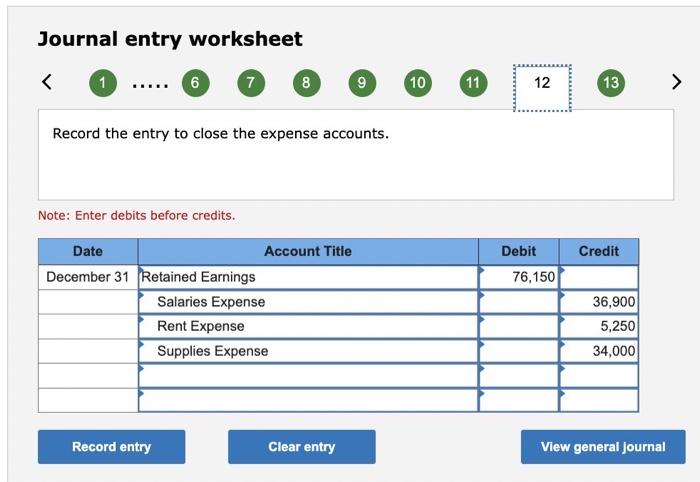

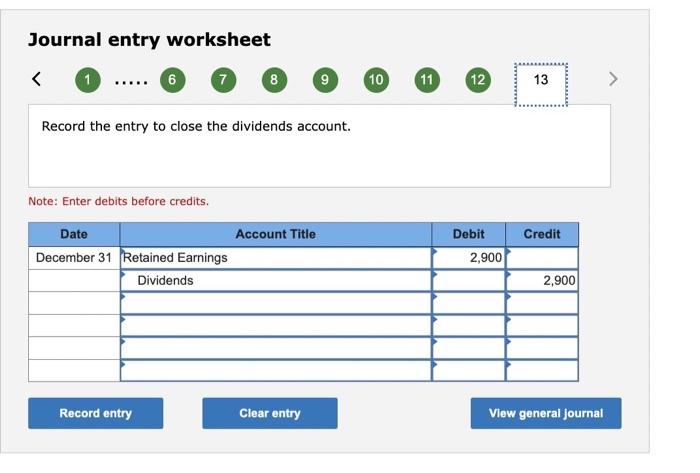

Question: what am i doing wrong? my income the homework program says answer is not complete, and will not allow it to transfer to the income

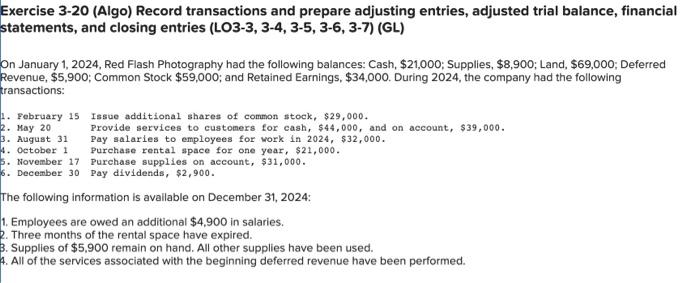

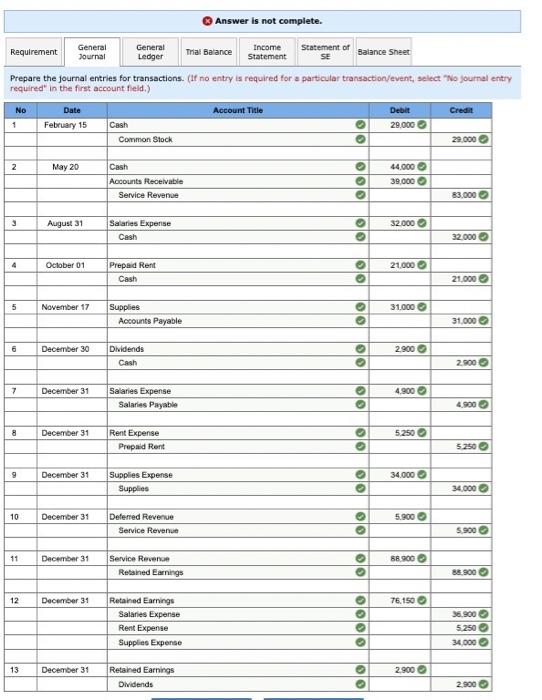

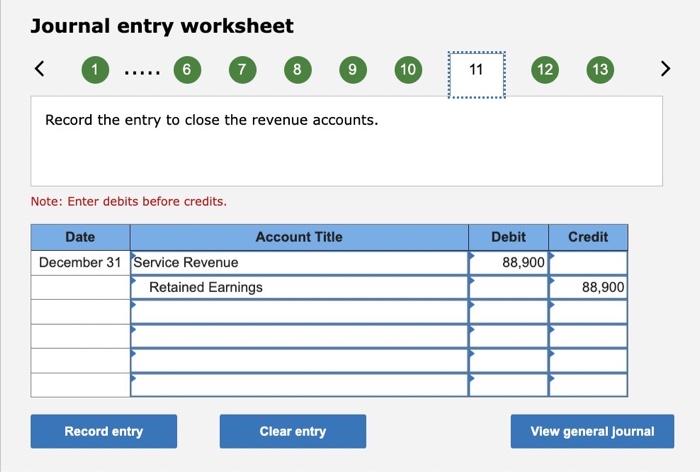

Exercise 3-20 (Algo) Record transactions and prepare adjusting entries, adjusted trial balance, financial statements, and closing entries (LO3-3, 3-4, 3-5, 3-6, 3-7) (GL) On January 1, 2024, Red Flash Photography had the following balances: Cash, $21,000; Supplies, $8,900; Land, $69,000; Deferred Revenue, \$5,900; Common Stock \$59,000; and Retained Earnings, $34,000. During 2024, the company had the following transactions: 1. February 15 Issue additional shares of common $ tock, $29,000. 2. May 20 Provide services to customers for cash, $44,000, and on account, $39,000. 3. August 31 Pay salaries to employees for work in 2024,$32,000. 4. October 1 Purchase rental space for one year, $21,000. 5. November 17 Purchase supplies on account, $31,000. 6. December 30 Pay dividends, $2,900. The following information is avallable on December 31, 2024: 1. Employees are owed an additional $4,900 in salaries. 2. Three months of the rental space have expired. 3. Supplies of $5,900 remain on hand. All other supplies have been used. 4. All of the services associated with the beginning deferred revenue have been performed. (3) Answer is not complete. repare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No journal ent? Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Journal entry worksheet 1 6 7 8 9 Record the entry to close the expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Exercise 3-20 (Algo) Record transactions and prepare adjusting entries, adjusted trial balance, financial statements, and closing entries (LO3-3, 3-4, 3-5, 3-6, 3-7) (GL) On January 1, 2024, Red Flash Photography had the following balances: Cash, $21,000; Supplies, $8,900; Land, $69,000; Deferred Revenue, \$5,900; Common Stock \$59,000; and Retained Earnings, $34,000. During 2024, the company had the following transactions: 1. February 15 Issue additional shares of common $ tock, $29,000. 2. May 20 Provide services to customers for cash, $44,000, and on account, $39,000. 3. August 31 Pay salaries to employees for work in 2024,$32,000. 4. October 1 Purchase rental space for one year, $21,000. 5. November 17 Purchase supplies on account, $31,000. 6. December 30 Pay dividends, $2,900. The following information is avallable on December 31, 2024: 1. Employees are owed an additional $4,900 in salaries. 2. Three months of the rental space have expired. 3. Supplies of $5,900 remain on hand. All other supplies have been used. 4. All of the services associated with the beginning deferred revenue have been performed. (3) Answer is not complete. repare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No journal ent? Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Journal entry worksheet 1 6 7 8 9 Record the entry to close the expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts