Question: West River Company is considering purchasing a machine (Class 8, CCA rate 20%) that will cost $1,000,000. The machine would replace an existing machine. The

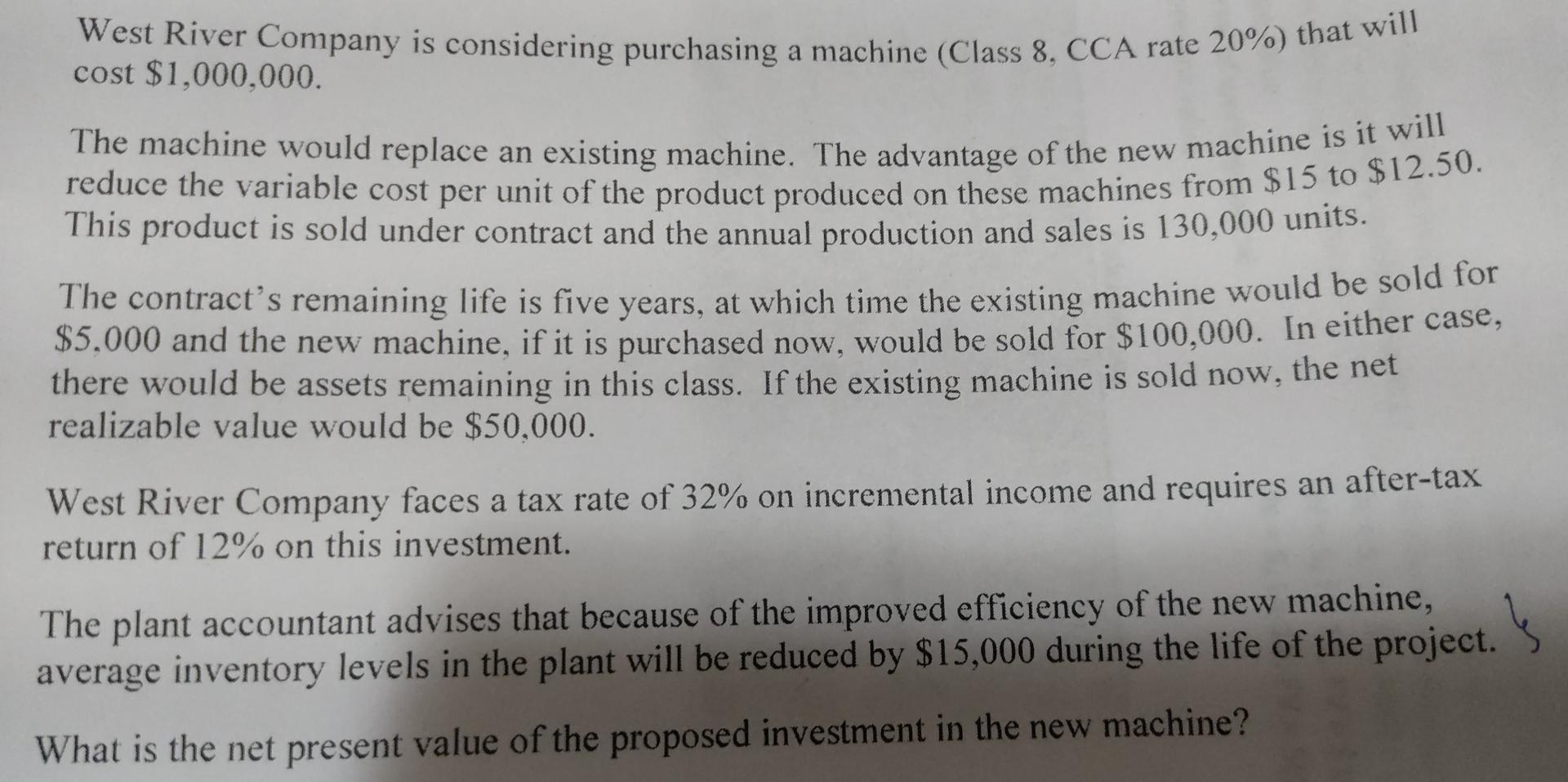

West River Company is considering purchasing a machine (Class 8, CCA rate 20%) that will cost $1,000,000. The machine would replace an existing machine. The advantage of the new machine is it will reduce the variable cost per unit of the product produced on these machines from $15 to $12.50. This product is sold under contract and the annual production and sales is 130,000 units. The contract's remaining life is five years, at which time the existing machine would be sold for $5,000 and the new machine, if it is purchased now, would be sold for $100,000. In either case, there would be assets remaining in this class. If the existing machine is sold now, the net realizable value would be $50,000. West River Company faces a tax rate of 32% on incremental income and requires an after-tax return of 12% on this investment. } The plant accountant advises that because of the improved efficiency of the new machine, average inventory levels in the plant will be reduced by $15,000 during the life of the project. What is the net present value of the proposed investment in the new machine? West River Company is considering purchasing a machine (Class 8, CCA rate 20%) that will cost $1,000,000. The machine would replace an existing machine. The advantage of the new machine is it will reduce the variable cost per unit of the product produced on these machines from $15 to $12.50. This product is sold under contract and the annual production and sales is 130,000 units. The contract's remaining life is five years, at which time the existing machine would be sold for $5,000 and the new machine, if it is purchased now, would be sold for $100,000. In either case, there would be assets remaining in this class. If the existing machine is sold now, the net realizable value would be $50,000. West River Company faces a tax rate of 32% on incremental income and requires an after-tax return of 12% on this investment. } The plant accountant advises that because of the improved efficiency of the new machine, average inventory levels in the plant will be reduced by $15,000 during the life of the project. What is the net present value of the proposed investment in the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts