Question: West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production

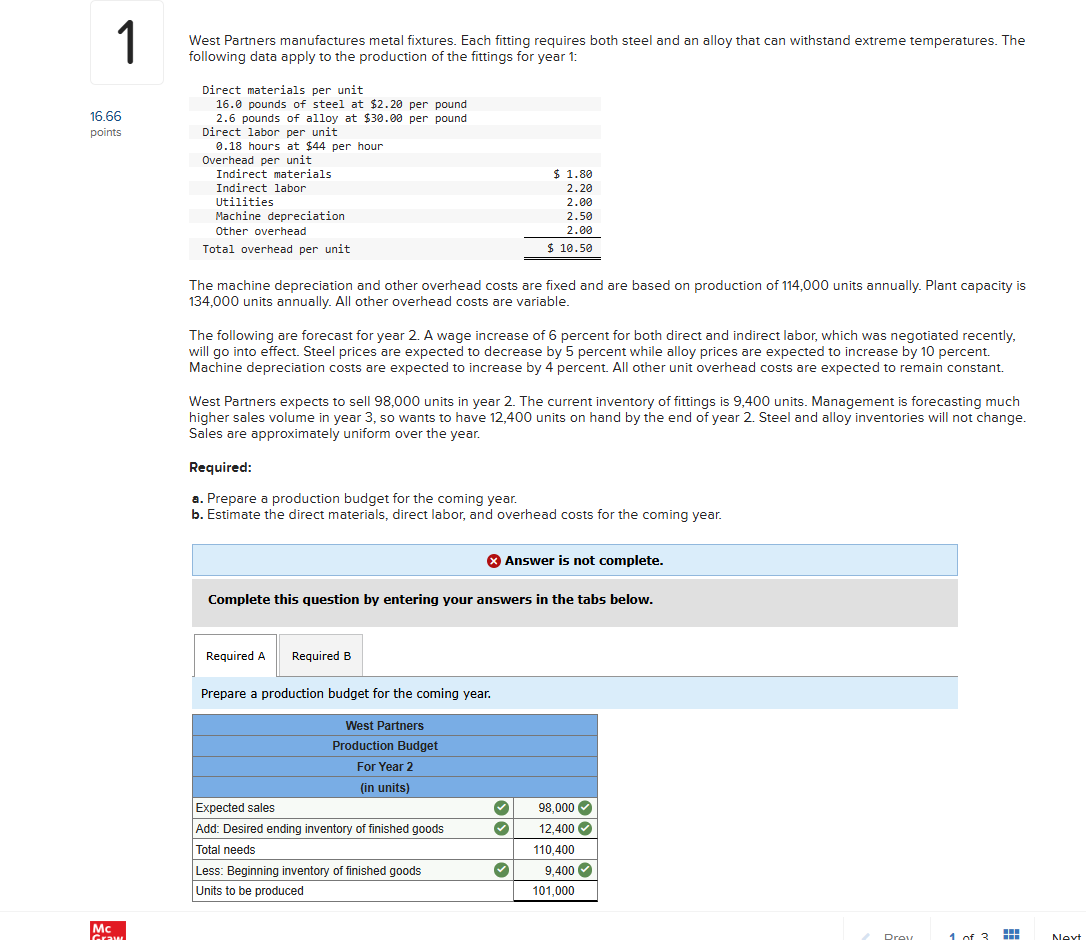

West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production of the fittings for year :

Direct materials per unit pounds of steel at $ per pound pounds of alloy at $ per poundDirect labor per unit hours at $ per hourOverhead per unitIndirect materials$ Indirect laborUtilitiesMachine depreciationOther overheadTotal overhead per unit$

The machine depreciation and other overhead costs are fixed and are based on production of units annually. Plant capacity is units annually. All other overhead costs are variable.

The following are forecast for year A wage increase of percent for both direct and indirect labor, which was negotiated recently, will go into effect. Steel prices are expected to decrease by percent while alloy prices are expected to increase by percent. Machine depreciation costs are expected to increase by percent. All other unit overhead costs are expected to remain constant.

West Partners expects to sell units in year The current inventory of fittings is units. Management is forecasting much higher sales volume in year so wants to have units on hand by the end of year Steel and alloy inventories will not change. Sales are approximately uniform over the year.

Required:

Prepare a production budget for the coming year.

Estimate the direct materials, direct labor, and overhead costs for the coming year.

West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production of the fittings for year :

Direct materials per unit

pounds of steel at $ per pound

pounds of alloy at $ per pound

Direct labor per unit

hours at $ per hour

Overhead per unit

The machine depreciation and other overhead costs are fixed and are based on production of units annually. Plant capacity is units annually. All other overhead costs are variable.

The following are forecast for year A wage increase of percent for both direct and indirect labor, which was negotiated recently, will go into effect. Steel prices are expected to decrease by percent while alloy prices are expected to increase by percent. Machine depreciation costs are expected to increase by percent. All other unit overhead costs are expected to remain constant.

West Partners expects to sell units in year The current inventory of fittings is units. Management is forecasting much higher sales volume in year so wants to have units on hand by the end of year Steel and alloy inventories will not change. Sales are approximately uniform over the year.

Required:

a Prepare a production budget for the coming year.

b Estimate the direct materials, direct labor, and overhead costs for the coming year.

I have a complete and b mostly complete, but with my math as well as an AI source, I am getting $ but it says this answer is incorrect.

Please answer overhead costs!! West Parthers manufactures metal fixtures, Each fiting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production of the fitings for year :

Direst materfals per unit

: pounds of steel it $ per pound

pounds of alloy at $ per pount

Direct labor per unit.

$ hours at $ per hour

Dvertiend fer unit

Indirect materlals $ $

Indirect labor e

#ilitias

Macun seprectitian

ather overhead

Trtal gverthead per wint $ $ $

The machire depreciation and other overtead cosis are fixedand are based on production of umits annisally. Fiant capacity is units amually. All other overhead costs are varfable.

The following are forecast for year A wage lncrease of percent for both diect and Indirect labor, which was negutiated recently, Will go lito effect Steel prices are expected to decrease by percent while alloy prices are expected to Increase by percent Machine depreciatlon costs are expected to Increase by percent. All other unit overhead costs are expected to remain constant

West Partners expects to sell units in year The current inventory of fittings is units Management is forecasting mitich higher sales volume in year ; so wants have units on hand by the end of year Steel and alpy inventaries will not change, Sales are approximately uniform over the year:

Required:

a Prepare o production budget for the coming yeat.

b Estimate the direct materlals, direct labor, and overhead costs for the coming year

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Estimate the direct materials, direot labor, and overhead costs for the coming y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock