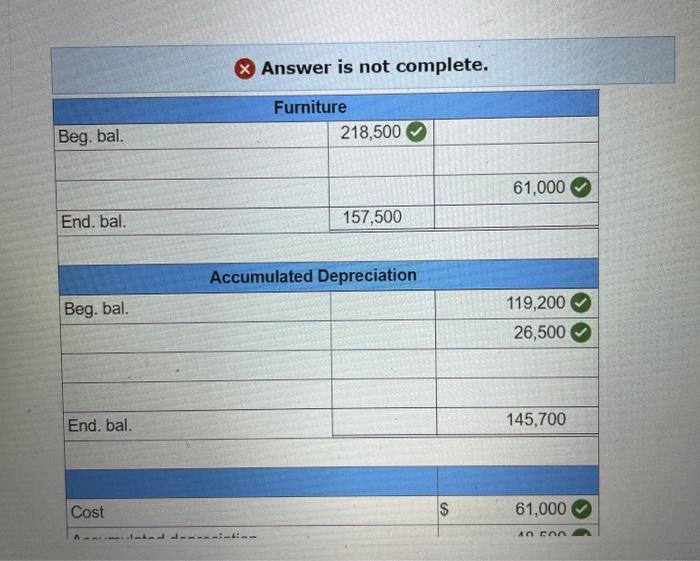

Question: what am I missing? The following information is from Ellerby Company's comparative balance sheets. At December 31 Furniture Accumulated depreciation-Furniture Current Year $157,5ee (97,200 Prior

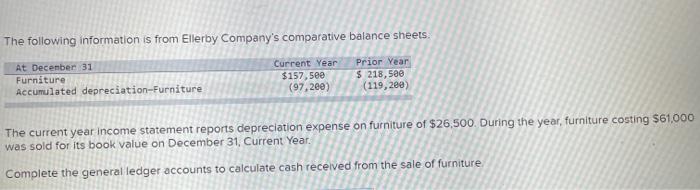

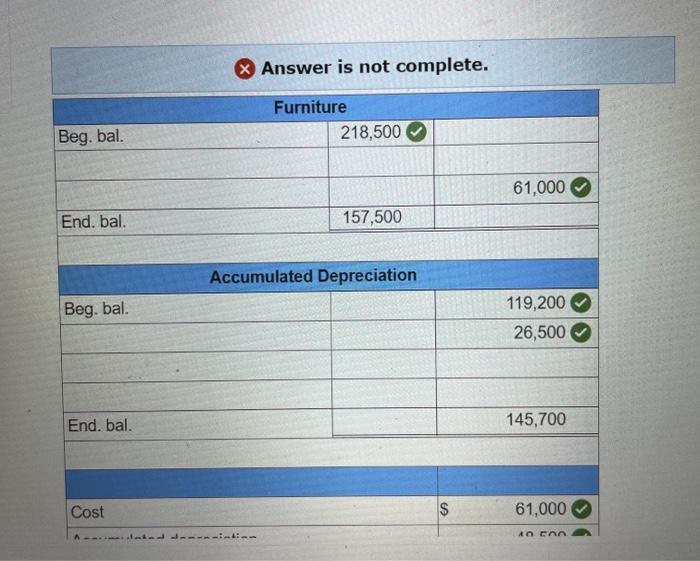

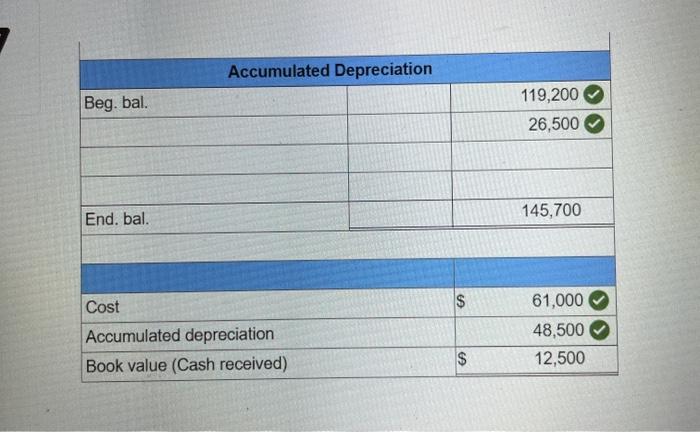

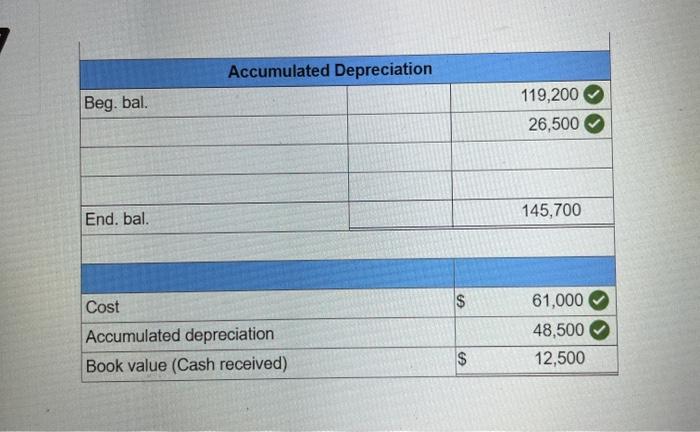

The following information is from Ellerby Company's comparative balance sheets. At December 31 Furniture Accumulated depreciation-Furniture Current Year $157,5ee (97,200 Prior Year $ 218,500 (119,200) The current year income statement reports depreciation expense on furniture of $26,500. During the year, furniture costing $61.000 was sold for its book value on December 31, Current Year. Complete the general ledger accounts to calculate cash received from the sale of furniture X Answer is not complete. Furniture 218,500 Beg. bal. 61,000 End. bal. 157,500 Accumulated Depreciation Beg. bal. 119,200 26,500 End. bal. 145,700 Cost $ 61,000 LOCA A-------- Accumulated Depreciation Beg. bal. 119,200 26,500 End. bal. 145,700 $ Cost Accumulated depreciation Book value (Cash received) 61,000 48,500 12,500 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts