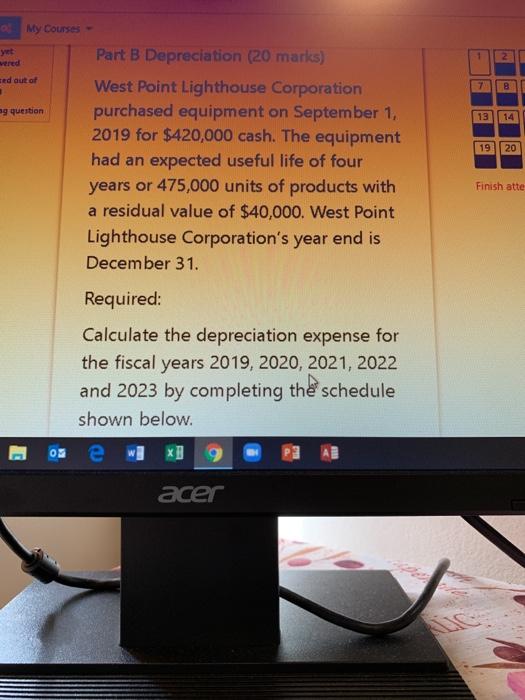

Question: wered 7 B og question 13 14 My Courses - Part B Depreciation (20 marks) ed out of West Point Lighthouse Corporation purchased equipment on

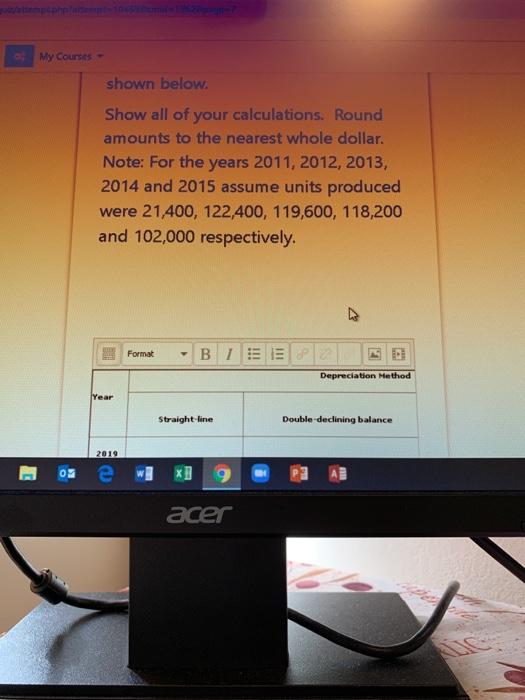

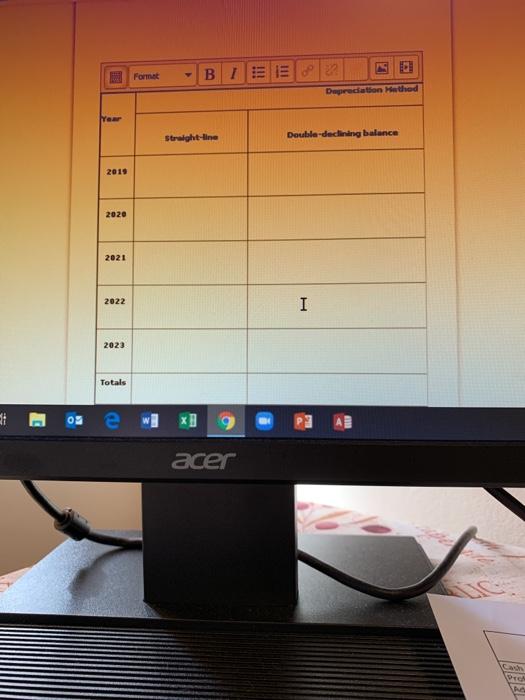

wered 7 B og question 13 14 My Courses - Part B Depreciation (20 marks) ed out of West Point Lighthouse Corporation purchased equipment on September 1, 2019 for $420,000 cash. The equipment had an expected useful life of four years or 475,000 units of products with a residual value of $40,000. West Point Lighthouse Corporation's year end is December 31. 19 20 Finish atte Required: Calculate the depreciation expense for the fiscal years 2019, 2020, 2021, 2022 and 2023 by completing the schedule shown below. E 03 e acer My Courses - shown below. Show all of your calculations. Round amounts to the nearest whole dollar. Note: For the years 2011, 2012, 2013, 2014 and 2015 assume units produced were 21,400, 122,400, 119,600, 118,200 and 102,000 respectively. Format -B1 Depreciation Method lYear Straight-line Double-declining balance 2019 07 e acer Format B TEIE Depreciation Method Year Straight-line Double-decling balance 2010 2020 2021 2022 I 2023 Totals 0 P] AB acer DER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts