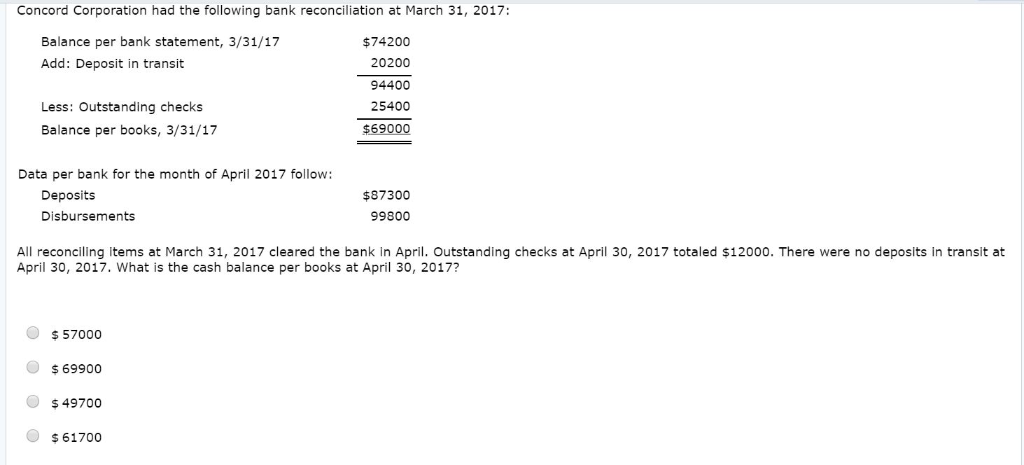

Question: what am i doing wrong. ending balance - outstanding checks +deposits - disbursements 69000-12000+87300-99800= 44500 Concord Corporation had the following bank reconciliation at March 31,

what am i doing wrong. ending balance - outstanding checks +deposits - disbursements 69000-12000+87300-99800= 44500

Concord Corporation had the following bank reconciliation at March 31, 2017: $74200 20200 94400 25400 $69000 Balance per bank statement, 3/31/17 Add: Deposit in transit Less: Outstanding checks Balance per books, 3/31/17 Data per bank for the month of April 2017 follow: Deposits Disbursements $87300 99800 All reconciling items at March 31, 2017 cleared the bank in April. Outstanding checks at April 30, 2017 totaled $12000. There were no deposits in transit at April 30, 2017. What is the cash balance per books at April 30, 2017? $ 57000 $69900 $4970o 61700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts