Question: What am I required to do in this assignment? Task 1: Triumph Traders LLC is a registered Company in Muscat Securities Market, Sultanate of Oman

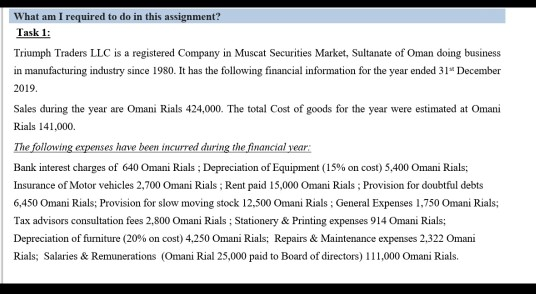

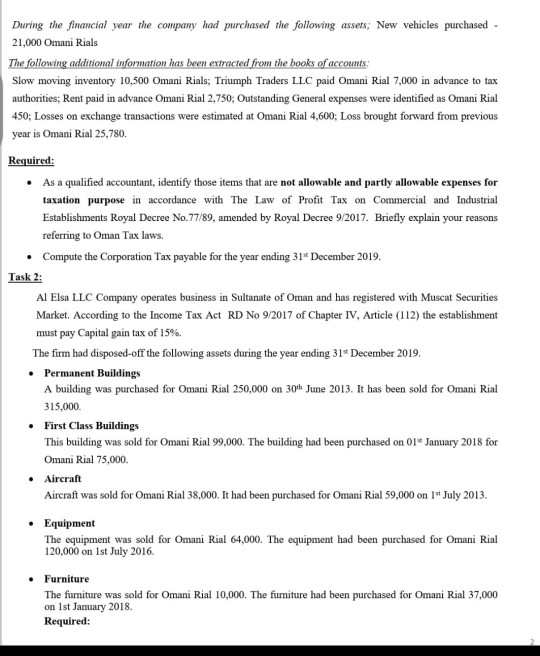

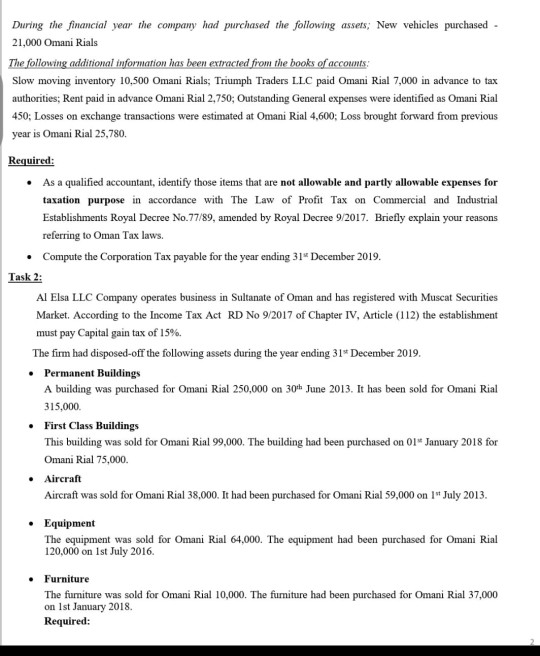

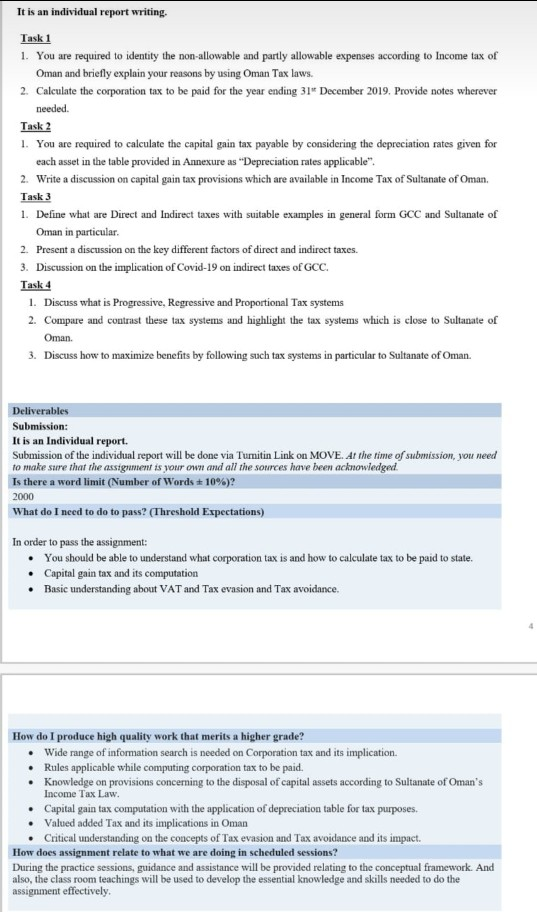

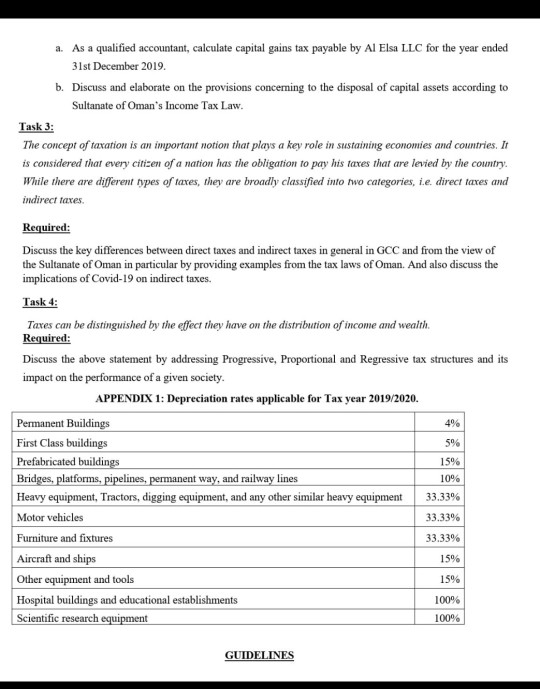

What am I required to do in this assignment? Task 1: Triumph Traders LLC is a registered Company in Muscat Securities Market, Sultanate of Oman doing business in manufacturing industry since 1980. It has the following financial information for the year ended 31* December 2019. Sales during the year are Omani Rials 424,000. The total cost of goods for the year were estimated at Omani Rials 141.000. The following expenses have been incurred during the financial year: Bank interest charges of 640 Omani Rials ; Depreciation of Equipment (15% on cost) 5,400 Omani Rials; Insurance of Motor vehicles 2,700 Omani Rials ; Rent paid 15,000 Omani Rials ; Provision for doubtful debts 6,450 Omani Rials; Provision for slow moving stock 12,500 Omani Rials ; General Expenses 1,750 Omani Rials; Tax advisors consultation fees 2,800 Omani Rials : Stationery & Printing expenses 914 Omani Rials; Depreciation of furniture (20% on cost)4,250 Omani Rials: Repairs & Maintenance expenses 2,322 Omani Rials; Salaries & Remunerations (Omani Rial 25,000 paid to Board of directors) 111,000 Omani Rials. During the financial year the company had purchased the following assets: New vehicles purchased 21,000 Omani Rials The following additional information has been extracted from the books of accounts: Slow moving inventory 10,500 Omani Rials; Triumph Traders LLC paid Omani Rial 7,000 in advance to tax authorities; Rent paid in advance Omani Rial 2,750; Outstanding General expenses were identified as Omani Rial 450; Losses on exchange transactions were estimated at Omani Rial 4,600; Loss brought forward from previous year is Omani Rial 25,780. Required: As a qualified accountant, identify those items that are not allowable and partly allowable expenses for taxation purpose in accordance with The Law of Profit Tax on Commercial and Industrial Establishments Royal Decree No.77/89, amended by Royal Decree 9/2017. Briefly explain your reasons referring to Oman Tax laws. Compute the Corporation Tax payable for the year ending 31 December 2019. Task 2: Al Elsa LLC Company operates business in Sultanate of Oman and has registered with Muscat Securities Market. According to the Income Tax Act RD No 9/2017 of Chapter IV, Article (112) the establishment must pay Capital gain tax of 15%. The firm had disposed-off the following assets during the year ending 31* December 2019. Permanent Buildings A building was purchased for Omani Rial 250,000 on 30th June 2013. It has been sold for Omani Rial 315,000 First Class Buildings This building was sold for Omani Rial 99,000. The building had been purchased on 01" January 2018 for Omani Rial 75,000 Aircraft Aircraft was sold for Omani Rial 38,000. It had been purchased for Omani Rial 59,000 on i* July 2013. Equipment The equipment was sold for Omani Rial 64,000. The equipment had been purchased for Omani Rial 120,000 on 1st July 2016 Furniture The furniture was sold for Omani Rial 10,000. The furniture had been purchased for Omani Rial 37,000 on 1st January 2018 Required: During the financial year the company had purchased the following assets: New vehicles purchased 21,000 Omani Rials The following additional information has been extracted from the books of accounts: Slow moving inventory 10,500 Omani Rials; Triumph Traders LLC paid Omani Rial 7,000 in advance to tax authorities; Rent paid in advance Omani Rial 2,750; Outstanding General expenses were identified as Omani Rial 450; Losses on exchange transactions were estimated at Omani Rial 4,600; Loss brought forward from previous year is Omani Rial 25,780. Required: As a qualified accountant, identify those items that are not allowable and partly allowable expenses for taxation purpose in accordance with The Law of Profit Tax on Commercial and Industrial Establishments Royal Decree No.77/89, amended by Royal Decree 9/2017. Briefly explain your reasons referring to Oman Tax laws. Compute the Corporation Tax payable for the year ending 31 December 2019. Task 2: Al Elsa LLC Company operates business in Sultanate of Oman and has registered with Muscat Securities Market. According to the Income Tax Act RD No 9/2017 of Chapter IV, Article (112) the establishment must pay Capital gain tax of 15%. The firm had disposed-off the following assets during the year ending 31* December 2019. Permanent Buildings A building was purchased for Omani Rial 250,000 on 30th June 2013. It has been sold for Omani Rial 315,000 First Class Buildings This building was sold for Omani Rial 99,000. The building had been purchased on 01" January 2018 for Omani Rial 75,000 Aircraft Aircraft was sold for Omani Rial 38,000. It had been purchased for Omani Rial 59,000 on i* July 2013. Equipment The equipment was sold for Omani Rial 64,000. The equipment had been purchased for Omani Rial 120,000 on 1st July 2016 Furniture The furniture was sold for Omani Rial 10,000. The furniture had been purchased for Omani Rial 37,000 on 1st January 2018 Required: It is an individual report writing. Task 1 1. You are required to identity the non-allowable and partly allowable expenses according to Income tax of Oman and briefly explain your reasons by using Oman Tax laws. 2. Calculate the corporation tax to be paid for the year ending 31 December 2019. Provide notes wherever needed. Task 2 1. You are required to calculate the capital gain tax payable by considering the depreciation rates given for each asset in the table provided in Annexure as "Depreciation rates applicable". 2. Write a discussion on capital gain tax provisions which are available in Income Tax of Sultanate of Oman. Task 3 1. Define what are Direct and Indirect taxes with suitable examples in general form GCC and Sultanate of Oman in particular. 2. Present a discussion on the key different factors of direct and indirect taxes. 3. Discussion on the implication of Covid-19 on indirect taxes of GCC. Task 4 1. Discuss what is Progressive, Regressive and Proportional Tax systems 2. Compare and contrast these tax systems and highlight the tax systems which is close to Sultanate of Oman. 3. Discuss how to maximize benefits by following such tax systems in particular to Sultanate of Oman. Deliverables Submission: It is an Individual report. Submission of the individual report will be done via Tumitin Link on MOVE. At the time of submission, you need to make sure that the assignment is your own and all the sources have been acknowledged. Is there a word limit (Number of Words + 10%)? 2000 What do I need to do to pass? (Threshold Expectations) In order to pass the assignment: You should be able to understand what corporation tax is and how to calculate tax to be paid to state. Capital gain tax and its computation Basic understanding about VAT and Tax evasion and Tax avoidance. 1 How do I produce high quality work that merits a higher grade? Wide range of information search is needed on Corporation tax and its implication. Rules applicable while computing corporation tax to be paid. Knowledge on provisions concerning to the disposal of capital assets according to Sultanate of Oman's Income Tax Law. Capital gain tax computation with the application of depreciation table for tax purposes. Valued added Tax and its implications in Oman Critical understanding on the concepts of Tax evasion and Tax avoidance and its impact. How does assignment relate to what we are doing in scheduled sessions? During the practice sessions, guidance and assistance will be provided relating to the conceptual framework. And also, the classroom teachings will be used to develop the essential knowledge and skills needed to do the assignment effectively a. As a qualified accountant, calculate capital gains tax payable by Al Elsa LLC for the year ended 31st December 2019. b. Discuss and elaborate on the provisions concerning to the disposal of capital assets according to Sultanate of Oman's Income Tax Law. Task 3: The concept of taxation is an important notion that plays a key role in sustaining economies and countries. It is considered that every citizen of a nation has the obligation to pay his taxes that are levied by the country. While there are different types of taxes, they are broadly classified into two categories, i.e. direct taxes and indirect taxes. Required: Discuss the key differences between direct taxes and indirect taxes in general in GCC and from the view of the Sultanate of Oman in particular by providing examples from the tax laws of Oman. And also discuss the implications of Covid-19 on indirect taxes. Task 4: Taxes can be distinguished by the effect they have on the distribution of income and wealth. Required: Discuss the above statement by addressing Progressive, Proportional and Regressive tax structures and its impact on the performance of a given society. APPENDIX 1: Depreciation rates applicable for Tax year 2019/2020. Permanent Buildings First Class buildings Prefabricated buildings 15% Bridges, platforms, pipelines, permanent way, and railway lines Heavy equipment, Tractors, digging equipment, and any other similar heavy equipment 33.33% Motor vehicles Furniture and fixtures Aircraft and ships Other equipment and tools Hospital buildings and educational establishments 100% Scientific research equipment 4% 5% 10% 33.33% 33.33% 15% 15% 100% GUIDELINES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts