Question: what amount do you need? activity based costing. (For simplicity, SG&A expenses for the firm are not included in the income statement for the two

what amount do you need?

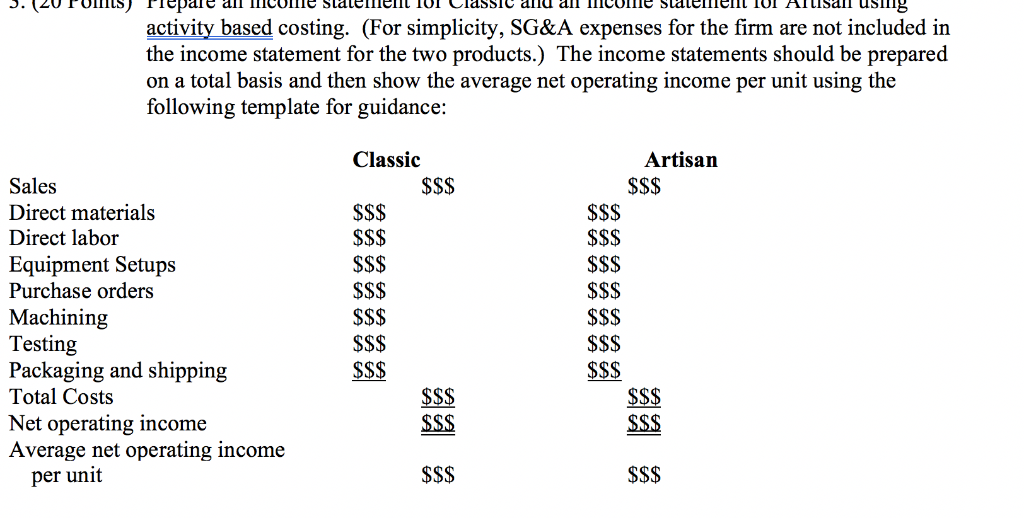

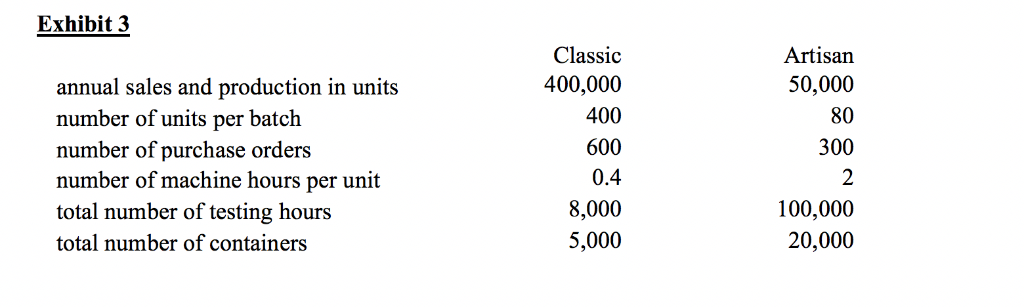

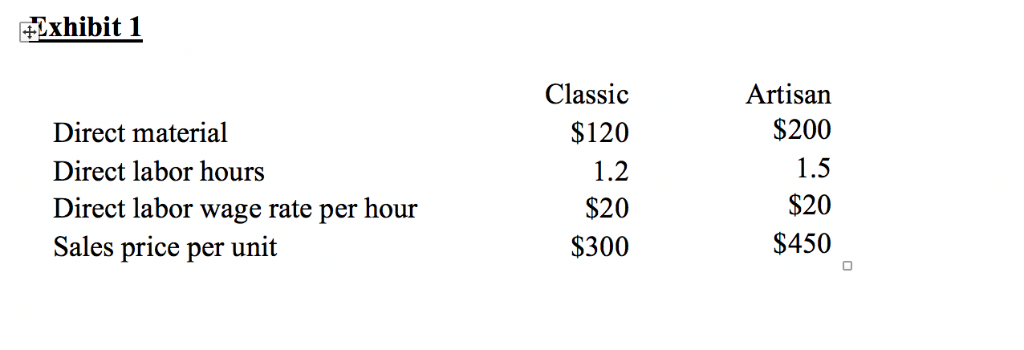

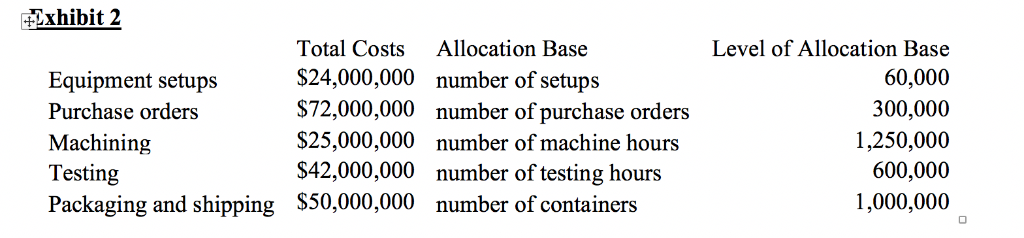

activity based costing. (For simplicity, SG&A expenses for the firm are not included in the income statement for the two products.) The income statements should be prepared on a total basis and then show the average net operating income per unit using the following template for guidance: Classic Artisan Sales Direct materials Direct labor Equipment Setups Purchase orders Machining Testing Packaging and shipping Total Costs Net operating income Average net operating income $$S S$$ $$S S$S per unit Exhibit 3 annual sales and production in units number of units per batch number of purchase orders number of machine hours per unit total number of testing hours total number of containers Classic 400,000 400 600 0.4 8,000 5,000 Artisan 50,000 80 300 100,000 20,000 xhibit Direct material Direct labor hours Direct labor wage rate per hour Sales price per unit Classic $120 1.2 $20 $300 Artisan $200 1.5 $20 $450 fixhibit 2 Equipment setups Purchase orders Machining Testing Packaging and shipping Total Costs $24,000,000 $72,000,000 $25,000,000 $42,000,000 $50,000,000 Allocation Base number of setups number of purchase orders number of machine hours number of testing hours number of containers Level of Allocation Base 60,000 300,000 1,250,000 600,000 1,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts