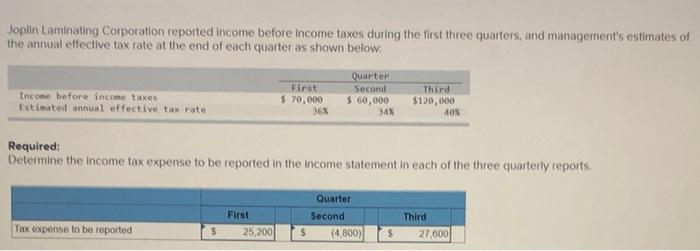

Question: what am i doing wrong in the second and thrid quarter Joplin Laminating Corporation reported income before income taxes during the first three quarters, and

Joplin Laminating Corporation reported income before income taxes during the first three quarters, and management's estimates of the annual effective tax rate at the end of each quarter as shown below: Income before income taxes Estimated annual effective tax rate First $ 70,000 36% Quarter Second $ 60,000 34 Third $120,000 40% Required: Determine the income tax expense to be reported in the income statement in each of the three quarterly reports Quarter Second (4.800) First 25,200 Tax expense to be reported Third 27600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts