Question: What advantage do options contracts offer in hedging contingent risks? Options provide unlimited exposure to currency moves Options eliminate the need for upfront premium payment

What advantage do options contracts offer in hedging

contingent risks?

Options provide unlimited exposure to currency moves

Options eliminate the need for upfront premium payment

O Options offer flexilotity in taloring exposure and hedging cost

Roots of the Bond Market

Why did US government bond yields plunge in the

summer of

Because of political turmoil in Washington, DC resulting

in the US losing its "triple debt rating

Because of a boom in the US stock market

Because of the strengthening of the US dollar

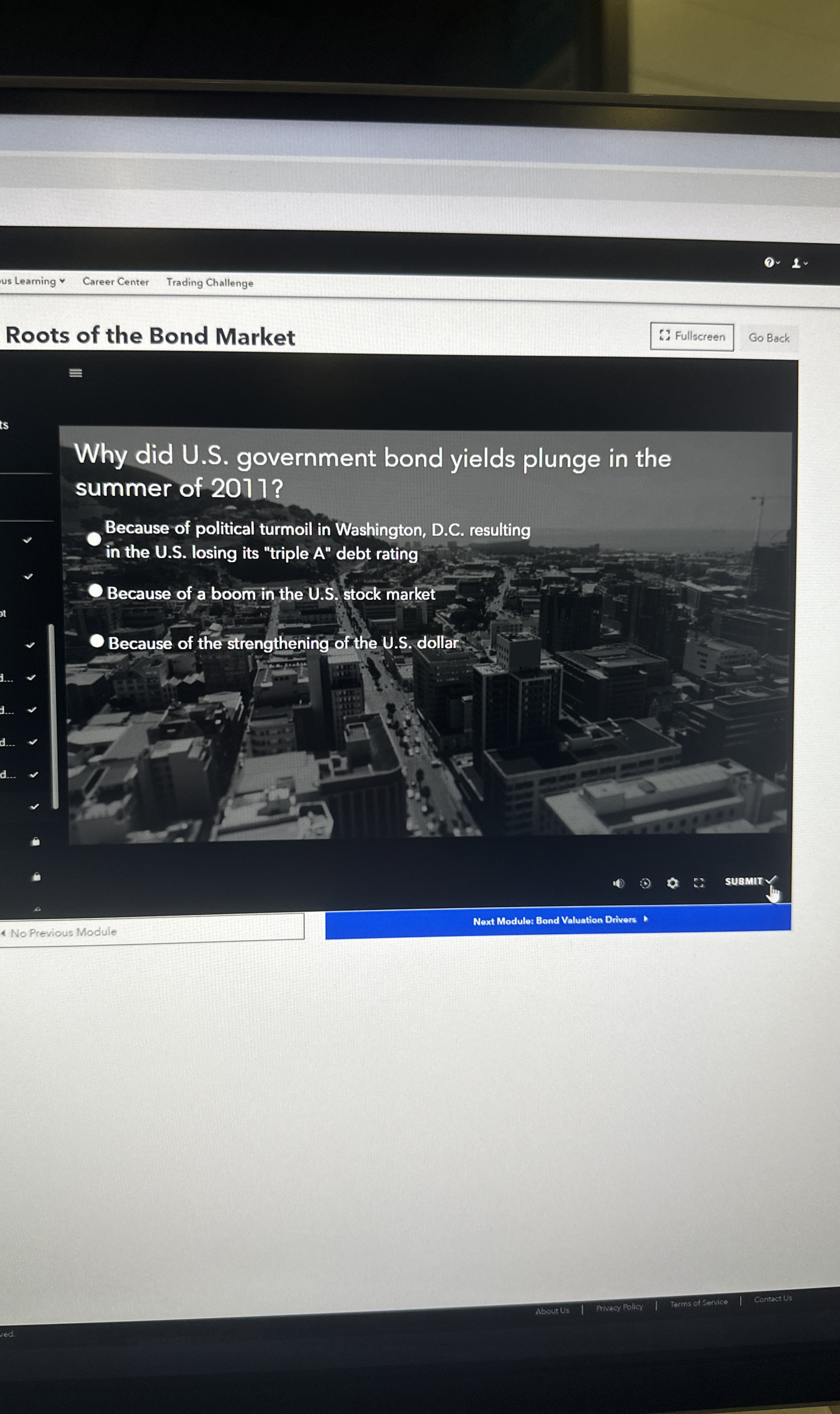

Roots of the Bond Market

Why did US government bond yields plunge in the

summer of

Because of political turmoil in Washington, DC resulting

in the US losing its "triple debt rating

Because of a boom in the US stock market

Because of the strengthening of the US dollar

Roots of the Bond Market

Why did US government bond yields plunge in the

summer of

Because of political turmoil in Washington, DC resulting

in the US losing its "triple debt rating

Because of a boom in the US stock market

Because of the strengthening of the US dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock