Question: Mike Greenberg opened Kleene Window Washing Co. on July 1, 2022. During July, the following transactions were completed. Owner invested $12,000 cash in the

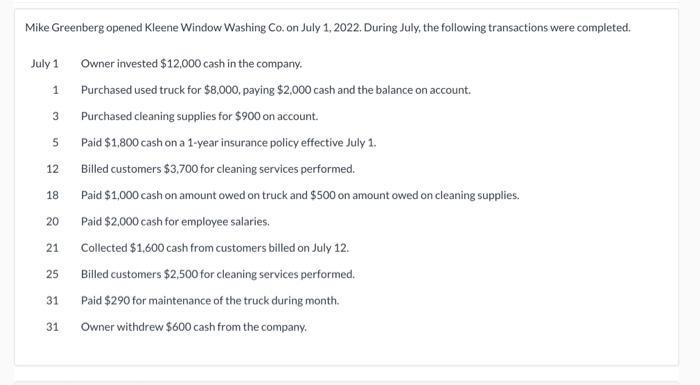

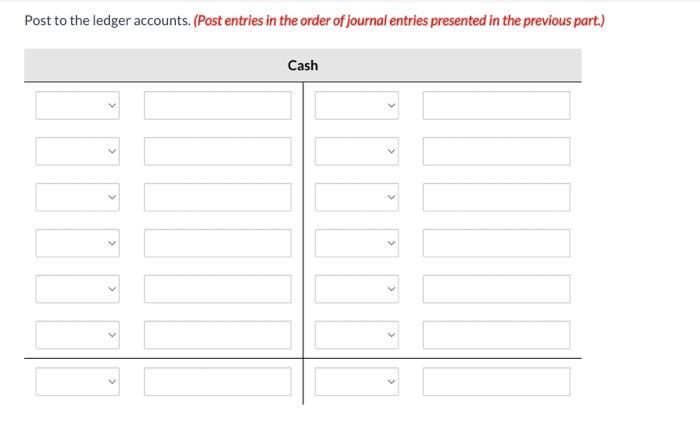

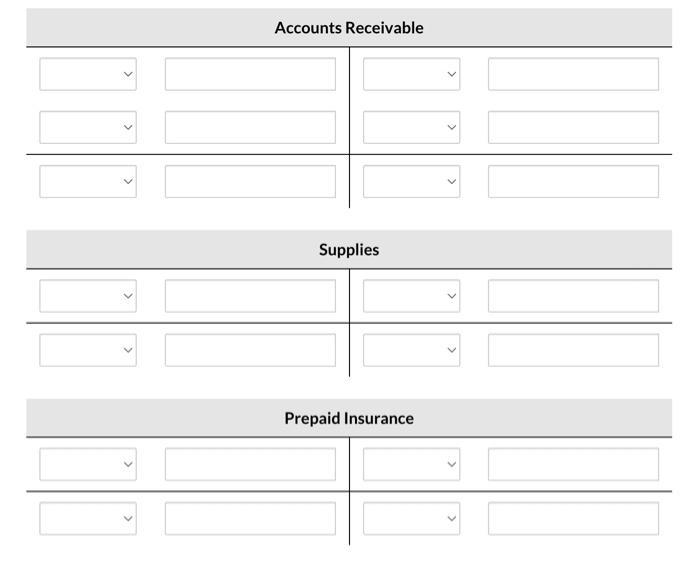

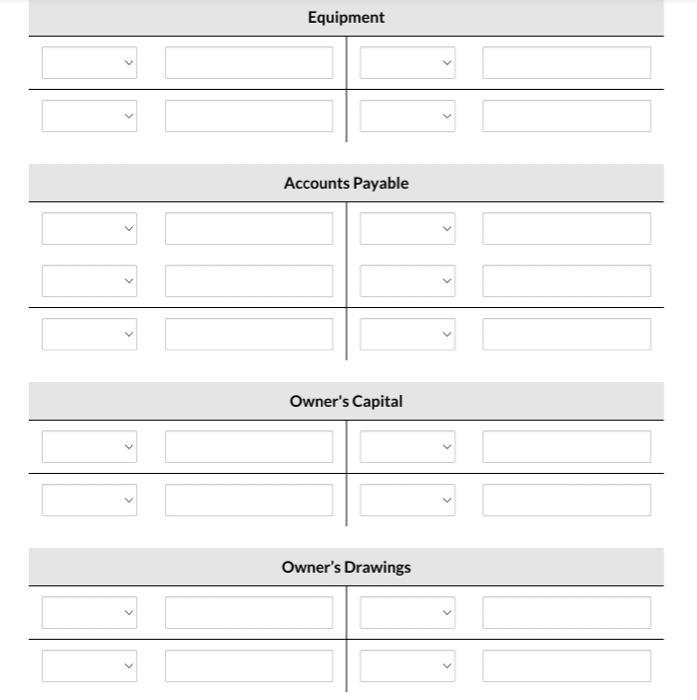

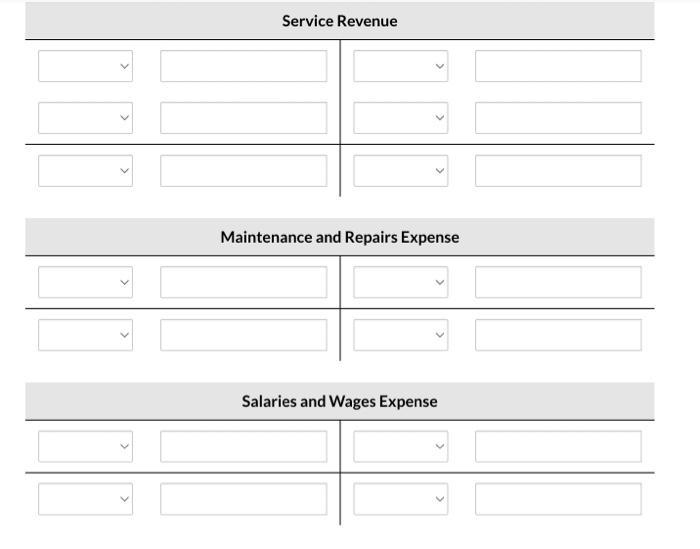

Mike Greenberg opened Kleene Window Washing Co. on July 1, 2022. During July, the following transactions were completed. Owner invested $12,000 cash in the company. Purchased used truck for $8,000, paying $2,000 cash and the balance on account. Purchased cleaning supplies for $900 on account. Paid $1,800 cash on a 1-year insurance policy effective July 1. Billed customers $3,700 for cleaning services performed. Paid $1,000 cash on amount owed on truck and $500 on amount owed on cleaning supplies. Paid $2,000 cash for employee salaries. Collected $1,600 cash from customers billed on July 12. Billed customers $2,500 for cleaning services performed. Paid $290 for maintenance of the truck during month. Owner withdrew $600 cash from the company. July 1 1 3 5 12 18 20 21 25 31 31 Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous part.) 100000 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue V Maintenance and Repairs Expense Salaries and Wages Expense V

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Solution From circuit diagram 408023 ... View full answer

Get step-by-step solutions from verified subject matter experts