Question: what am I doing wrong and how do I do these 5 Many businesses borrow money during periods of increased business activity to finance Inventory

what am I doing wrong and how do I do these

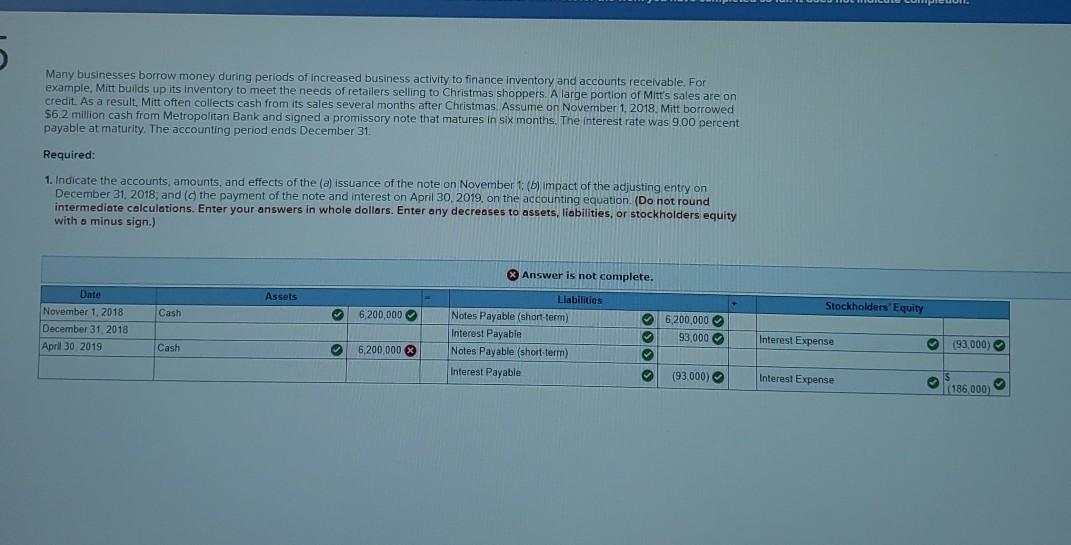

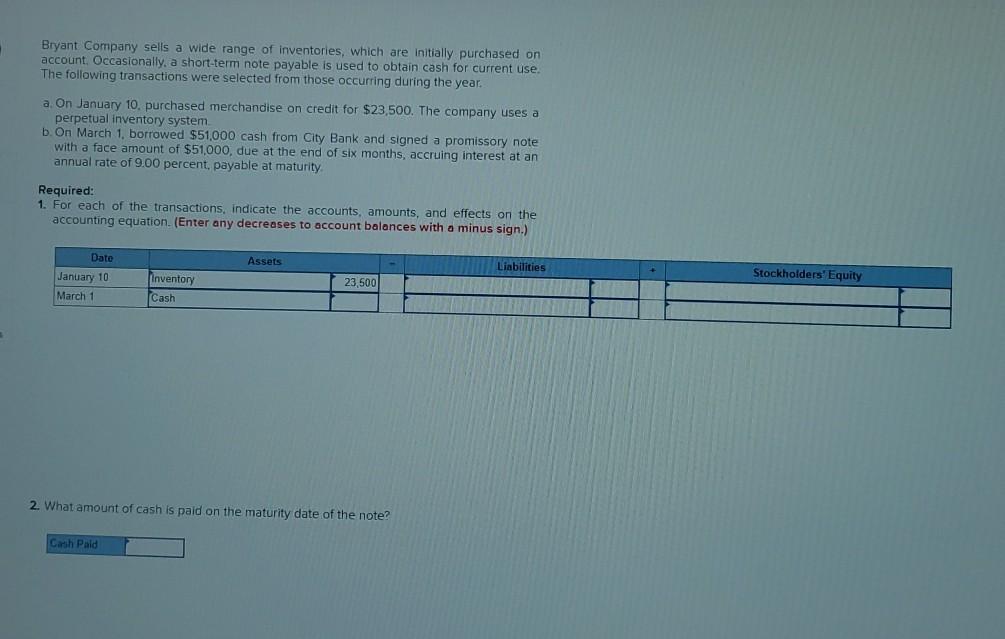

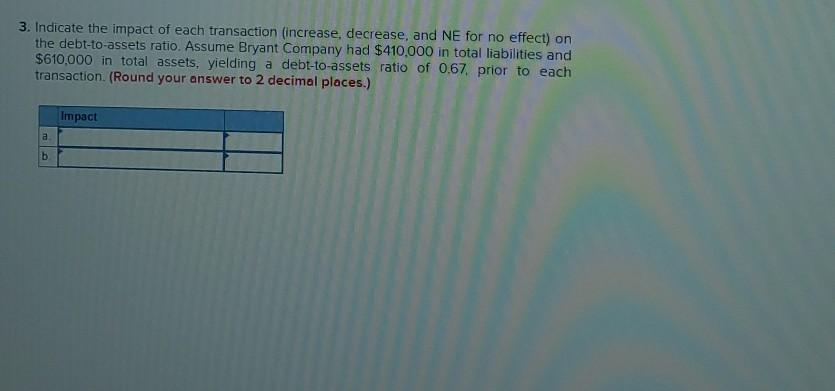

5 Many businesses borrow money during periods of increased business activity to finance Inventory and accounts receivable. For example, Mitt builds up its inventory to meet the needs of retailers selling to Christmas shoppers A large portion of Mitt's sales are on credit. As a result, Mitt often collects cash from its sales several months after Christmas. Assume on November 1, 2018, Mitt borrowed $6.2 million cash from Metropolitan Bank and signed a promissory note that matures in six months. The interest rate was 9.00 percent payable at maturity. The accounting period ends December 31 Required: 1. Indicate the accounts, amounts, and effects of the (a) issuance of the note on November (6) impact of the adjusting entry on December 31, 2018; and (the payment of the note and interest on April 30, 2019, on the accounting equation (Do not round intermediate calculations. Enter your answers in whole dollars. Enter any decreases to assets, liabilities, or stockholders equity with a minus sign.) * Answer is not complete. Assets Stockholders' Equity Cash Date November 1, 2018 December 31 2018 April 30 2019 6,200,000 Liabilities Notes Payable (short-term) Interest Payable Notes Payable (short-term) Interest Payable 6,200,000 93,000 Interest Expense Cash 6,200,000 193 000) (93.000) Interest Expense (186,000 Bryant Company sells a wide range of inventories, which are initially purchased on account. Occasionally, a short-term note payable is used to obtain cash for current use. The following transactions were selected from those occurring during the year. a On January 10. purchased merchandise on credit for $23,500. The company uses a perpetual inventory system b. On March 1, borrowed $51,000 cash from City Bank and signed a promissory note with a face amount of $51,000, due at the end of six months, accruing interest at an annual rate of 9.00 percent, payable at maturity Required: 1. For each of the transactions, indicate the accounts, amounts, and effects on the accounting equation. (Enter any decreases to account balances with a minus sign.) Assets Liabilities Date January 10 March 1 Stockholders' Equity 23,500 Inventory Cash 2. What amount of cash is paid on the maturity date of the note? Cash Pald 3. Indicate the impact of each transaction (increase, decrease, and NE for no effect) on the debt-to-assets ratio. Assume Bryant Company had $410,000 in total liabilities and $610,000 in total assets. yielding a debt-to-assets ratio of 0.67. prior to each transaction. (Round your answer to 2 decimal places.) Impact b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts