Question: What are the adjusting entries? Doodles Practice Set below was gathered for the accountant to complete December 31 adjusting entries (use the mal below and

What are the adjusting entries?

What are the adjusting entries?

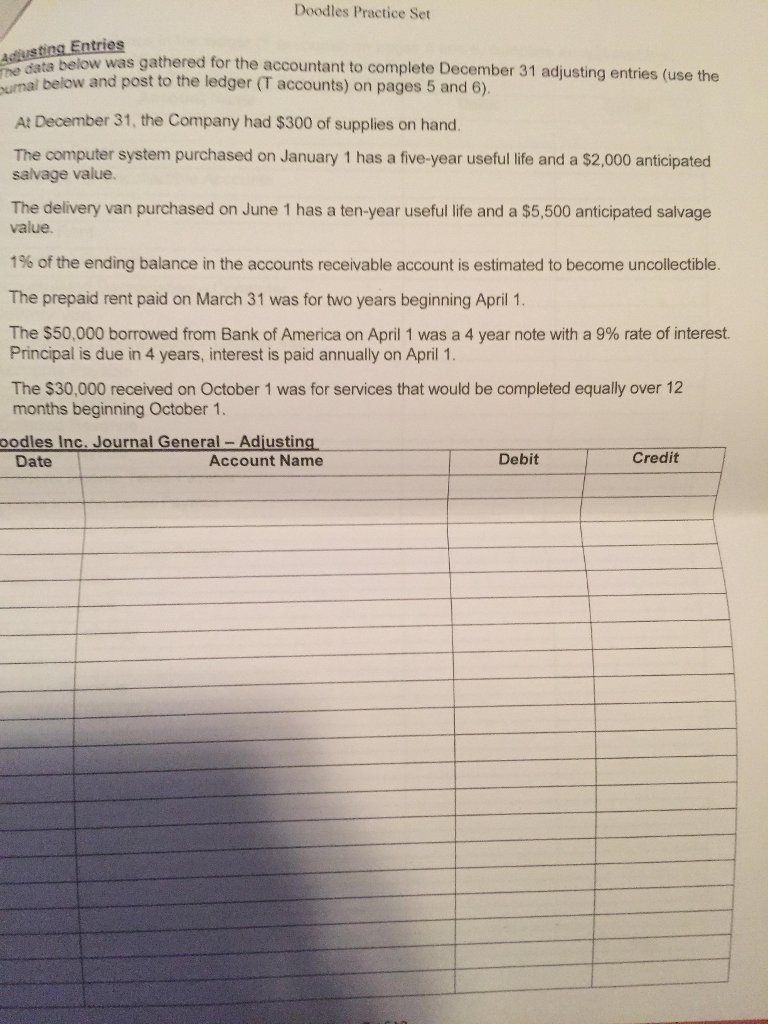

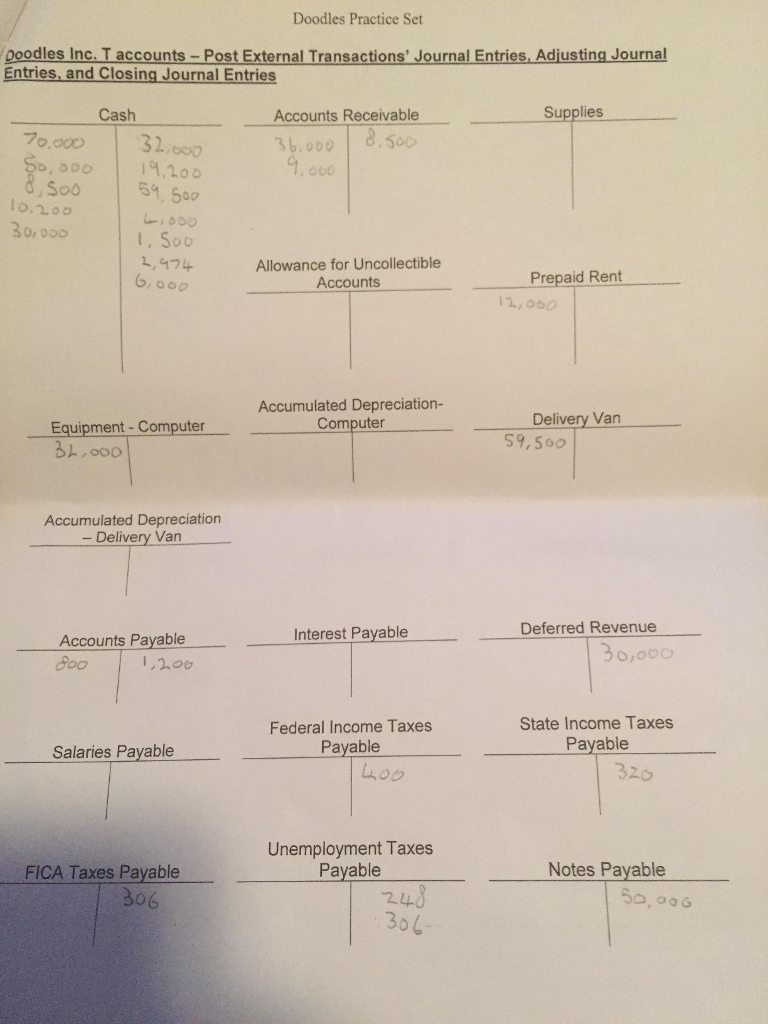

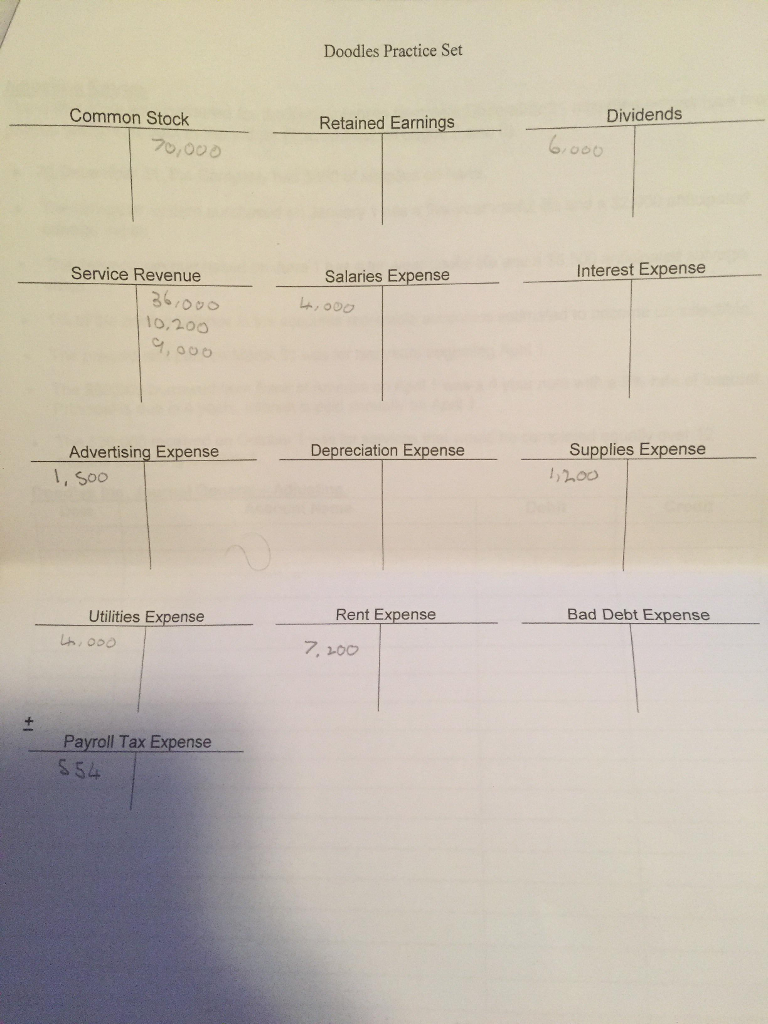

Doodles Practice Set below was gathered for the accountant to complete December 31 adjusting entries (use the mal below and post to the ledger (T accounts) on pages 5 and 6). At December 31, the Company had $300 of supplies on hand. The computer system purchased on January 1 has a five-year useful life and a $2,000 anticipated salvage value The delivery van purchased on June 1 has a ten-year useful life and a $5,500 anticipated salvage urnal value. 1% of the ending balance in the accounts receivable account is estimated to become uncollectible. The prepaid rent paid on March 31 was for two years beginning April 1 The $50,000 borrowed from Bank of America on April 1 was a 4 year note with a 9% rate of interest. Principal is due in 4 years, interest is paid annually on April 1 The $30,000 received on October 1 was for services that would be completed equally over 12 months beginning October 1 podles Inc, Journal General-Adiusting Date Account Name Debit Credit Doodles Practice Set below was gathered for the accountant to complete December 31 adjusting entries (use the mal below and post to the ledger (T accounts) on pages 5 and 6). At December 31, the Company had $300 of supplies on hand. The computer system purchased on January 1 has a five-year useful life and a $2,000 anticipated salvage value The delivery van purchased on June 1 has a ten-year useful life and a $5,500 anticipated salvage urnal value. 1% of the ending balance in the accounts receivable account is estimated to become uncollectible. The prepaid rent paid on March 31 was for two years beginning April 1 The $50,000 borrowed from Bank of America on April 1 was a 4 year note with a 9% rate of interest. Principal is due in 4 years, interest is paid annually on April 1 The $30,000 received on October 1 was for services that would be completed equally over 12 months beginning October 1 podles Inc, Journal General-Adiusting Date Account Name Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts