Question: what am i missing ? please help Kay Wing, Inc., prepared the following balance sheet at December 31, 20X0. Kay Wing, Inc. Balance Sheet as

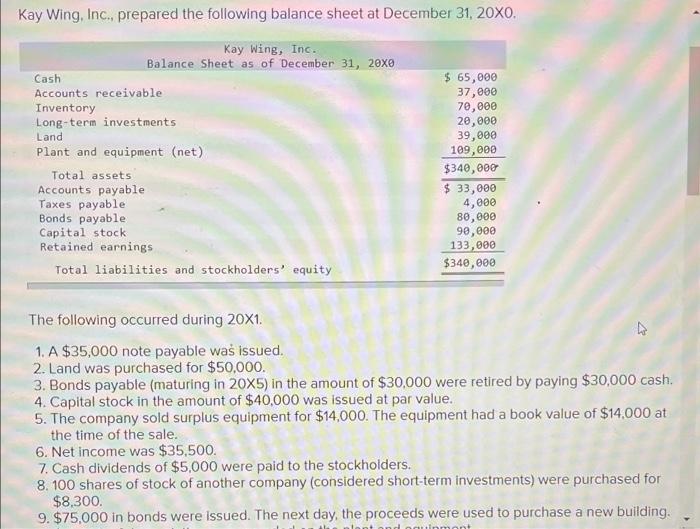

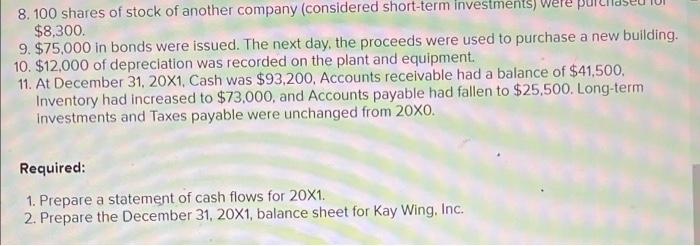

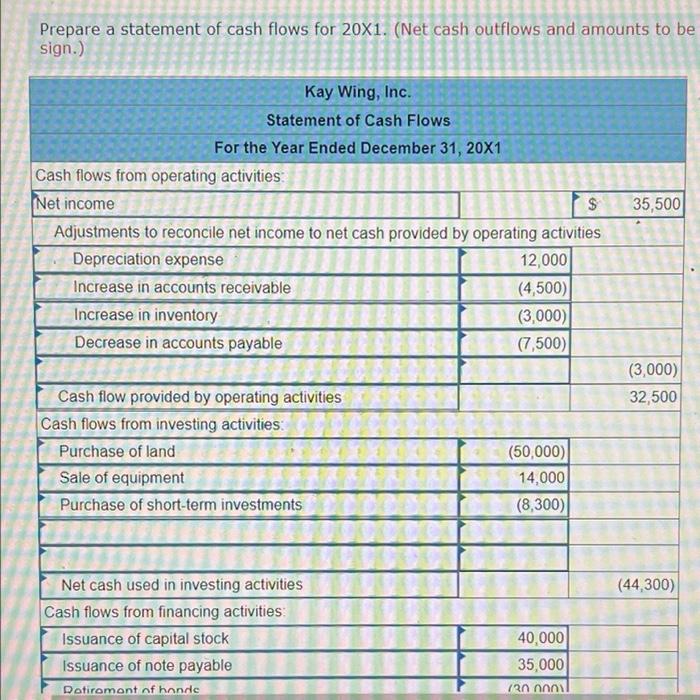

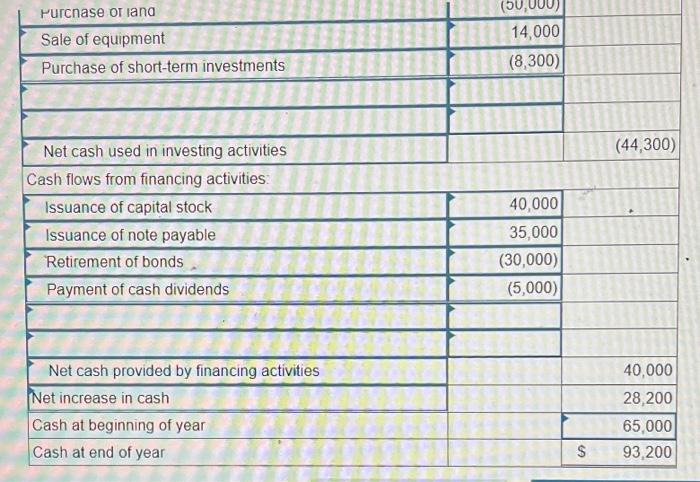

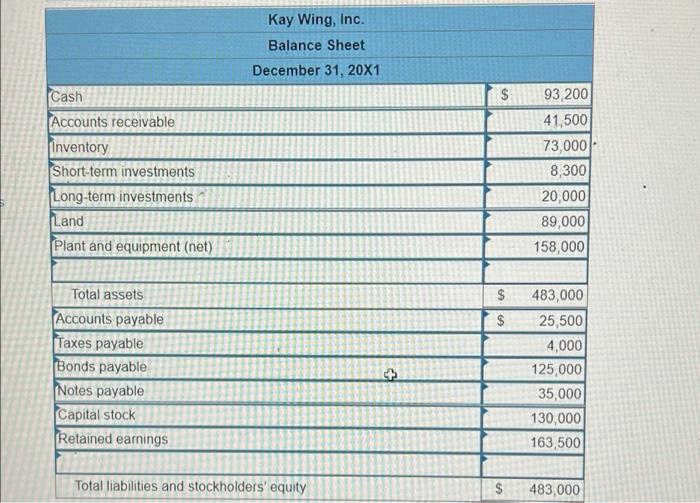

Kay Wing, Inc., prepared the following balance sheet at December 31, 20X0. Kay Wing, Inc. Balance Sheet as of December 31, 20xe Cash Accounts receivable Inventory Long-term investments Land Plant and equipment (net) Total assets Accounts payable Taxes payable Bonds payable Capital stock Retained earnings Total liabilities and stockholders' equity $ 65,000 37 , 70,000 2 , 39,000 109,000 $340,000 $ 33 , 4,000 80,000 99,000 133,000 $340,000 The following occurred during 20X1. 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000. 3. Bonds payable (maturing in 20X5) in the amount of $30,000 were retired by paying $30,000 cash. 4. Capital stock in the amount of $40,000 was issued at par value. 5. The company sold surplus equipment for $14,000. The equipment had a book value of $14,000 at the time of the sale. 6. Net income was $35,500. 7. Cash dividends of $5,000 were paid to the stockholders. 8. 100 shares of stock of another company (considered short-term investments) were purchased for $8,300. 9. $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building. 8.100 shares of stock of another company (considered short-term investments) $8,300. 9. $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building. 10. $12,000 of depreciation was recorded on the plant and equipment. 11. At December 31, 20X1. Cash was $93,200, Accounts receivable had a balance of $41,500, Inventory had increased to $73,000, and Accounts payable had fallen to $25,500. Long-term Investments and Taxes payable were unchanged from 20x0. Required: 1. Prepare a statement of cash flows for 20X1. 2. Prepare the December 31, 20X1, balance sheet for Kay Wing, Inc. Prepare a statement of cash flows for 20X1. (Net cash outflows and amounts to be sign.) 35,500 Kay Wing, Inc. Statement of Cash Flows For the Year Ended December 31, 20X1 Cash flows from operating activities: Net income $ Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense 12,000 Increase in accounts receivable (4,500) Increase in inventory (3.000) Decrease in accounts payable (7,500) (3,000) 32,500 Cash flow provided by operating activities Cash flows from investing activities: Purchase of land Sale of equipment Purchase of short-term investments (50,000) 14,000 (8,300) (44,300) Net cash used in investing activities Cash flows from financing activities: Issuance of capital stock Issuance of note payable Retiromont of hands 40,000 35,000 nnnn Purcnase or lana Sale of equipment Purchase of short-term investments (50,000) 14,000 (8,300) (44,300) Net cash used in investing activities Cash flows from financing activities: Issuance of capital stock Issuance of note payable Retirement of bonds Payment of cash dividends 40,000 35,000 (30,000) (5,000) Net cash provided by financing activities Net increase in cash Cash at beginning of year Cash at end of year 40,000 28,200 65,000 93,200 $ Kay Wing, Inc. Balance Sheet December 31, 20X1 $ Cash Accounts receivable Inventory Short-term investments Long-term investments Land Plant and equipment (net) 93 200 41,500 73,000 8,300 20,000 89,000 158,000 $ $ Total assets Accounts payable Taxes payable Bonds payable Notes payable Capital stock Retained earnings + 483,000 25,500 4,000 125,000 35,000 130,000 163,500 Total liabilities and stockholders' equity $ 483,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts