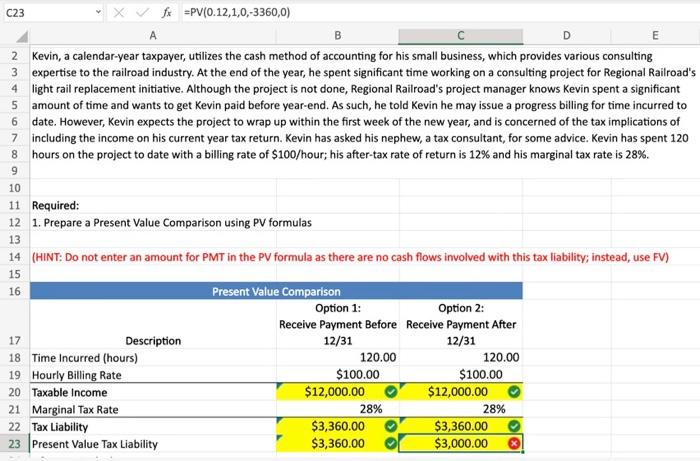

Question: what am I doing wrong inputing the present value formula into cell C23? 2 Kevin, a calendar-year taxpayer, utilizes the cash method of accounting for

2 Kevin, a calendar-year taxpayer, utilizes the cash method of accounting for his small business, which provides various consulting 3 expertise to the railroad industry. At the end of the year, he spent significant time working on a consulting project for Regional Railroad's 4 light rail replacement initiative. Although the project is not done, Regional Railroad's project manager knows Kevin spent a significant 5 amount of time and wants to get Kevin paid before year-end. As such, he told Kevin he may issue a progress billing for time incurred to 6 date. However, Kevin expects the project to wrap up within the first week of the new year, and is concerned of the tax implications of 7 including the income on his current year tax return. Kevin has asked his nephew, a tax consultant, for some advice. Kevin has spent 120 8 hours on the project to date with a billing rate of $100/ hour; his after-tax rate of return is 12% and his marginal tax rate is 28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts