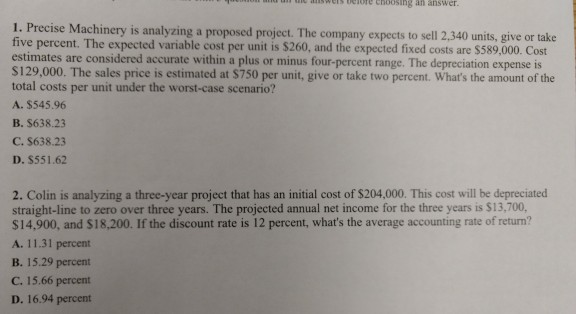

Question: wes heore choosing an answer. 1. Precise Machinery is analyzing a proposed project. The company expects to sell 2,340 units, give or take five percent.

wes heore choosing an answer. 1. Precise Machinery is analyzing a proposed project. The company expects to sell 2,340 units, give or take five percent. The expected variable cost per unit is $260, and the expected fixed costs are $589,000. Cost estimates are considered accurate within a plus or minus four-percent range. The depreciation expense is S129,000. The sales price is estimated at $750 per unit, give or take two percent. What's the amount of the total costs per unit under the worst-case scenario? A. $545.96 B. S638.23 C. $638.23 D. S551.62 2. Colin is analyzing a three-year project that has an initial cost of $204,000. This cost will be depreciated straight-line to zero over three years. The projected annual net income for the three years is $13,700, $14,900, and $18,200. If the discount rate is 12 percent, what's the average accounting rate of return? A. 11.31 percent B. 15.29 percent C. 15.66 percent D. 16.94 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts