Question: ABC common stock just paid a dividend of $9.75 per share. Dividends are paid annually. Two different analysts are valuing ABC's stock. The analyst

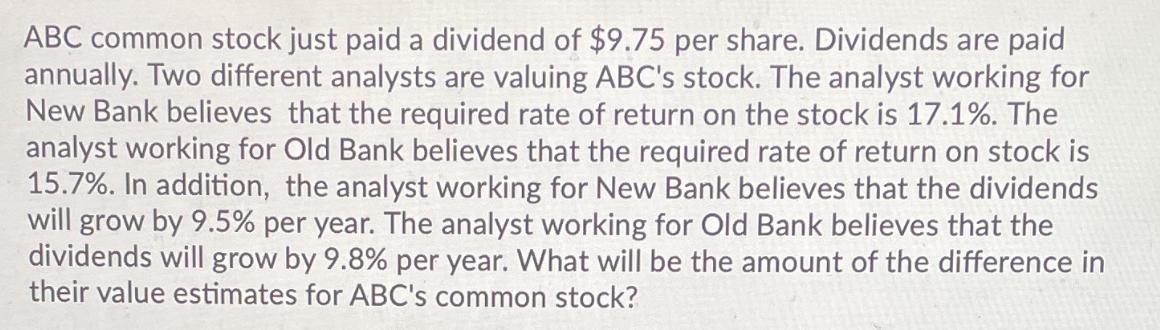

ABC common stock just paid a dividend of $9.75 per share. Dividends are paid annually. Two different analysts are valuing ABC's stock. The analyst working for New Bank believes that the required rate of return on the stock is 17.1%. The analyst working for Old Bank believes that the required rate of return on stock is 15.7%. In addition, the analyst working for New Bank believes that the dividends will grow by 9.5% per year. The analyst working for Old Bank believes that the dividends will grow by 9.8% per year. What will be the amount of the difference in their value estimates for ABC's common stock?

Step by Step Solution

There are 3 Steps involved in it

We can use the Gordon Growth Model to calculate the value estimates for ABCs ... View full answer

Get step-by-step solutions from verified subject matter experts