Question: WestCorp, a regional bank will shift from the basic indicator to the standardized approach for purposes of operational risk capital under new Basel standards. The

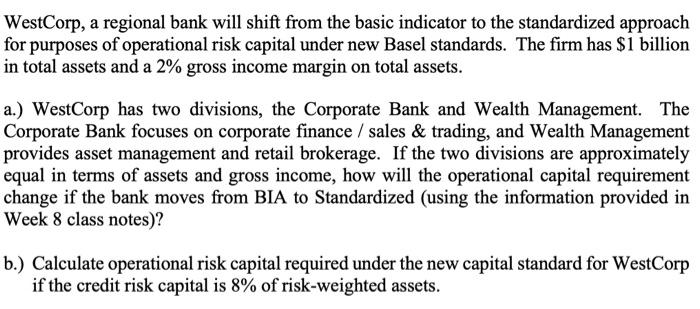

WestCorp, a regional bank will shift from the basic indicator to the standardized approach for purposes of operational risk capital under new Basel standards. The firm has $1 billion in total assets and a 2% gross income margin on total assets. a.) WestCorp has two divisions, the Corporate Bank and Wealth Management. The Corporate Bank focuses on corporate finance / sales & trading, and Wealth Management provides asset management and retail brokerage. If the two divisions are approximately equal in terms of assets and gross income, how will the operational capital requirement change if the bank moves from BIA to Standardized (using the information provided in Week 8 class notes)? b.) Calculate operational risk capital required under the new capital standard for WestCorp if the credit risk capital is 8% of risk-weighted assets. WestCorp, a regional bank will shift from the basic indicator to the standardized approach for purposes of operational risk capital under new Basel standards. The firm has $1 billion in total assets and a 2% gross income margin on total assets. a.) WestCorp has two divisions, the Corporate Bank and Wealth Management. The Corporate Bank focuses on corporate finance / sales & trading, and Wealth Management provides asset management and retail brokerage. If the two divisions are approximately equal in terms of assets and gross income, how will the operational capital requirement change if the bank moves from BIA to Standardized (using the information provided in Week 8 class notes)? b.) Calculate operational risk capital required under the new capital standard for WestCorp if the credit risk capital is 8% of risk-weighted assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts