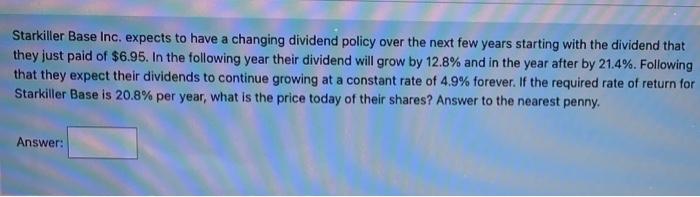

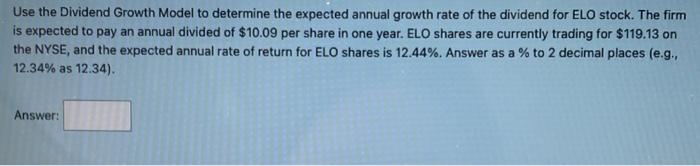

Starkiller Base Inc. expects to have a changing dividend policy over the next few years starting with the dividend that they just paid of $6.95. In the following year their dividend will grow by 12.8% and in the year after by 21.4%. Following that they expect their dividends to continue growing at a constant rate of 4.9% forever. If the required rate of return for Starkiller Base is 20.8% per year, what is the price today of their shares? Answer to the nearest penny. Answer: Use the Dividend Growth Model to determine the expected annual growth rate of the dividend for ELO stock. The firm is expected to pay an annual divided of $10.09 per share in one year. ELO shares are currently trading for $119.13 on the NYSE, and the expected annual rate of return for ELO shares is 12.44%. Answer as a % to 2 decimal places (e.g., 12.34% as 12.34)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts