Question: WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of

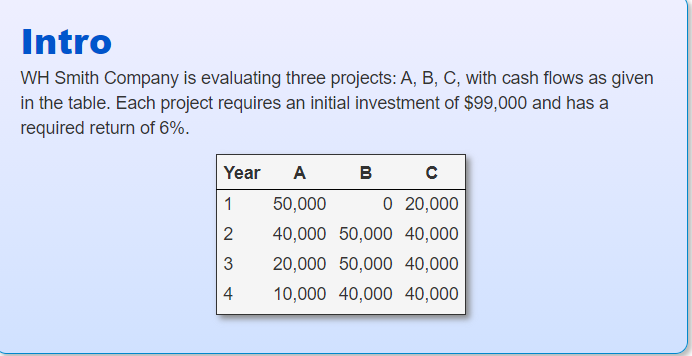

WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of $99,000 and has a required return of 6%.

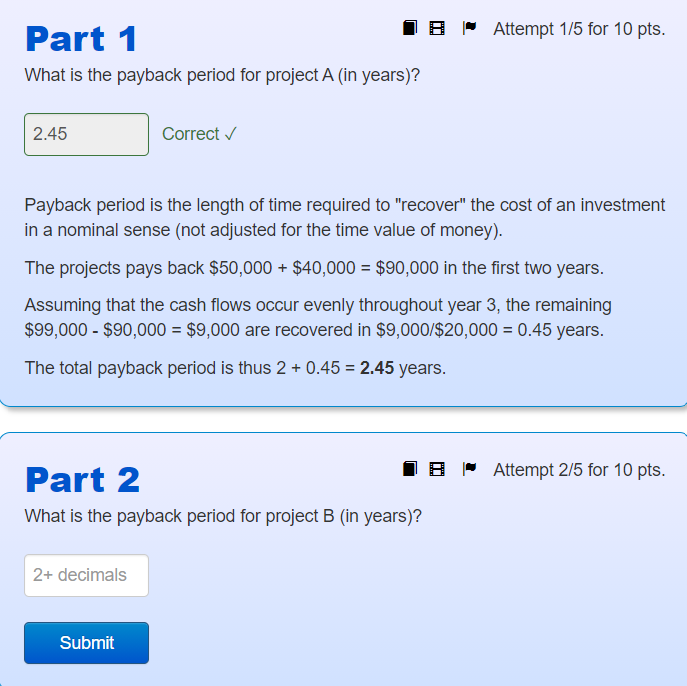

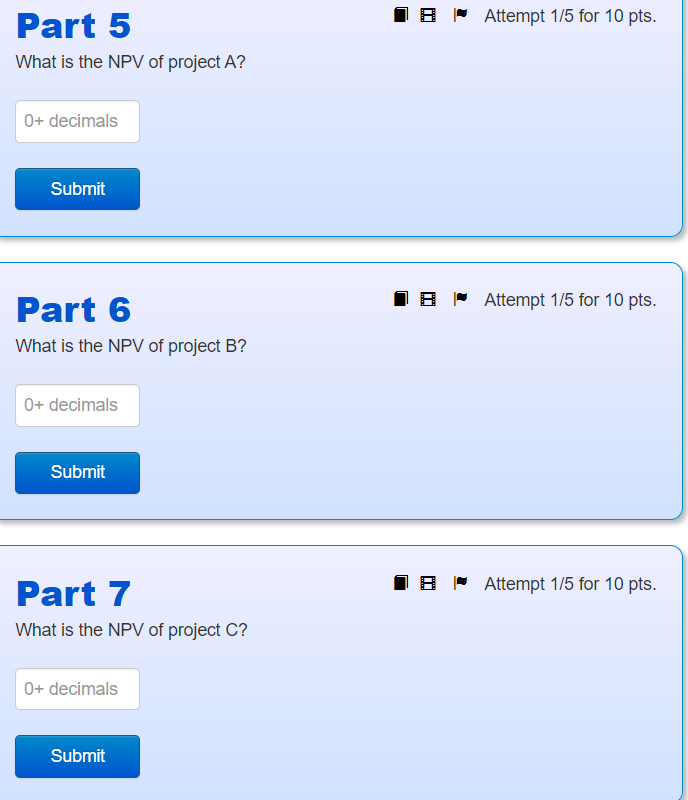

Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of $99,000 and has a required return of 6%. Year 1 2 A B 50,000 0 20,000 40,000 50,000 40,000 20,000 50,000 40,000 10,000 40,000 40,000 3 4 IB Attempt 1/5 for 10 pts. Part 1 What is the payback period for project A (in years)? 2.45 Correct Payback period is the length of time required to "recover" the cost of an investment in a nominal sense (not adjusted for the time value of money). The projects pays back $50,000 + $40,000 = $90,000 in the first two years. Assuming that the cash flows occur evenly throughout year 3, the remaining $99,000 - $90,000 = $9,000 are recovered in $9,000/$20,000 = 0.45 years. The total payback period is thus 2 + 0.45 = 2.45 years. 8 Attempt 2/5 for 10 pts. Part 2 What is the payback period for project B (in years)? 2+ decimals Submit IB Attempt 1/5 for 10 pts. Part 5 What is the NPV of project A? 0+ decimals Submit IB Attempt 1/5 for 10 pts. Part 6 What is the NPV of project B? 0+ decimals Submit IB Attempt 1/5 for 10 pts. Part 7 What is the NPV of project C? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts