Question: what am i doing wrong? on January 2, 2018, Maxwell Furniture purchased display shelving for $9,000 cash, expecting the shelving to remain in service for

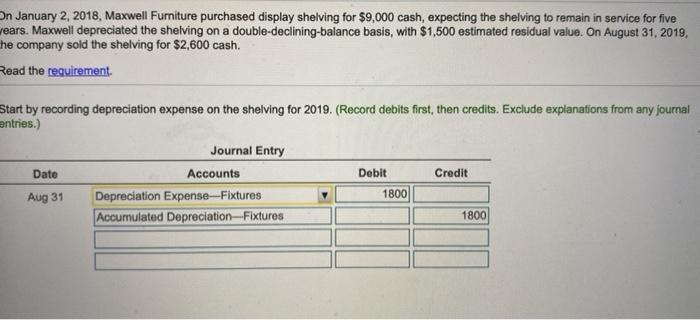

on January 2, 2018, Maxwell Furniture purchased display shelving for $9,000 cash, expecting the shelving to remain in service for five years. Maxwell depreciated the shelving on a double-declining-balance basis, with $1,500 estimated residual value. On August 31, 2019, he company sold the shelving for $2,600 cash. Read the requirement Start by recording depreciation expense on the shelving for 2019. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Aug 31 Depreciation Expense--Fixtures 1800 Accumulated Depreciation-Fixtures 1800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts