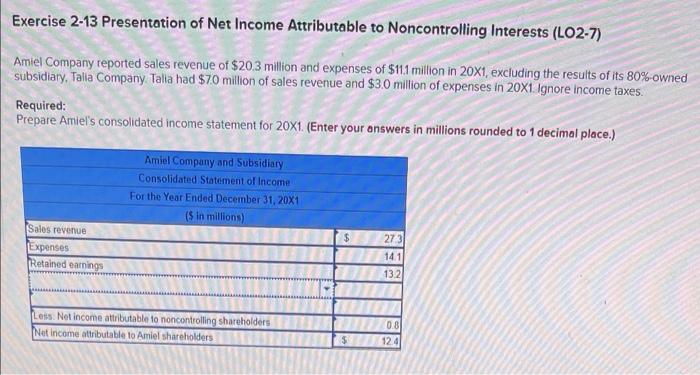

Question: - What am I still missing and whats incorrect? - Note: row 3 is incorrect (both right/left boxes. Exercise 2-13 Presentation of Net Income Attributable

Exercise 2-13 Presentation of Net Income Attributable to Noncontrolling Interests (LO2-7) Amiel Company reported sales revenue of $20.3 million and expenses of $111 million in 20X1, excluding the results of its 80%-owned subsidiary, Talia Company. Talia had $70 million of sales revenue and $3.0 million of expenses in 20X1. Ignore income taxes. Required: Prepare Amiel's consolidated income statement for 20X1. (Enter your answers in millions rounded to 1 decimal place.) Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 (5 in millions) 273 Sales revenue Expenses Retained earnings 14.1 132 Less Net income attributable to noncontrolling shareholders Net Income attributable to Amiel shareholders 0.81 12.4 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts