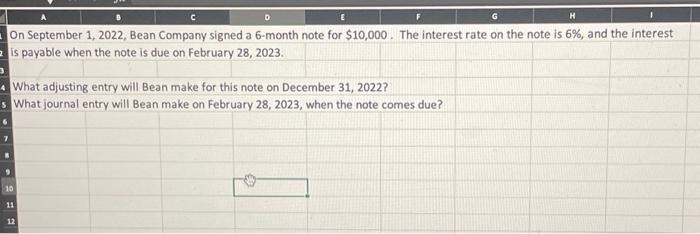

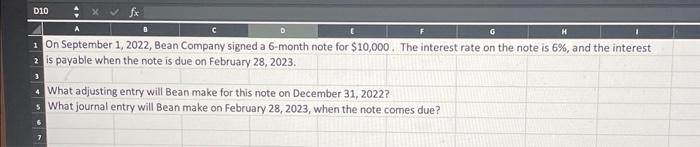

Question: What adjusting entry will Bean make for this note on December 31,2022? What journal entry will Bean make on February 28,2023 , when the note

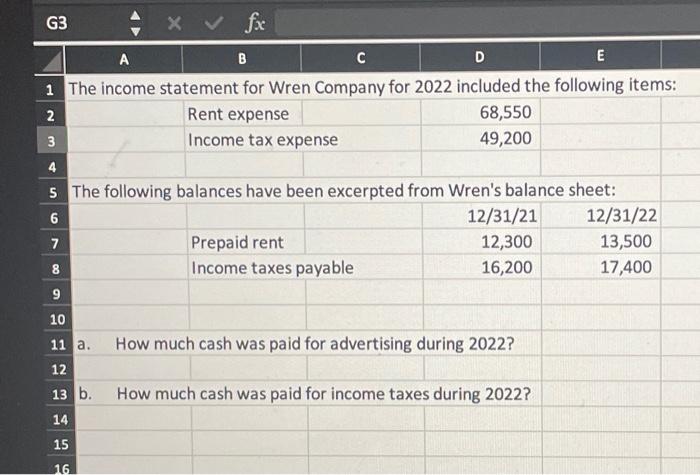

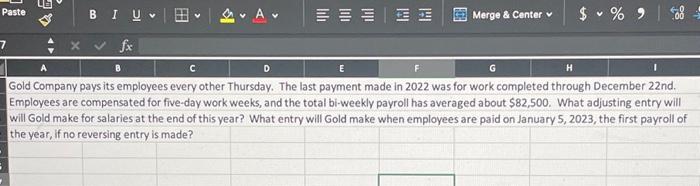

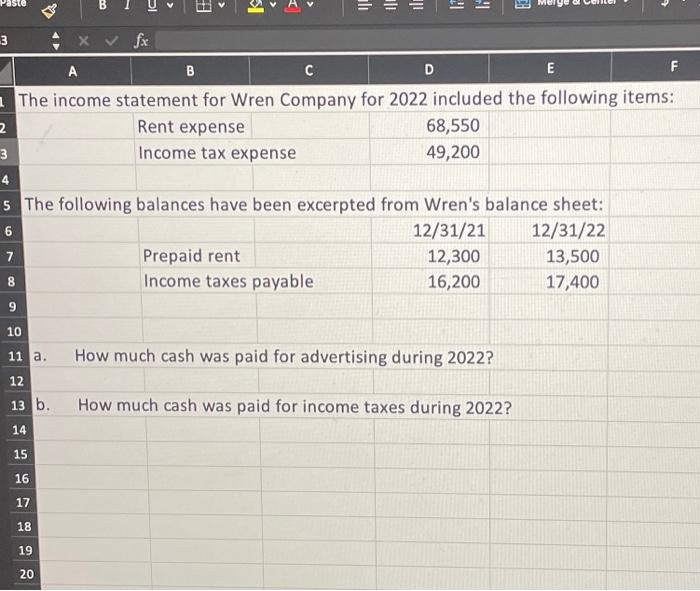

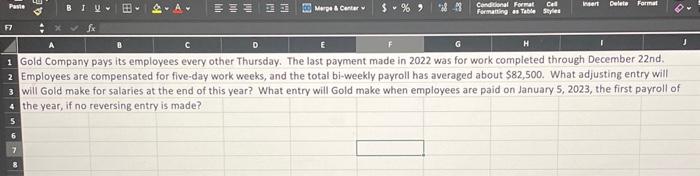

What adjusting entry will Bean make for this note on December 31,2022? What journal entry will Bean make on February 28,2023 , when the note comes due? The following balances have been excerpted from Wren's balance sheet: Gold Company pays its employees every other Thursday. The last payment made in 2022 was for work completed through December 22 nd. Employees are compensated for five-day work weeks, and the total bi-weekly payroll has averaged about $82,500. What adjusting entry will will Gold make for salaries at the end of this year? What entry will Gold make when employees are paid on January 5,2023, the first payroll of the year, if no reversing entry is made? On September 1, 2022, Bean Company signed a 6 -month note for $10,000. The interest rate on the note is 6%, and the interest is payable when the note is due on February 28,2023. What adjusting entry will Bean make for this note on December 31, 2022? What journal entry will Bean make on February 28,2023 , when the note comes due? a. How much cash was paid for advertising during 2022 ? b. How much cash was paid for income taxes during 2022? Gold Company pays its employees every other Thursday. The last payment made in 2022 was for work completed through December 22 nd. Employees are compensated for five-day work weeks, and the total bi-weekly payroll has averaged about $82,500. What adjusting entry will will Gold make for salaries at the end of this year? What entry will Gold make when employees are paid on January 5, 2023, the first payroll of the year, if no reversing entry is made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts