Question: We've been asked to evaluate a project that is expected to increase our company's flow by $2,620 every year for the next eight years. The

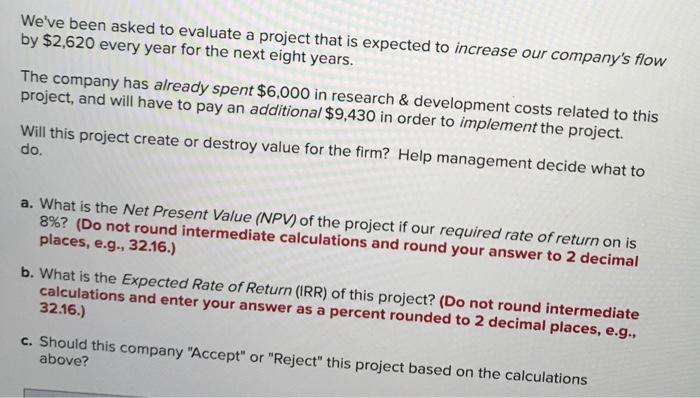

We've been asked to evaluate a project that is expected to increase our company's flow by $2,620 every year for the next eight years. The company has already spent $6,000 in research & development costs related to this project, and will have to pay an additional $9,430 in order to implement the project. Will this project create or destroy value for the firm? Help management decide what to do. a. What is the Net Present Value (NPV) of the project if our required rate of return on is 8%? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the Expected Rate of Return (IRR) of this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Should this company "Accept" or "Reject" this project based on the calculations above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts