Question: what am I doing wrong??? Eagle Tree Services reports the following amounts on December 31, 2024. Assets Cash Supplies Prepaid insurance Building $7,900 2,000 3,700

what am I doing wrong???

what am I doing wrong???

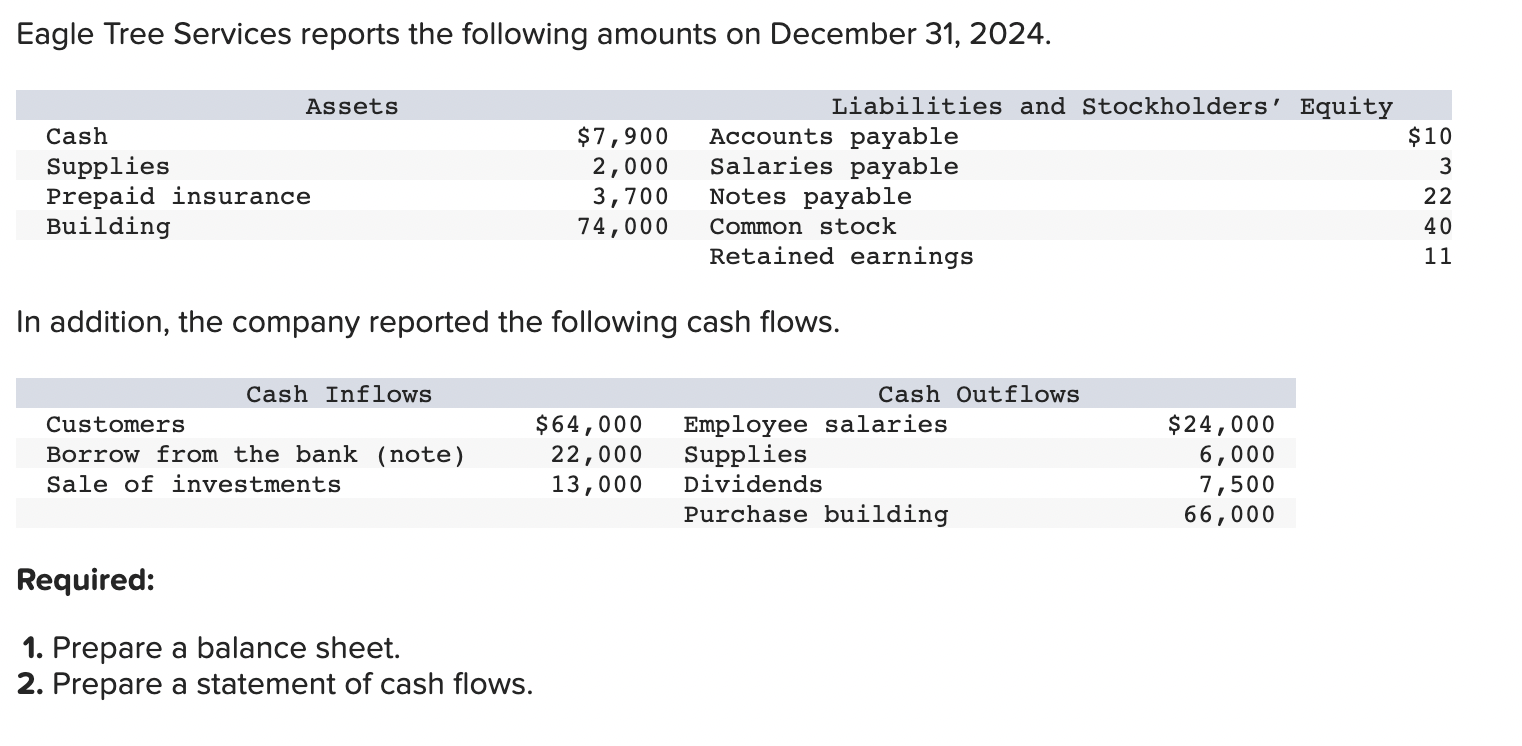

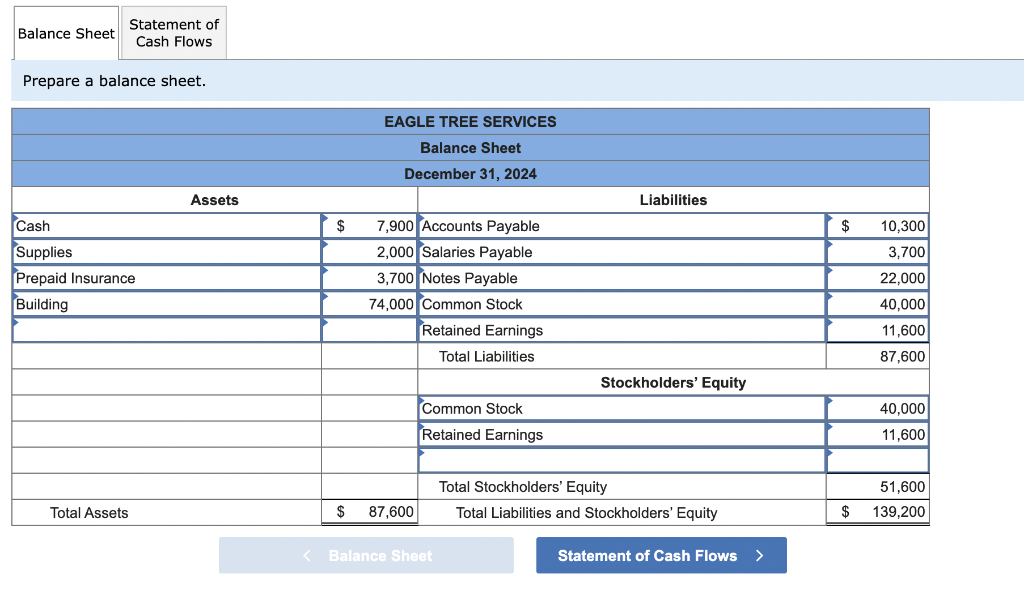

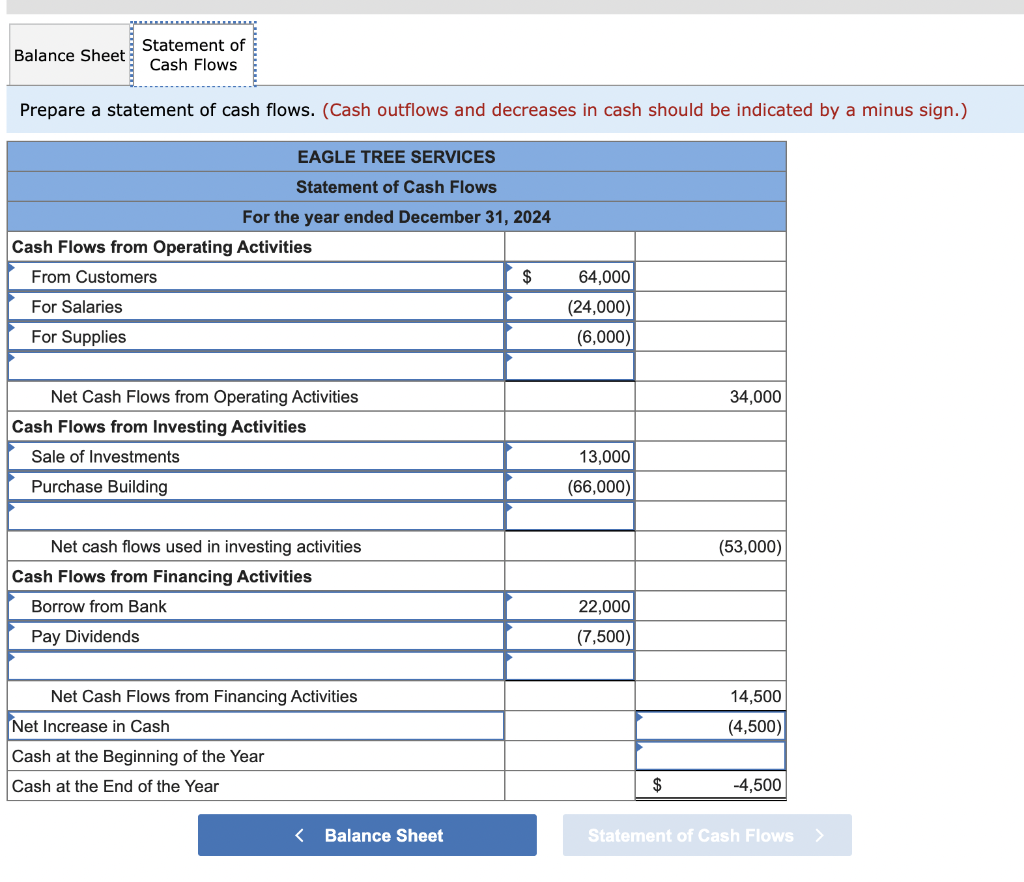

Eagle Tree Services reports the following amounts on December 31, 2024. Assets Cash Supplies Prepaid insurance Building $7,900 2,000 3,700 74,000 Liabilities and Stockholders' Equity Accounts payable $10 Salaries payable 3 Notes payable 22 Common stock 40 Retained earnings 11 12 In addition, the company reported the following cash flows. Cash Inflows Customers Borrow from the bank (note) Sale of investments $64,000 22,000 13,000 Cash Outflows Employee salaries Supplies Dividends Purchase building $24,000 6,000 7,500 66,000 Required: 1. Prepare a balance sheet. 2. Prepare a statement of cash flows. Balance Sheet Statement of Cash Flows Prepare a balance sheet. EAGLE TREE SERVICES Balance Sheet December 31, 2024 Assets Liabilities Cash $ $ 10,300 3,700 Supplies Prepaid Insurance Building 7,900 Accounts Payable 2,000 Salaries Payable 3,700 Notes Payable 74,000 Common Stock Retained Earnings 22,000 40,000 11,600 Total Liabilities 87,600 Stockholders' Equity Common Stock Retained Earnings 40,000 11,600 51,600 Total Stockholders' Equity Total Liabilities and Stockholders' Equity Total Assets $ 87,600 $ 139,200 Balance Sheet Statement of Cash Flows Prepare a statement of cash flows. (Cash outflows and decreases in cash should be indicated by a minus sign.) EAGLE TREE SERVICES Statement of Cash Flows For the year ended December 31, 2024 Cash Flows from Operating Activities From Customers $ For Salaries 64,000 (24,000) (6,000) For Supplies 34,000 Net Cash Flows from Operating Activities Cash Flows from Investing Activities Sale of Investments Purchase Building 13,000 (66,000) (53,000) Net cash flows used in investing activities Cash Flows from Financing Activities Borrow from Bank Pay Dividends 22,000 (7,500) 14,500 (4,500) Net Cash Flows from Financing Activities Net Increase in Cash Cash at the Beginning of the Year Cash at the End of the Year $ -4,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts