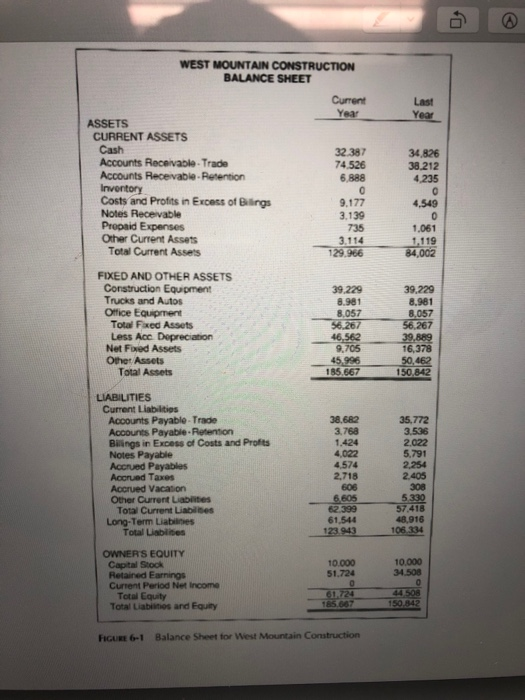

Question: WEST MOUNTAIN CONSTRUCTION BALANCE SHEET Year CURRENT ASSETS 32.387 4.526 6,888 34,826 38.212 Accounts Receivable Trade Accounts Recevable Retention Inventory Costs and Profits in Excess

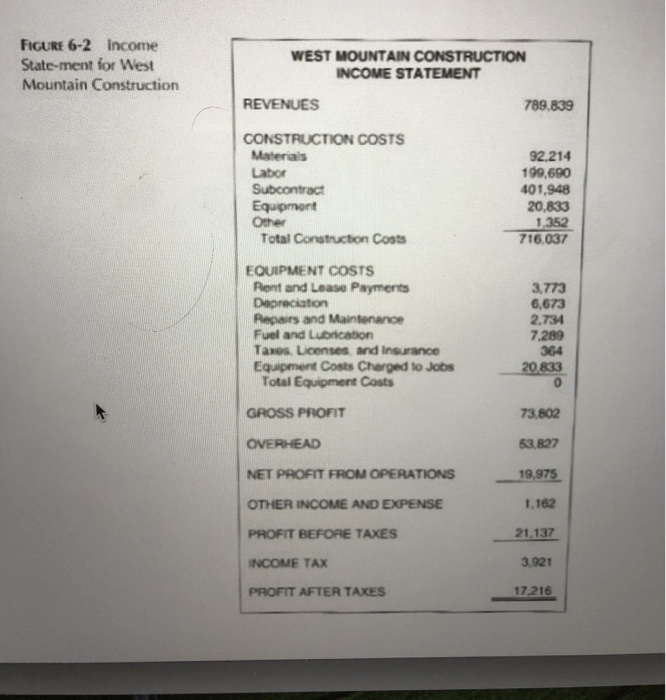

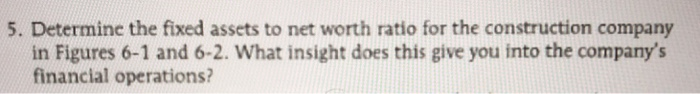

WEST MOUNTAIN CONSTRUCTION BALANCE SHEET Year CURRENT ASSETS 32.387 4.526 6,888 34,826 38.212 Accounts Receivable Trade Accounts Recevable Retention Inventory Costs and Profits in Excess of Bilings Notes Receivable Propaid Expenses Oher Current Assets 9,177 3,139 1,061 Total Current Assets 129.966 FIXED AND OTHER ASSETS Construction Equipment Trucks and Autos Office Equipment 39.229 8.981 8,981 Total Fxed Assets Less Acc Depreciation Net Foxed Assets Other Assets 50,462 150,842 Total Assets Current Liablitios Accounts Payable- Trade Accounts Payable-Retention Biings in Excess of Costs and Profts Notes Payable Accrued Payables Accrued Taxes Accrued Vacation Other Current Liablites 35,772 3.768 1.424 4,022 4.574 2.022 2.405 57 418 48,916 Total Current Liabites Term 61,544 Total Liablites OWNERS EQUITY Capital Stock Retained Earnings Current Period Net Income 10.000 51.724 Total Equity Total Liabiitios and Equity ha 6-1 Balance sheet for West Mountain Construction FIGURE 6-2 income State-ment for West Mountain Construction WEST MOUNTAIN NCOME STATEMENT REVENUES 789.839 CONSTRUCTION COSTS Materas Labor Subcontract 92,214 199,690 401,948 20,833 352 16.037 Other Total Construction Costs EQUIPMENT COSTS Rent and Lease Payments Depreciation Repairs and Maintenance Fuel and Lubrication Taxes. Licenses and Insurance Equipment Costs Cherged to Jobs 3,773 6,673 2.734 7.289 364 833 Total Equipment Costs GROSS PROFIT OVERHEAD NET PROFIT FROM OPERATIONS OTHER INCOME AND EXPENSE PROFIT BEFORE TAXES INCOME TAX PROFIT AFTER TAXES 73,802 53,827 19.975 1,162 21.137 3.921 17-216 5. Determine the fixed assets to net worth ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts